Analysis by Dr. Nancy Yamaguchi

Overview and COVID-19 Apparent Demand Response

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended August 31. Retail prices for gasoline rose by 4.0 cents per gallon to average $2.222/gallon. Diesel prices, which have not yet shown a strong rebound, rose by 1.5 cents per gallon. The COVID-19 pandemic caused severe demand destruction, which is reversing gradually. COVID-19 infections continue to rise, and some closures of economic activities have been reinstituted.

Last week, Hurricane Laura made landfall in Louisiana as a Category 4 Hurricane. Nearly half of the offshore oil platforms were evacuated, and seven key refineries were shut down in preparation. An estimated 580,000 were ordered to evacuate. Electric power was lost to an estimated 875,000 customers at the height, and 350,000 Louisiana residents were still without power as of Sunday.

The EIA publishes weekly “product supplied” data as its proxy for demand. These data show gasoline demand crashing from 9,696 barrels per day (kbpd) during the week ended March 13 to just 5,065 kbpd during the week ended April 3, a huge hit of 4,631 kbpd in just four weeks. That was the low point. Demand thereafter trended generally up until it reached 8,608 kbpd during the week ended June 19. Since then, demand has cycled up and down. Apparent demand recovered to 8,809 kbpd during the week ended July 24, retreated to 8,617 kbpd during the week ended July 31, and jumped to 9,161 kbpd during the most recent week ended August 21. The EIA points out that “product supplied” is not a precise measure of demand, but these data provide the most up-to-date numbers publicly available.

Diesel demand dropped sharply in response to COVID-19, and it is recovering in fits and starts. Diesel demand stagnated at first, recovered somewhat, then began to vacillate between approximately 3,000 kbpd and 3,800 kbpd. The EIA reported that distillate fuel oil demand plunged by 1,256 kbpd between the week ended March 13 and the week ended April 10, slumping from 4,013 kbpd to 2,757 kbpd in a four-week period. Demand has been cycling up and down, but it rose strongly to 3,958 kbpd during the most recent week ended August 21.

For the week ended August 31, retail prices for gasoline rose by 4.0 cents/gallon. Retail prices for diesel rose by 1.5 cents/gallon.

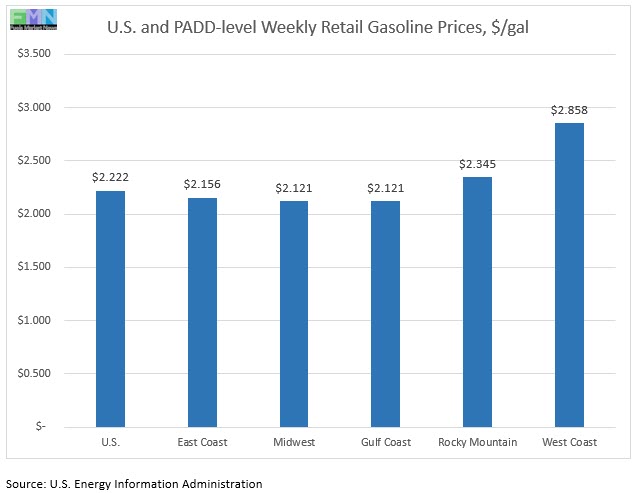

The national average price for gasoline was $2.222/gallon. This price was 34.1 cents/gallon below the price for the same week one year ago. In February, retail prices for gasoline were higher than they had been a year earlier. The COVID-19 pandemic caused gasoline prices to fall below $2/gallon. Now, prices in four of the five PADDs have regained the $2/gallon level. From late-November through early March, gasoline prices had been above their levels from last year. During the week ended March 2, retail gasoline prices were a mere 0.001 cent/gallon above last year’s level. The huge price declines since then have brought gasoline prices dramatically below their levels of last year.

