Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

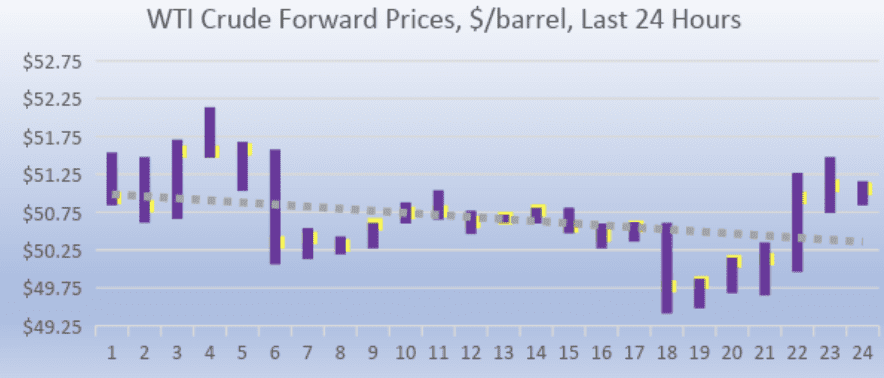

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices have been volatile this morning. For the first time all year, WTI (West Texas Intermediate) crude prices dropped below $50/b, hitting a new annual low of $49.41/b. WTI opened at $50.31/b today, a drop of $1.78 (3.42%) from yesterday’s opening price of $52.09/b. Diesel and gasoline futures prices also opened lower today. However, after hitting some of the year’s lowest levels, crude and product prices are staging a recovery in this morning’s early trading.

Oil prices dropped yesterday upon the release of supply and demand data from the U.S. Energy Information Administration (EIA.) The EIA reported another addition to crude oil stockpiles during the week ended November 23rd, amounting to 3.577 million barrels (mmbbls.) There was a small drawdown of 0.764 mmbbls from gasoline inventories. There was also a significant addition of 2.61 mmbbls to diesel inventories. The net addition to stockpiles was 5.423 mmbbls. U.S. crude oil inventories have expanded for the last nine weeks in a row. Over those nine weeks, 56.35 mmbbls of crude oil have flowed into storage.

The official EIA data on crude oil stock movements agreed well with the earlier inventory data released by the American Petroleum Institute (API,) but product inventory data diverged significantly. The API reported that U.S. crude inventories had risen by 3.453 mmbbls, just slightly below the EIA statistics. However, the API had measured a much larger drawdown of 2.62 mmbbls from gasoline stocks, combined with a smaller build in diesel stocks. The API numbers showed a net addition of 2.018 mmbbls to U.S. stocks, which was significantly less than the 5.423 mmbbls reported by the EIA. The EIA data was bearish for prices.

The EIA also reported that domestic crude production remained stable at 11.7 mmbpd during the week ended November 23rd. Product supplied, a calculated number approximating demand, fell for the second week, including a significant drop in apparent demand for diesel. The weekly data paint a picture of a well-supplied (if not over-supplied) market, giving no reason yet for prices to climb.

GASOLINE

Gasoline opened on the NYMEX at $1.3905/gallon today, down significantly by 4.94 cents (3.41%) from yesterday’s opening of $1.4399 cents/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices crept up by 0.43 cents/gallon (0.3%.) Currently, gasoline prices are recovering. The latest price is $1.418/gallon.

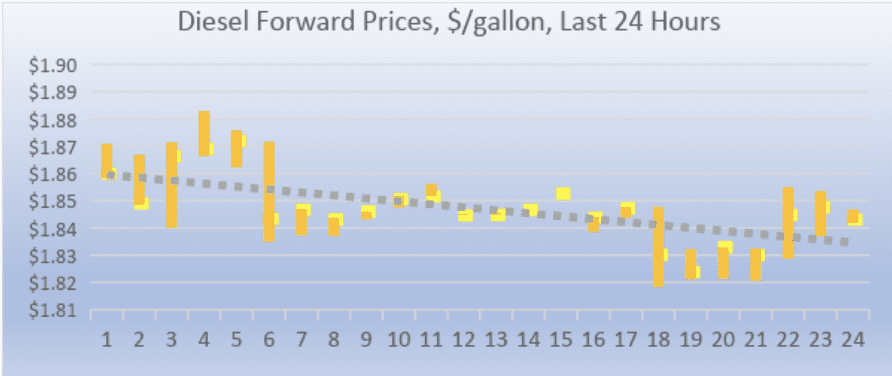

DIESEL

Diesel opened on the NYMEX at $1.8438/gallon today, a significant drop of 5.8 cents (3.04%) from yesterday’s opening price of $1.9018/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices declined by 1.73 cents/gallon (0.93%.) Currently, diesel prices appear to have hit bottom, and prices now are stabilizing. The latest price is $1.8414/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $50.31/b today, a drop of $1.78 (3.42%) from yesterday’s opening price of $52.09/b. This session included the lowest traded price of the year to date–$49.41/b. The dip below the $50/b mark was brief, however. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures declined slightly by $0.12/b (0.23%.) Currently, crude prices are trending back up. The latest price is $51.06/b.