Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

Readers, kindly note that we are changing our weekly review to show how the current week has developed. The charts now present hourly price trends from the previous Friday at 9AM EST to the current Friday at 6AM EST, consistent with our daily price trends column.

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices were flattish at today’s market opening, up by only a nickel, and prices are easing currently. WTI (West Texas Intermediate) crude forward prices opened at $63.76/b today, up by $0.05 (0.08%) from Friday’s opening price of $63.71/b. Gasoline and diesel futures prices opened with slight losses today, though gasoline opened for the fourth consecutive day above $2/gallon. Crude and product prices are declining currently.

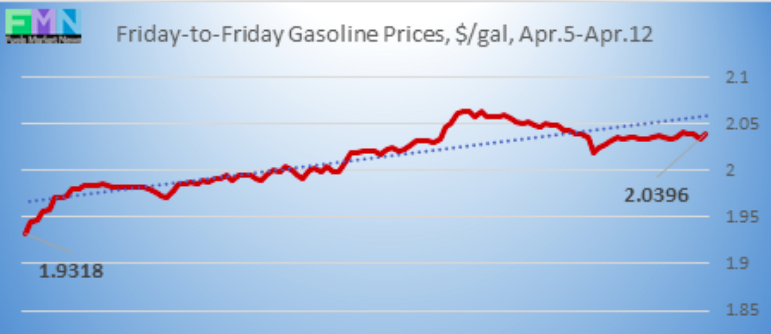

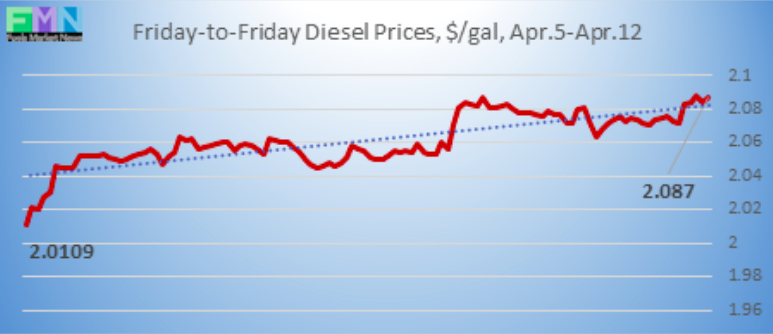

Prices are easing currently, but crude oil, gasoline and diesel futures prices all ended last week solidly in the black. WTI crude futures prices opened on Monday April 8 at $63.33/b and closed on Friday April 12th at $63.89, up by $0.56/b (0.9%) for the week. Diesel futures prices opened on Monday at $2.0449/gallon and closed Friday at $2.0707/gallon, up by 2.58 cents/gallon (1.3%) for the week. Gasoline futures prices opened on Monday at $1.98/gallon and closed on Friday at $2.037/gallon, up by 5.7 cents/gallon (2.9%) for the week.

Last week brought another significant addition to U.S crude oil stockpiles, offset by a major drawdown from gasoline stocks, plus a modest reduction in diesel inventories. Oil prices came under pressure on Friday when the International Energy Agency (IEA) noted demand-side risk. However, the IEA did not cut its forecast of demand.

Many forces are at work that could tighten oil supply. Waivers on purchases of Iranian crude are scheduled to expire in May, and the U.S. has not provided full clarity on whether any waivers will be extended. Japan noted that it would most likely stop importing Iranian crude this month. Indian refiners bumped up Iranian crude purchases in March in preparation for the sanctions. The U.S. also is working to tighten sanctions against Venezuela, attempting to cut off exports to Cuba. Violence continues in Libya and Algeria. OPEC production dropped by over 500,000 barrels per day in March, including a drop of 289,000 bpd in Venezuela. OPEC compliance with production cut targets is so high that the next step may be to see the OPEC+ group back off somewhat on production cuts.

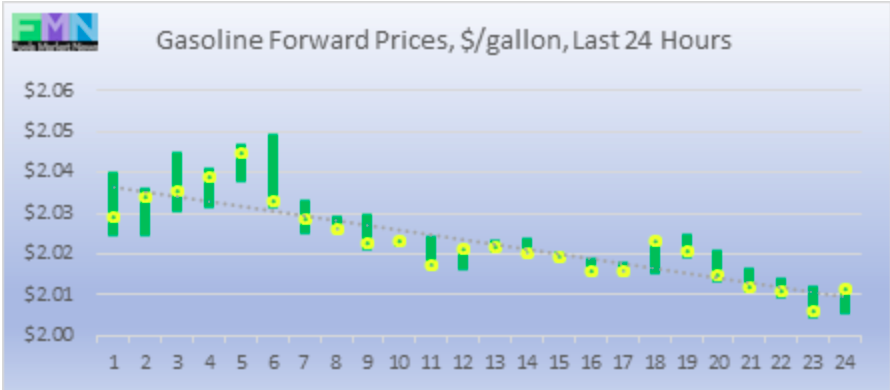

GASOLINE

Gasoline opened on the NYMEX at $2.0296/gallon today, down by 0.65 cents (0.32%) from Friday’s opening price of $2.0361 cents/gallon. Until last week, gasoline futures prices had not opened above $2/gallon since November 1st. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices fell by 3.31 cents (1.62%.) Gasoline forward prices currently are easing, with trades occurring mainly in the range of $2.00-$2.03/gallon. The latest price is $2.0102/gallon.

DIESEL

Diesel opened on the NYMEX at $2.0707/gallon today, down by 0.44 cents (0.21%) from Friday’s opening price of $2.0751/gallon. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices fell by 3.42 cents (1.64%.) Diesel prices currently are recovering after an overnight drop, trading mainly in the $2.05-$2.07/gallon range. The latest price is $2.0582/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $63.76/b today, up by $0.05 (0.08%) from Friday’s opening price of $63.71/b. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices dropped by $1.18 (1.83%.) Prices are volatile currently, climbing back up after an overnight drop. WTI is trading mainly in the range of $63.25/b-$63.75/b. The latest price is $63.51/b.