Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

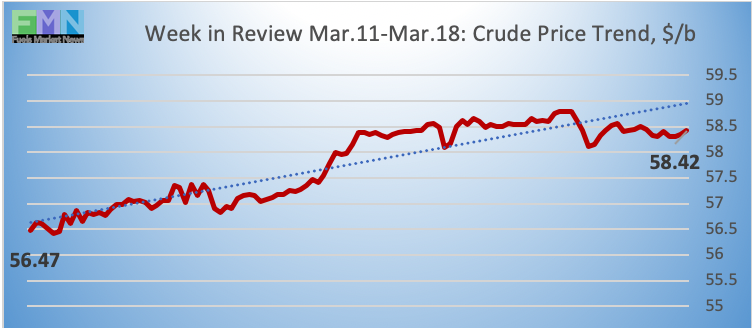

Crude oil futures prices are higher today, with trades yesterday and today breaking through the $60/b barrier. WTI (West Texas Intermediate) crude forward prices opened today at $59.99/b today, up by nearly one dollar ($0.97, or 1.64%) from yesterday’s opening price of $59.02/b. WTI prices have not been above $60/b since November 12th. Gasoline and diesel futures prices also opened with gains today. A significant price rally began yesterday upon the release of weekly statistics from the Energy Information Administration (EIA.) The rally is slowing as investors digest announcements from yesterday’s Fed meeting, which noted an economic slowdown.

The EIA reported across-the-board drawdowns from crude oil, gasoline and diesel inventories. These were major drains on inventory—the largest of the year to date. Crude inventories were drawn down by 9.589 million barrels (mmbbls.) Gasoline inventories were drawn down by 4.587 mmbbls. Diesel inventories were drawn down by 4.127 mmbbls. The total was an 18.303-mmbbl reduction in oil inventories.

The EIA data went well beyond the information earlier presented by the American Petroleum Institute (API.) The API also reported across-the-board drawdowns: 2.133 mmbbls of crude, 2.794 mmbbls of gasoline, and 1.607 mmbbls of diesel, for a total of 6.5 mmbbls. The API data was more bullish than the market expected, and prices strengthened prices. The EIA official statistics sparked a serious run-up in prices.

The oil price rally is waning currently as markets digest the larger picture of U.S. and global markets. Yesterday, Federal Reserve Chair Jerome Powell held a press conference to announce the decisions made at the latest meeting. The new Fed plan includes no interest rate increases in 2019, one in 2020, and none in 2021. The Fed raised rates four times in 2018, and its December 2018 plan included two more rate increases in 2019. However, the Federal Open Market Committee (FOMC) has adjusted its plan according to its belief that the economy is slowing. The FOMC’s formal statement yesterday noted “Information received since the Federal Open Market Committee met in January indicates that the labor market remains strong but that growth of economic activity has slowed from its solid rate in the fourth quarter.”

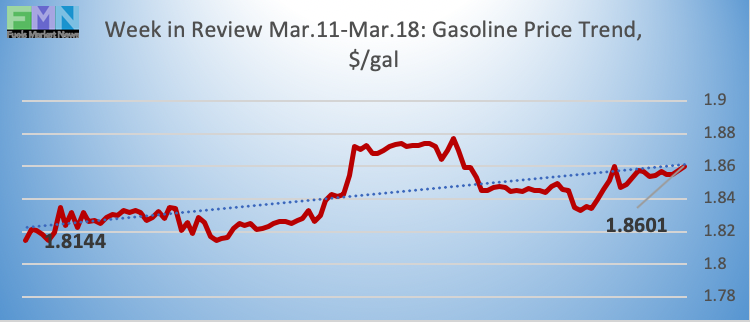

GASOLINE

Gasoline opened on the NYMEX at $1.9067/gallon today, up by 1.37 cents (0.71%) from yesterday’s opening price of $1.893 cents/gallon. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices rose by 2.88 cents (1.53%.) Gasoline forward prices currently are levelling off, trading between $1.90-$1.92/gallon. The latest price is $1.917/gallon.

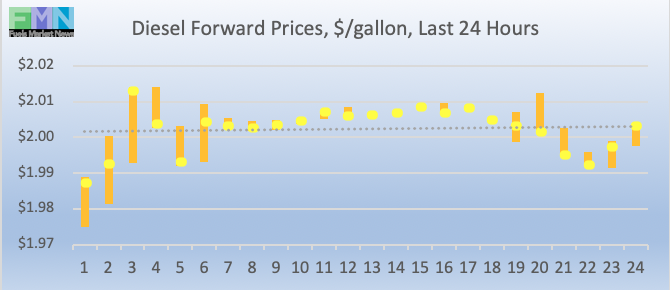

DIESEL

Diesel opened on the NYMEX at $2.0021/gallon today, up by 1.21 cents (0.6%) from yesterday’s opening price of $1.99/gallon. Diesel forward prices had not opened above $2/gallon in nearly two weeks. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices rose by 2.26 cents (1.14%.) Diesel prices are hovering around the $2/gallon level currently, trading in the $1.98-$2.01/gallon range. The latest price is $1.995/gallon.

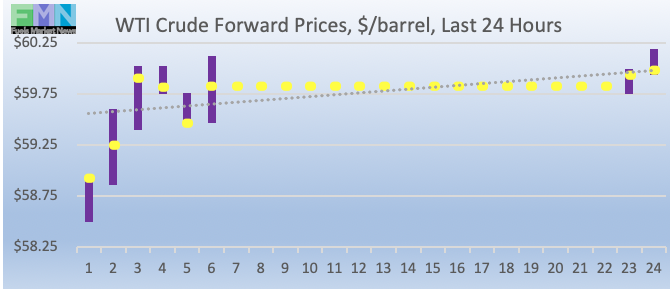

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $59.99/b today, up by $0.97 (1.64%) from yesterday’s opening price of $59.02/b. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices increased by $1.44 (2.46%.) Currently, crude prices are hovering in the vicinity of $60.00/b. WTI prices have not been above $60/b since November 12th. The latest price is $60.12/b.