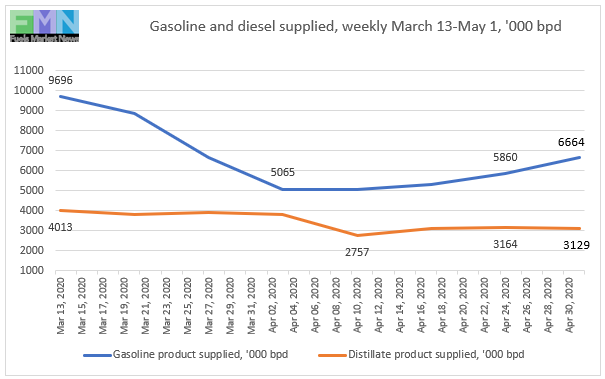

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended May 11, 2020. Retail prices for gasoline rose for the second week in a row, after a nine-week downward spiral. Diesel prices continued to weaken, though only by half a cent. The COVID-19 pandemic caused severe demand destruction, which only recently is beginning to recover, and it appears that gasoline demand is recovering more swiftly than diesel demand. The EIA publishes weekly “product supplied” data as its proxy for demand, and the latest weekly data show that gasoline demand crashed from 9,696 thousand barrels per day (kbpd) during the week ended March 13 to just 5,065 kbpd during the week ended April 3, a huge hit of 4,631 kbpd in just four weeks. That was the low point, and the data for the week ended May 1 report that gasoline demand has crept back up to 6,664 kbpd. The EIA points out that these numbers are not a precise measure of demand. Still, it is noteworthy that apparent gasoline demand rose for the latest three weeks for which data has been reported.

Distillate fuel oil demand fell by 1,256 kbpd between the week ended March 13 and the week ended April 10, slumping from 4,013 kbpd to 2,757 kbpd in a four-week period. The EIA reported that diesel demand crept back up by the week ended April 24, averaging 3,164 kbpd that week. However, apparent demand for diesel weakened again during the week ended May 1, dropping back down to 3,129 kbpd. U.S. apparent demand for all petroleum products appeared to have hit bottom at 13,797 kbpd for the week ended April 10, 2020. This was the lowest demand ever recorded since the EIA began publishing the series in November of 1990—nearly 30 years ago. Recall that demand in January and February 2020 was over 20,000 kbpd, before the COVID-19 pandemic hit. U.S. total demand bounced back to 15,763 kbpd during the week ended April 24, but demand ebbed again to 15,354 kbpd during the week ended May 1. Demand recovery will be linked to economic recovery, which is expected to come in phases. The unemployment rate skyrocketed to 14.7% in April. Some of the lost jobs will come back slowly, and some will not come back at all.

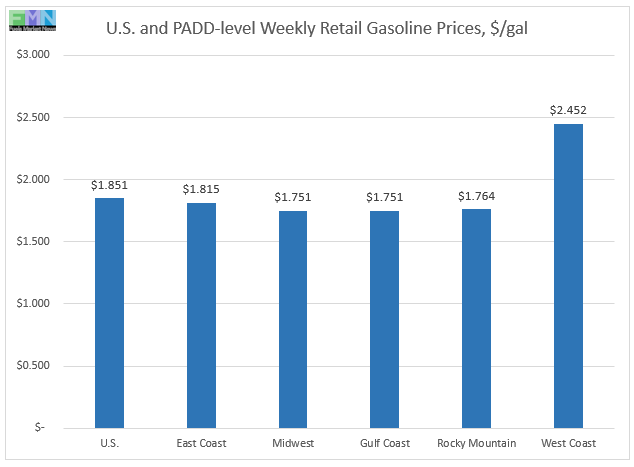

For the week ended May 11, retail prices for gasoline jumped by 6.2 cents/gallon. Retail prices for diesel continued a gentle decline of 0.5 cents/gallon. The national average price for gasoline was $1.851/gallon. This price was $1.015/gallon below the price for the same week one year ago. In February, just two months ago, retail prices for gasoline were higher than they had been a year earlier. Now, prices in four of the five PADDs are below the $2/gallon level, with only the West Coast PADD 5 having retail prices above $2/gallon. From late-November through early March, gasoline prices had been above their levels from last year. Prices declined until, during the week ended March 2, retail gasoline prices were a mere 0.001 cent/gallon above last year’s level. The dramatic price declines since then have brought gasoline prices significantly below their levels of last year.