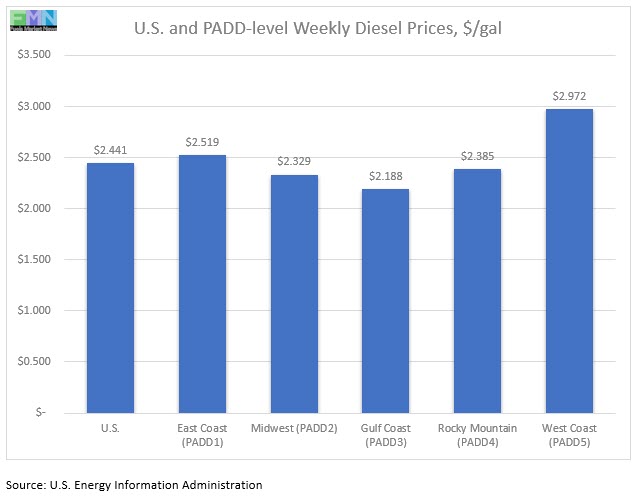

Diesel prices also had been above last year’s level, but prices are now well below these levels. On a national basis, the retail price for diesel averaged $2.441/gallon—53.5 cents/gallon lower than the price in the same week last year.

Futures Prices and Retail Price Outlook

During the week August 24 to August 28, West Texas Intermediate (WTI) crude oil futures prices rose by $0.50 per barrel (1.2%.) WTI futures prices largely had been rangebound between $39-$41 per barrel, but they broke out in August and strengthened to the $41-$43 a barrel range. This came despite a continued increase in COVID-19 infections.

During the week of August 24 to August 28, gasoline futures prices fell by 8.43 cents per gallon (3.6%.) Diesel futures prices rose by 1.63 cents per gallon (1.3%.) Contracts were switching to the next forward month. While the relationship between futures prices and retail prices is not immediate or one-for-one, futures prices are roughly flat so far this week, and the Gulf Coast is settling in for a long period of cleanup and recovery. Gasoline and diesel retail prices may change little this week.

Retail Diesel Prices

The week ended August 31 brought a 1.5 cents/gallon increase in the retail price for diesel. For the year to date, diesel prices have fallen by a cumulative 63.8 cents/gallon, a major downward slump that now appears to be stabilizing. In the autumn of 2019, retail diesel prices had been below the $3/gallon mark until the attacks on Saudi Arabian oil facilities in mid-September 2019. They rose at that time, and they remained above the $3/gallon mark until the week ended February 3, 2020. Prices then continued to slide. For the current week, retail diesel prices rose by 1.5 cents to arrive at an average price of $2.441/gallon. Prices rose in all PADDs. The national average price for the week was 53.5 cents/gallon below where it was during the same week last year.

In the East Coast PADD 1, diesel prices increased by 1.3 cents to average $2.519/gallon. Within PADD 1, New England prices rose by 0.2 cents to average $2.622/gallon. Central Atlantic diesel prices increased by 1.1 cents to average $2.694/gallon. Lower Atlantic prices rose by 1.6 cents to average $2.379/gallon. PADD 1 prices were 48.1 cents/gallon below their levels for the same week last year.

In the Midwest PADD 2 market, retail diesel prices rose by 2.1 cents to average $2.329/gallon. Prices were 54.5 cents below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17, 2019, in having diesel prices fall below $3/gallon. Prices subsequently fell below $3/gallon in PADD 4 and PADD 1. Fifteen weeks ago, PADD 5 prices also slid below the $3/gallon mark.

In the Gulf Coast PADD 3, retail diesel prices rose by 1.4 cents to average $2.188/gallon. PADD 3 continues to have the lowest diesel prices among the PADDs, currently 25.3 cents below the U.S. average. Prices were 55.2 cents below their level for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices rose by 1.6 cents to average $2.385/gallon. PADD 4 prices were 53.9 cents lower than for the same week in the prior year.

In the West Coast PADD 5 market, retail diesel prices rose by 1.2 cents to average $2.972/gallon. PADD 5 prices were 58.3 cents below their level from last year. Until December 2019, PADD 5 had been the only district where diesel prices were higher than they were in the same week last year. Subsequently, prices rose until this was true in all other PADDs. Prices have fallen dramatically, and the national average price is now well below its level of last year. PADD 5 prices excluding California rose by 1.3 cents to average $2.603/gallon. This price was 53.6 cents below the retail price for the same week last year. California diesel prices rose by 1.1 cents to average $3.276/gallon. Until the week ended June 24, 2019, California had been the only major market where diesel prices were above $4/gallon, where they had been for nine weeks. California prices retreated below $4/gallon from July through October, rose above $4/gallon again during the first three weeks of November, and declined since then until beginning to pick up in June and July 2020. California diesel prices were 60.9 cents lower than they were at the same week last year.

