Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

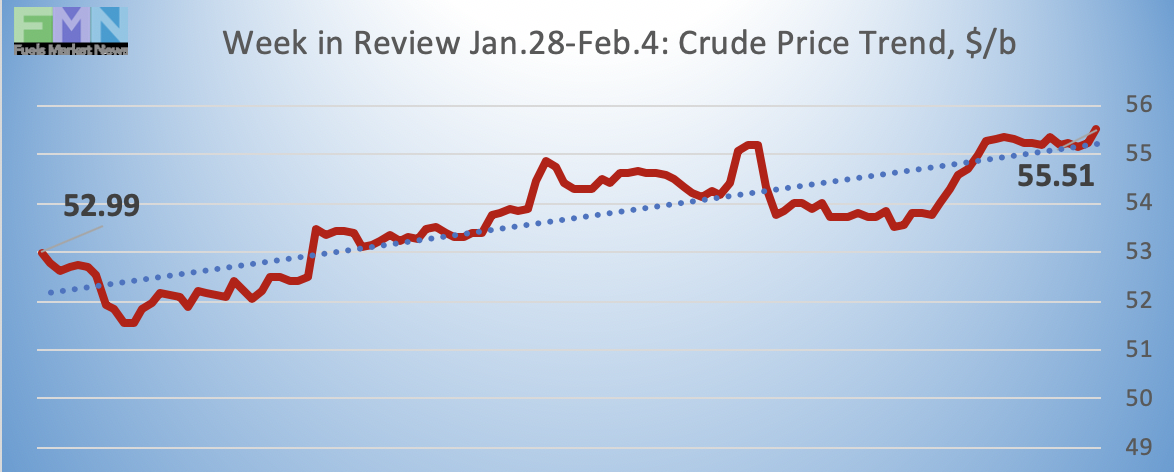

Crude oil prices rebounded this morning, regaining the $54/b level and climbing up to $55/b—the highest levels since November. WTI (West Texas Intermediate) crude forward prices opened at $54.48/b today, up by $0.52 (0.96%) from yesterday’s opening price of $53.96/b. Gasoline and diesel futures prices also opened with gains today. Prices are at three-month highs, re-attaining the levels last common in November 2018.

Oil prices appear to be headed for a week of major gains. As of the time of this writing, WTI crude forward prices are up by $2.84 (5.4%.) Diesel forward prices are up by 10.63 cents (5.6%.) Gasoline prices are up by 11.76 cents (8.3%.)

Markets now appear ready to believe that OPEC is attacking the global oversupply. OPEC reported that crude production by its members dropped by 797 thousand barrels per day (kbpd) in January. Of this, Saudi Arabia cut its crude production by 350 kbpd. The International Energy Agency (IEA) believes that the cuts went even deeper. Despite geopolitical risk factors that could shift oversupply into shortage, (including U.S. sanctions against Iran and Venezuela,) Saudi Arabia pledged to cut its crude production by another 500 kbpd, stating that it would cut its total output to 9.8 million bpd in March. The current drop in Saudi exports may partly stem from a partial shut-in of the Safaniyah offshore oilfield, where a ship’s anchor reportedly severed a power cable. While this repair is said to be under control, there is less market urgency, since the Saudi goal is to continue with cuts.

Prices sank for most of yesterday, then staged a late-afternoon rally. Prices began to slide when the U.S. Department of Commerce reported that retail sales dropped by 1.2% in December, after revising the November data to show an uptick of 0.1%. Economists had expected December retail sales to rise by 0.2%. There is little doubt that the government shutdown caused economic damage, but the impact is difficult to measure exactly. For the time being, a compromise bill seems likely to avert another shutdown, but President Donald Trump announced that he would declare a national emergency to gain additional funds for his border wall. This may simply trade one expensive political battle for another one.

GASOLINE

Gasoline opened on the NYMEX at $1.511/gallon today, up significantly by 4.23 cents (2.79%) from yesterday’s opening price of $1.4687 cents/gallon. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices jumped by 4.6 cents (3.19%.) Prices surged yesterday, exceeding $1.50/gallon, a price level not seen since November. Gasoline forward prices are currently trending up, trading in a range of $1.49-$1.55/gallon. The latest price is $1.547/gallon.

DIESEL

Diesel opened on the NYMEX at $1.9748/gallon today, up strongly by 3.55 cents (1.80%) from yesterday’s opening price of $1.9393/gallon. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices rose by 3.6 cents (1.84%,) hitting highs of nearly $2.00/gallon. Diesel prices currently are retaining strength, trading in the range of $1.98-$2.01/gallon. The latest price is $2.008/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $54.48/b today, up by $0.52 (0.96%) from yesterday’s opening price of $53.96/b. Prices have hit highs of over $55/b. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices rose by $1.02 (1.89%.) Currently, prices are still trending up, trading in the range of $54.50/b-$55.50. The latest price is $55.24/b.