Diesel prices also had been above last year’s level, but prices are now well below their levels of last year. On a national average basis, the retail price for diesel averaged $2.394/gallon. This was 76.6 cents/gallon lower than the price in the same week last year. Retail prices for diesel have now fallen for eighteen consecutive weeks, shedding a total of 68.5 cents/gallon.

Collapse of Futures Prices, and Retail Price Outlook

During the week May 4, 2020, to May 8, 2020, West Texas Intermediate (WTI) crude oil futures prices recovered significantly by $4.31/b (22.2%.) This was the second week of price recovery following a general downward trend punctuated with sharp collapses. This included the historical event of seeing WTI crude futures for May delivery close at -$37.63/b on April 20, 2020. Infrastructure limitations and loss of liquidity had caused a collapse of never-before-seen proportions. June delivery contracts remained in the $20-$22/b range Monday, allowing many to conclude that this was closer to the “true” value of WTI crude. Crude futures prices soon regained this level, and currently are rising. The month of May is beginning with partial re-opening of economic activities, plus additional production cuts from Saudi Arabia. Market optimism continues despite words of caution from medical experts concerned about increased outbreaks of the coronavirus.

During the week of May 4 to May 8, gasoline futures prices shot up by 16.34 cents/gallon (21.4%.) Diesel futures prices recovered by 4.21 cents/gallon (5.3%.) While the relationship between futures prices and retail prices is not immediate or one-for-one, the current week’s rise of futures prices suggests that gasoline and diesel retail prices will also strengthen in the coming week. The supply overhang remains massive, however, so a major price rally is unlikely.

Retail Diesel Prices

Retail prices for diesel have now fallen for 18 consecutive weeks—every week this calendar year since the first week of January. Prices have fallen by a cumulative 68.5 cents/gallon. Last autumn, retail diesel prices had been below the $3/gallon mark until the attacks on Saudi Arabian oil facilities in mid-September 2019. They rose at that time, and they remained above the $3/gallon mark until the week ended Feb. 3, 2020. Prices have continued to slide. For the current week ended May 11, retail diesel prices declined by 3.8 cents to settle at an average price of $2.399/gallon. For the current week ended May 11, diesel prices fell in PADDs 1, 2 and 4, while rising in PADDs 3 and 5. The national average price for the week was 76.6 cents/gallon below where it was during the same week last year. According to EIA data, diesel demand has dropped by 212% in the seven-week period from March 13 through May 1.

In the East Coast PADD 1, diesel prices fell by 1.2 cents to settle at an average price of $2.498/gallon. Within PADD 1, New England prices dropped by 2.2 cents to average $2.630/gallon. Central Atlantic diesel prices declined by 0.8 cents to average $2.680/gallon. Lower Atlantic prices fell by 1.2 cents to an average price of $2.348/gallon. PADD 1 prices were 67.8 cents/gallon below their levels for the same week last year.

In the Midwest PADD 2 market, retail diesel prices declined by 0.8 cents to average $2.240/gallon. Prices were 80.6 cents below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17, 2019, in having diesel prices fall below $3/gallon. Prices subsequently fell below $3/gallon in PADD 4 and PADD 1. Three weeks ago, PADD 5 prices also slid below the $3/gallon mark.

In the Gulf Coast PADD 3, retail diesel prices rose by 0.9 cents to arrive at an average of $2.178/gallon. PADD 3 continues to have the lowest diesel prices among the PADDs, currently 21.6 cents below the U.S. average. Prices were 72.7 cents below their level for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices dropped by 2.4 cents to settle at an average of $2.346/gallon. This was the largest price drop among the PADDs. PADD 4 prices were 83.5 cents lower than for the same week in the prior year.

