Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

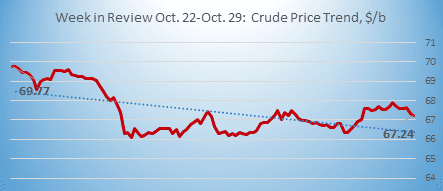

Oil prices were relatively stable at yesterday’s market opening, but they collapsed at midday. WTI (West Texas Intermediate) crude prices in today’s trading session opened at $63.50, down by $1.38 from yesterday’s opening price of $64.88/b. This was the fourth day in a row that crude prices have fallen. Gasoline and diesel futures prices opened lower as well. The week is set to finish in the red once again.

Has the market overprepared for the sanctions against Iran, or will it take another month to feel the pinch? Sanctions come into force in just two days. But after months of buildup, fears of $100/b oil have faded, and prices are slumping. First, OPEC and non-OPEC producing countries, led by Saudi Arabia and Russia, quickly pledged to replace lost Iranian supplies. Second, U.S. production and inventories have risen. The Energy Information Administration (EIA) reported that U.S. crude production rose by 300 kbpd last week, rising to an average of 11.2 million barrels per day (mmbpd.) The EIA also reported a 3.217-million-barrel (mmbbl) addition to crude oil inventories during the week ended October 26th. Crude inventories have expanded for six consecutive weeks, swelling by 31.9 million barrels (mmbbls.)

Relaxing the market even further, the U.S. will grant temporary waivers from the sanctions to eight countries, including Japan, South Korea, and India. South Korea reportedly has no more cargoes of Iranian crude en route. India, however, is a major crude importer, and relies on Iranian supplies. As a condition of the waiver, India agreed to reduce imports of Iranian crude by around 35% from the levels imported during fiscal year 2017-2018. Despite the trade war, China also has reduced imports of Iranian crude oil in observance of the sanctions.

The Jobs Report for October has just been released, showing strong performance. The Bureau of Labor Statistics reported payroll employment rose by 250,000 jobs, and that the unemployment rate remained unchanged at 3.7%. The job gains occurred mainly in health care, manufacturing, construction, transportation and warehousing.

GASOLINE

Gasoline opened on the NYMEX at $1.7117/gallon today, a drop of 3.28 cents (1.87%) below yesterday’s opening price of $1.7445/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices fell by 3.58 cents/gallon (2.04%.) Currently, gasoline prices are maintaining above $1.70/gallon. The latest price is $1.7081/gallon.

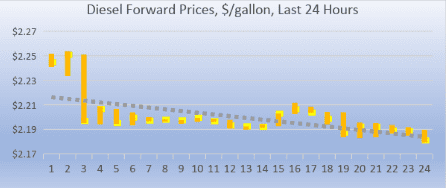

DIESEL

Diesel opened on the NYMEX at $2.1945/gallon today, down by 4.88 cents (2.17%) from yesterday’s opening. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices dropped by 5.51 cents/gallon (2.46%.) Currently, diesel prices are continuing to trend down. The latest price is $2.1799/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $63.50, down by $1.38 (2.13%) from yesterday’s opening price of $64.88/b. WTI prices have not been this low since the first quarter of 2015. Over the last 24-hour period from 9AM EST to 9AM EST, crude prices fell by $1.47/b (2.22%.) Currently, crude prices appear to be holding above the $63/b mark. The latest price is $63.13/b.