Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

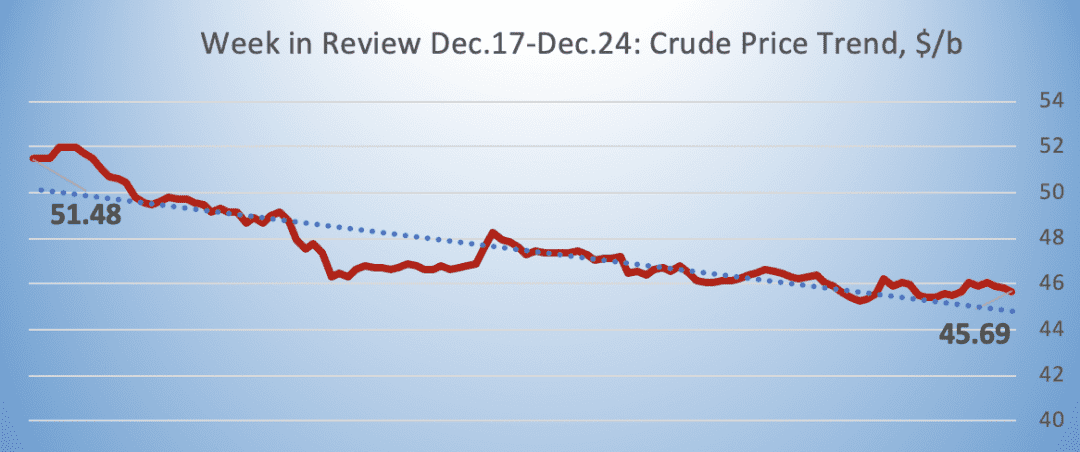

Oil prices have seesawed this week, and they are down again this morning. This market psychology is significant: when investors are confident, they want to get into the market before a holiday, in case something good happens. In difficult times, they want to get out in case something bad happens. WTI (West Texas Intermediate) crude forward prices opened at $45.44/b today, a drop of $1.14 (1.14%) from yesterday’s opening price of $46.58/b. Wednesday, WTI prices opened at the lowest level since February 2016. They popped back up on Thursday, then began to sag on profit taking ahead of the New Year’s holiday. Gasoline and diesel forward prices also opened lower in today’s session.

Currently, oil prices are trending down, and the week appears likely to end in the red. As of the time of this writing, WTI crude prices are down by 1.2% from Monday’s opening. Gasoline prices are down by 0.4%. Diesel prices are down by 3.3%. However, with the upcoming New Year’s holiday, traders may leave early, allowing smaller events to have larger price impacts. A significant news event or an unusually bullish weekly report from the EIA could still reverse today’s trend.

Markets have been volatile this week. Equity markets have plunged and rebounded. Although experienced investors appear to be buying the dips, which indicates a positive outlook, the overall picture for December remains grim. The Dow Jones Industrial Average began the month at approximately 25,800, with most investors fully expecting continued growth, or at least preservation, through the end of 2018. Instead, the DJIA began to slide, crashing to around 21,800 on Christmas Eve. It crept back up to around 23,100 since then. A New Year’s rally is possible late today, with buyers seeking value left behind when the “Santa Rally” failed to appear.

Oil prices were pressured yesterday when the American Petroleum Institute (API) reported a build of crude oil inventories of 6.9 million barrels (mmbbls) for the week ended December 21st. Market experts had predicted a drawdown of 2.869 mmbbls. The API also reported an addition of 3.7 mmbbls to gasoline inventories, and a drawdown of 0.598 mmbbls from diesel inventories. The API numbers were bearish compared to market expectations. The U.S. Energy Information Administration (EIA) is scheduled to release official statistics later today. Data releases have been delayed because of the Christmas holiday. It is unknown whether the government shutdown will affect the timing or accuracy of the EIA data releases, but a bullish EIA report could reverse the current weakness in oil prices.

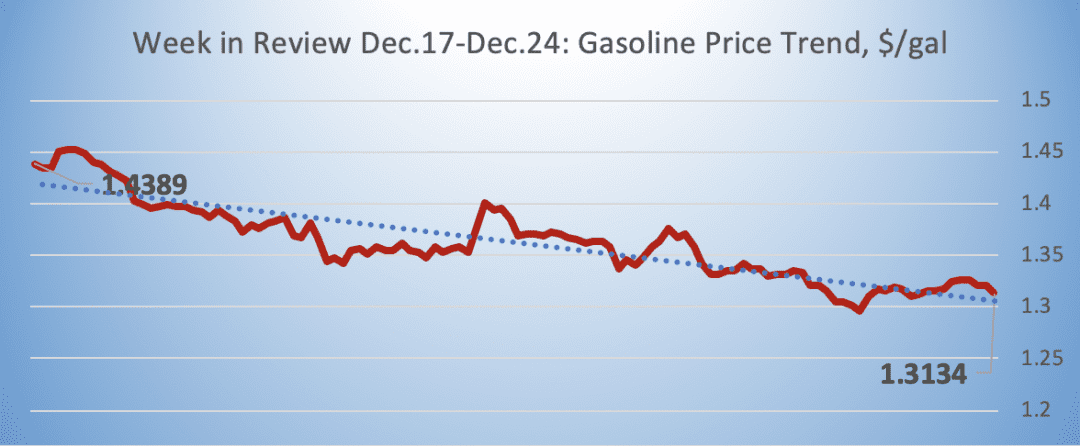

GASOLINE

Gasoline opened on the NYMEX at $1.3243/gallon today, a decline of 1.76 cents (1.31%) from yesterday’s opening price of $1.3419 cents/gallon. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices rose by 0.56 cents (0.43%.) Gasoline prices are trending down gently at present. The latest price is $1.3174/gallon.

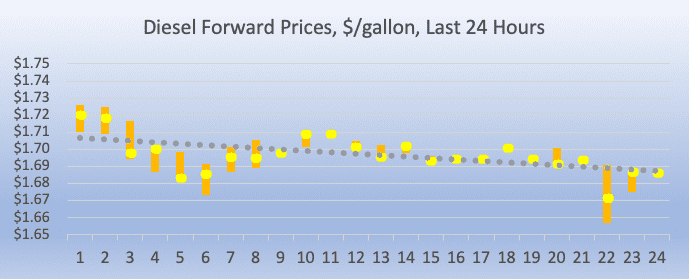

DIESEL

Diesel opened on the NYMEX at $1.6983/gallon today, a decline of 4.28 cents (2.45%) from yesterday’s opening price of $1.7411/gallon. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices fell by 3.64 cents (2.11%.) Diesel prices currently are trending down. The latest price is $1.6747/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $45.44/b today, a decline of $1.14 (2.45%) from yesterday’s opening price of $46.58/b. Wednesday’s opening price was the lowest opening price since February 2016. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices declined by $0.28/b (0.61%.) WTI crude prices are trending down, possibly heading below the $45/b level today. The latest price is $45.16/b.