Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices pulled out of their descent during the weekend, and they opened in today’s trading session only a nickel lower than on Friday’s opening. WTI (West Texas Intermediate) crude prices in today’s trading session opened at $60.70, a small decline of $0.05 from Friday’s opening price of $60.75/b. Still, this was the tenth day in a row that crude prices have fallen. Friday’s market brought a low point of $59.26/b—the lowest since early March, over eight months ago. Gasoline futures prices opened lower today’s trading session, while diesel futures prices recovered modestly.

Last week brought another week in the red for crude oil and gasoline. WTI crude prices dropped by $2.80/b (4.4%) during the week, opening at$62.99/b on Monday and closing at $60.19/b on Friday. Gasoline futures prices dropped by 8.71 cents/gallon (5.1%,) opening on Monday at $1.7085/gallon and closing at $1.6214/gallon on Friday. In contrast, diesel futures prices seesawed during the week, and ended up at essentially the same level at Friday’s closing. Diesel futures prices opened on Monday at $2.1724/gallon and closed on Friday at $2.1728/gallon, up fractionally by 0.0004 cents.

On Friday, crude oil officially entered bear market territory. Since the high opening in the first week of October, WTI crude finished in the red for five consecutive weeks. The streak of losses brought WTI crude futures prices down from a high opening price of $76.18/b on October 4th, to an opening price of $60.75/b on Friday. This loss amounted to $15.43/b, or 20.2%. The accepted definition of a bear market is one where the price of a commodity drops by 20% from its 52-week high.

However, prices pulled out of their downward spiral this morning, following OPEC’s meeting this weekend in Abu Dhabi. Saudi Oil Minister Khalid al-Falih reported that technical analysis concluded that global oil supplies needed to be cut by 1 million barrels per day (mmbpd) in 2019 from October levels. Saudi Arabia plans to cut output by 0.5 mmbpd as early as December. An announcement of this type was sure to come, and prices were sure to bounce back somewhat. Yet the market must now watch for signs that the supply overhang actually does begin to shrink once again, which naturally will take more than a day.

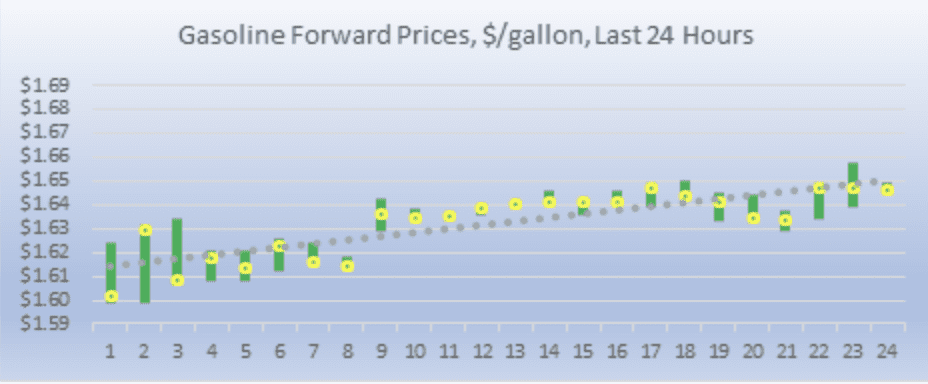

GASOLINE

Gasoline opened on the NYMEX at $1.635/gallon today, down by 1.33 cents (0.81%) from Friday’s opening price of $1.6483/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices recovered by 2.79 cents/gallon (1.72%.) Currently, gasoline prices are stabilizing at around $1.63-$1.64/gallon. The latest price is $1.6378/gallon.

DIESEL

Diesel opened on the NYMEX at $2.1838/gallon today, an increase of 1.14 cents (0.52%) over Friday’s opening price. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices rose by 2.94 cents/gallon (1.37%.) Currently, the downward trend in diesel prices appears to be arrested, with prices holding at around $2.17/gallon. The latest price is $2.1701/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $60.70/b, down by $0.05 (0.08%) from Friday’s opening price of $60.75/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures bounced back by $1.12/b (1.87%.) Currently, crude prices are stable, buoyed by news that Saudi Arabia and other key OPEC-Non-OPEC producers plan to cut production. The latest price is $60.78/b.