Retail Gasoline Prices

The COVID-19 pandemic is having a massive impact on the U.S. gasoline market. Retail prices for gasoline dropped below $2 a gallon in April, and they remained there throughout April, May, and into early June before finally climbing back to the $2/gallon level during the week ended June 8. Until the pandemic, it had been over four years since the average retail price for gasoline had been below the $2/gallon mark. With the phased re-opening of the economy, demand began to rise, as did prices. Unfortunately, so did coronavirus infections, and some economic activities are being scaled back. Gasoline prices flattened over the past month, though they picked up during the current week.

During the current week ended August 31, average retail prices for gasoline rose by 4.0 cents to average $2.222/gallon. Prices rose in all PADDs except for the Rocky Mountains PADD 4. Retail gasoline prices for the current week were 34.1 cents per gallon lower than they were one year ago. Until November, gasoline prices had been below their levels of last year. Prices then rose to surpass last year’s levels in all PADDs. The downhill price slide changed this, making gasoline a bargain.

Looking back at historic prices, gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for 14 weeks in a row, shedding a total of 66.6 cents per gallon. In the next 17 weeks, prices marched back up by 66 cents/gallon. Prices came very close to the peak they hit in early October 2018. However, the months of May and the June 2019 brought an easing of prices amounting to 23.3 cents per gallon. The week ended July 1 reversed that downward trend and sent prices up once again. The COVID-19 pandemic caused a price collapse, but prices began to climb back up in May, June, and early July. The second half of July brought a modest easing of prices, which levelled off in mid-August then began to turn around over the past two weeks.

For the current week ended August 31, East Coast PADD 1 gasoline retail prices rose strongly by 6.0 cents to average $2.156/gallon. This was the largest price hike among the PADDs. This week’s average price was 32.4 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices rose by 4.1 cents to average $2.162/gallon. Central Atlantic market prices jumped by 8.5 cents to average $2.320/gallon. Prices in the Lower Atlantic market rose by 4.9 cents to average $2.052/gallon.

In the Midwest PADD 2 market, retail gasoline prices rose by 4.8 cents to average $2.121/gallon. PADD 2 prices for the week were 34.3 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices rose by 2.3 cents to average $1.889/gallon. During the week ended March 16, PADD 3 was the first region where retail prices fell below the $2/gallon level. It was joined subsequently by PADD 2, then by PADD 1, and then by PADD 4. Currently, PADD 3 remains the only PADD where prices are still below $2/gallon. PADD 3 usually has the lowest average prices among the PADDs. PADD 3 prices for the week were 33.7 cents/gallon lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices eased by 0.5 cents to average $2.345/gallon. This was the only price decrease among the PADDs. This week’s PADD 4 prices were 28.3 cents/gallon lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices rose slightly by 0.3 cents to average $2.858/gallon. PADD 5 typically has the highest retail prices for gasoline, and until mid-March it had been the only PADD where retail gasoline prices stayed above $3/gallon. Prices this week were 39.1 cents/gallon lower than last year’s price. Prices excluding California rose by 0.3 cents to average $2.577/gallon, which was 38.1 cents/gallon below last year’s price. California prices regained the $3 per gallon level seven weeks ago, and they rose by 0.8 cents during the current week to average $3.100/gallon. (Note that there is an error in this week’s retail price data. If California prices rose by 0.8 cents and West Coast less California prices rose by 0.3 cents, the total PADD 5 price would have had to rise by more than the 0.3 cents listed.) California had been the last state where gasoline prices had remained above the $3/gallon line, but this changed the week ended March 30. On Thursday March 19, California led the U.S. by taking the dramatic step of ordering a statewide shelter-in-place to combat the spread of COVID-19. This order affected approximately 40 million people, and it caused a dramatic contraction in fuel demand. The state began to re-open businesses and facilities in May, but COVID-19 cases are rising again, and some counties have backtracked reopening. California retail gasoline prices were 39.1 cents per gallon below their levels from the same week last year.