MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

April 10, 2020: Oil prices retained strength leading up to the OPEC ++ meeting Thursday, but prices dropped when yesterday’s results failed to produce a miracle. Last week, prices jumped based on a Tweet from President Trump that Saudi Arabia and Russia were close to an agreement to end the oil price war. The volumes of production to be cut were 10-15 million barrels per day. Most market experts believed the agreed-upon cuts would be lower than 10 mmbpd, and that the impact would be less than adequate. The International Energy Agency already had estimated that oil demand was down by as much as 20 mmbpd. Nonetheless, prices jumped, and reinforced themselves when OPEC’s President, Algerian Energy Minister Mohamed Arkab, spoke optimistically prior to Thursday’s meeting. WTI crude prices hit a high of $28.36/b on Thursday, before falling to close at $22.57/b. Note that markets closed for the Good Friday holiday, so the full impact on trading has not yet occurred. Reports from the meeting indicated that Saudi Arabia and Russia were close to a deal that would take 10 mmbpd off the market for two months. However, Kuwait’s oil minister later announced that Mexico had disrupted the deal. Today, Mexico’s President announced that Mexico would join the deal as long as the U.S. compensated for what Mexico could not add to the proposed cuts. While this may support prices for the week, the cuts still fall short of rebalancing the market.

The U.S. remains by far the global hotspot of the COVID-19 pandemic. As of Friday, April 10 (Good Friday) The U.S. has 466,299 confirmed cases, pulling away from the numbers reported in Spain (157,022) and Italy (143,626). U.S. fatalities are reported at 16,686, shockingly up from 6,058 a week ago. Global confirmed cases have risen to 1,612,646, with the death toll at 97,039. Last week brought a low WTI crude price of $19.90/b, and prices may descend to this level again in the coming week barring a significant improvement in the supply-demand balance. WTI crude futures prices opened at $26.28/b Thursday morning, then shed $3.52/b after news began to flow concerning the OPEC++ meeting. This week appears to be heading for a finish in the red.

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, April 3, at $24.81/b. Prices rose to open at $26.28/b on Thursday, April 9. However, the results of the OPEC++ meeting caused a selloff, and Thursday’s market closed at $22.76/b. Last week had brought a price rebound of $1.52/b, but this amount of price recovery paled in view of the combined drop of $22.80/b seen during the prior three weeks. Our weekly price review covers hourly forward prices from Thursday, April 2nd, through Thursday, April 9th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