In the West Coast PADD 5 market, retail diesel prices crept up by 0.1 cents to average $2.900/gallon. PADD 5 prices were 89.0 cents below their level from last year. Until December 2019, PADD 5 had been the only district where diesel prices were higher than they were in the same week last year. Subsequently, prices rose until this was true in all other PADDs. Prices have been falling dramatically, and the national average price is now well below its level of last year. PADD 5 prices excluding California rose by 1.2 cents to average $2.557/gallon. This price was 79.8 cents below the retail price for the same week last year. California diesel prices fell by 0.9 cents to settle at an average price of $3.182/gallon. Until the week ended June 24th, California had been the only major market where diesel prices were above $4/gallon, where they had been for nine weeks. California prices retreated below $4/gallon from July through October, rose above $4/gallon again during the first three weeks of November, and declined since then. California diesel prices were 90.6 cents lower than they were at the same week last year.

Retail Gasoline Prices

The COVID-19 pandemic is having a massive impact on the U.S. gasoline market. U.S. retail gasoline prices fell below the $2/gallon threshold during the week ended April 6, and they have remained below $2/gallon for five weeks despite the small increases over the past two weeks. Average retail prices jumped by 6.2 cents/gallon to average $1.851/gallon during the week ended May 11. Prices rose in all PADDs except for the Rocky Mountains PADD 4. Retail gasoline prices for the current week were $1.015 cents per gallon lower than they were one year ago. Until November, gasoline prices had been below their levels of last year. Prices then rose to surpass last year’s levels in all PADDs. The current downhill price slide has changed this, making gasoline a bargain—if you need it. It has been over four years since the average retail price for gasoline was below the $2/gallon mark.

Gasoline prices hit a peak of $2.903/gallon during the week ended Oct. 8, 2018. Prices then slid downward for fourteen weeks in a row, shedding a total of 66.6 cents per gallon. In the next seventeen weeks, prices marched back up by 66.0 cents/gallon. Prices came very close to the peak they hit in early October. However, the months of May and the June brought an easing of prices amounting to 23.3 cents per gallon. The week ended July 1 reversed that downward trend and sent prices up once again. The COVID-19 pandemic is causing a severe contraction in demand as people shelter in place, and many jobs have been lost. Last week, the Bureau of Labor Statistics reported that the U.S. unemployment rate surged to 14.7% in April. According to EIA data, gasoline demand during the week ended May 1 was approximately 31% lower than it had been during the week ended March 13.

For the current week ended May 11, East Coast PADD 1 gasoline retail prices rose by 2.1 cents to arrive at an average of $1.815/gallon. Six weeks ago, PADD 1 joined PADDs 2 and 3 in having retail prices drop below the $2/gallon line. The average price was 93.9 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices increased by 3.9 cents to average $1.864/gallon. Central Atlantic market prices rose by 2.4 cents, reaching an average of $2.007/gallon. Prices in the Lower Atlantic market rose by 1.4 cents to average $1.679/gallon.

In the Midwest PADD 2 market, retail gasoline prices jumped by 17.8 cents to average $1.751/gallon. The past two weeks have brought PADD 2 prices back above prices in the U.S. Gulf Coast PADD 3 market. PADD 2 prices for the week were $0.987/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices rose by 1.3 cents to average $1.501/gallon. Eight weeks ago, PADD 3 was the first to fall below the $2/gallon level, joined by PADD 2, then by PADD 1, and then by PADD 4. PADD 3 usually has the lowest average prices among the PADDs. PADD 3 prices for the week were a hefty $1.017/gallon lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices fell by 0.08 cents, settling at an average price of $1.764/gallon. This was the only price drop among the PADDs. This week’s PADD 4 prices were $1.200/gallon lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices rose by 1.1 cents to average $2.452/gallon. PADD 5 typically has the highest retail prices for gasoline, and until mid-March it had been the only PADD where retail gasoline prices stayed above $3/gallon. Prices this week were $1.238/gallon lower than last year’s price. Prices excluding California rose by 0.08 cents to average $2.216/gallon, which was $1.140/gallon below last year’s price. California prices recovered by 1.5 cents to average $2.650/gallon. California had been the last state where gasoline prices had remained above the $3/gallon line, but this changed the week ended March 30. On Thursday March 19, California led the U.S. by taking the dramatic step of ordering a statewide shelter-in-place to combat the spread of COVID-19. This order affected approximately 40 million people, and it is causing a dramatic drop in gasoline demand, as well as demand for other fuels including jet fuel and diesel. California retail gasoline prices were a massive $1.318 per gallon below their levels from the same week last year.