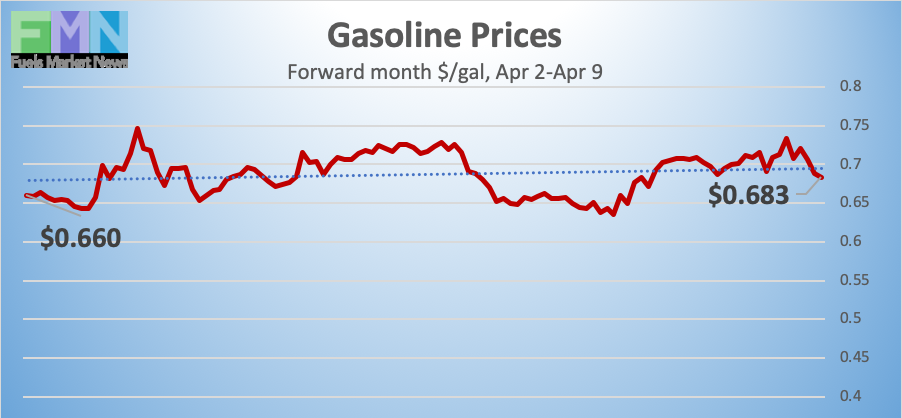

GASOLINE PRICES

Gasoline opened on the NYMEX at $0.6586/gallon on Friday, April 3, and prices rose to open at $0.705/gallon on Thursday, April 9. This was an increase of 4.64 cents (7.0%). Prices have been limping back after the month of March brought a crippling collapse of nearly 87 cents per gallon. U.S. average retail prices for gasoline dropped by 8.1 cents/gallon during the week ended April 6th. Futures prices for gasoline had been rising on the back of optimism over crude prices, but they trailed down again on Thursday when crude prices retreated. Nonetheless, the week appears to be ready to finish in the black, up until the market closed for Good Friday. Gasoline futures closed at $0.6773 on Thursday, up by 1.87 cents/gallon (2.8%) since Friday’s market opening. Trades on Thursday were in the range of $0.668-$0.7697/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $0.9969/gallon on Friday, April 3, and opened on Thursday, April 9, at $1.03/gallon, an increase of 3.31 cents (3.3%). U.S. average retail prices for diesel fell by 3.8 cents/gallon during the week ended April 6th. Retail prices for diesel have fallen for thirteen consecutive weeks. Prices on Thursday rose and fell alongside crude oil. During Thursday trading, prices subsided to close at $0.9726/gallon, down by 2.43 cents/gallon (2.4%) from Friday’s opening. Diesel futures prices appear to be finishing in the red this week as of the market closing for the Good Friday holiday.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, April 3, at $24.81/b. Prices strengthened to open at $26.28/b on Thursday, April 9. By the close of the market on Thursday, however, WTI prices had retreated to $22.76/b, a daily drop of $1.98/b. The Friday-to-Thursday closure week brought a loss of $2.05/b (8.3%). WTI futures prices on Thursday ranged from $22.57/b to $28.36/b. The latest price as of Good Friday market closure was $22.76/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices retained strength leading up to the OPEC ++ meeting Thursday, but they dropped when yesterday’s results appeared to produce a deal, but not enough of a deal, and then perhaps not a deal after all, and then the deal that was expected. Last week, prices jumped based on a Tweet from President Trump that Saudi Arabia and Russia were close to an agreement that would end the oil price war. The volumes of production to be cut were 10-15 million barrels per day. Most market experts doubted that the producers would agree to cut 10 mmbpd, much less 15 mmbpd. Moreover, the International Energy Agency already had estimated that oil demand was down by as much as 20 mmbpd, so the cuts of 10 mmbpd or even 15 mmbpd would be insufficient. Nonetheless, prices jumped, and they reinforced themselves when OPEC’s President, Algerian Energy Minister Mohamed Arkab, spoke optimistically prior to Thursday’s OPEC++meeting. WTI crude prices hit a high of $28.36/b on Thursday, before falling to close at $22.57/b. Note that U.S. markets closed for the Good Friday holiday, so the full impact on trading has not yet occurred. Reports from the meeting indicated that Saudi Arabia and Russia were close to a deal that would take 10 mmbpd off the market for two months. However, Kuwait’s oil minister later announced that Mexico had disrupted the deal. Today, Mexico’s President announced that Mexico would join the deal as long as the U.S. compensated for what Mexico could not add to the proposed cuts.

The U.S. remains the global hotspot of the COVID-19 pandemic. All fifty of the United States have confirmed cases. Every state governor has declared a state of emergency. As of Friday, April 10 (Good Friday,) the U.S. has 466,299 confirmed cases, pulling away from the numbers reported in Spain (157,022) and Italy (143,626). U.S. fatalities are reported at 16,686, shockingly up from 6,058 a week ago. Global confirmed cases have risen to 1,612,427, with the death toll at 95,699. Last week brought a low WTI crude price of $19.90/b, and prices may descend to this level again in the coming week barring a significant improvement in the supply-demand balance. WTI crude futures prices opened at $26.28/b Thursday morning, up by $1.47/b (5.9%) for the week since Friday April 3rd. Prices during Thursday then shed $3.52. This week appears to be heading for a finish in the red.

The economic impacts of the COVID-19 pandemic are showing dramatically in U.S. economic statistics. The Bureau of Labor Statistics (BLS) this morning released the latest data on the Consumer Price Index for all urban consumers (CPI-U). According to the release, the (CPI-U) declined 0.4 percent in March on a seasonally adjusted basis, the largest monthly decline since January 2015. The BLS report stated: “A sharp decline in the gasoline index was a major cause of the monthly decrease in the seasonally adjusted all items index, with decreases in the indexes for airline fares, lodging away from home, and apparel also contributing.”

The American Petroleum Institute (API) reported a major crude inventory build of 10.9 mmbbls. The API also reported a huge build of 9.4 mmbbls of gasoline, and a small drawdown of 0.177 mmbbls from diesel inventories diesel. The API’s net inventory build was a massive 21.123 mmbbls. Market analysts had predicted across-the-board inventory additions, but with a total addition to inventories of only 15.512 mmbbls.

U.S. Energy Information Administration (EIA) official statistics showed even more significant additions to inventories. The addition to crude stocks was 15.177 mmbbls, the addition to gasoline stocks was one of the largest in years at 10.497 mmbbls, and the addition to distillate stockpiles was 0.476 mmbbls. The EIA net result was an astounding inventory build of 26.150 mmbbls.