Analysis by Dr. Nancy Yamaguchi

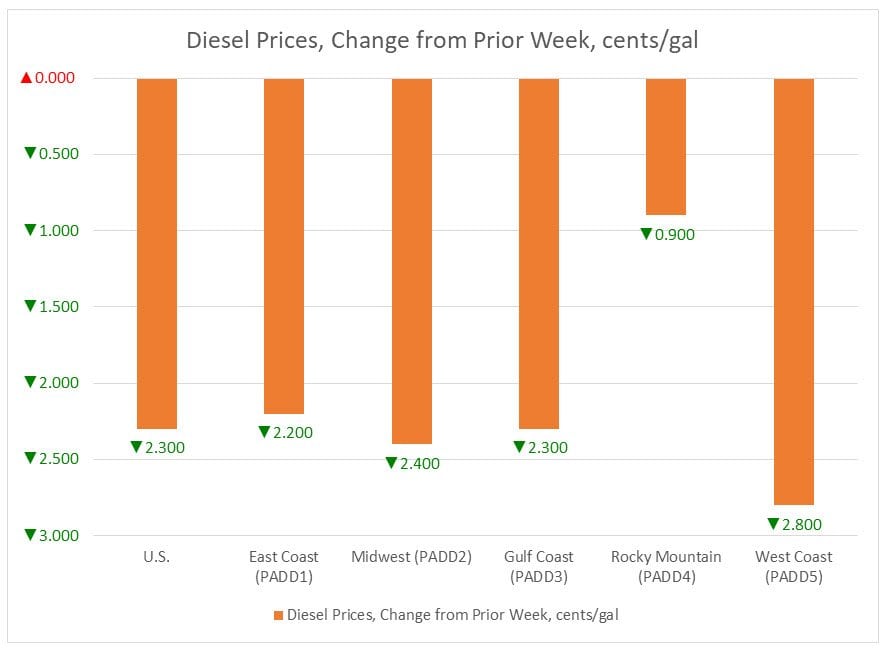

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended February 12, 2018. At the national level, gasoline prices fell by 3.0 cents per gallon, while diesel prices declined by 2.3 cents per gallon. Gasoline prices fell in all PADDs except for the Rocky Mountains PADD 4. Diesel prices fell in all PADDs countrywide.

During the week ended February 9, WTI crude prices crashed by $5.90/b, closing the market at $59.20/b on Friday. This was the lowest price of 2018. During the prior week ended February 2, WTI crude prices had begun to ease, falling by $0.73/b to close the weekly market at $65.45/b. The following week brought a sharp downward correction in US and global equity markets, and a plunge in crude prices.

The US market also hit a major milestone: During the week ended February 2, US crude production passed the 10-million barrel per day mark. Production levels this high have not been seen since 1970, and production is expected to continue to expand, setting new records. Production is expected to reach 11 mmbpd, perhaps within the coming year. OPEC officials maintain that the production cut agreement is working, and that global oil stockpiles are coming under control. Other market experts, including the IEA, warn that growing output in non-OPEC countries is undermining part of OPEC’s work.

Until the past two weeks, crude prices had run up much more quickly than expected, hitting highs of $66/b by late January. Refined fuel prices followed crude prices up. Until the week ended February 12, US gasoline prices at the pump rose every week since the week ended December 18, 2017. Retail prices for diesel rose on average every week except for one during that seven-week stretch.

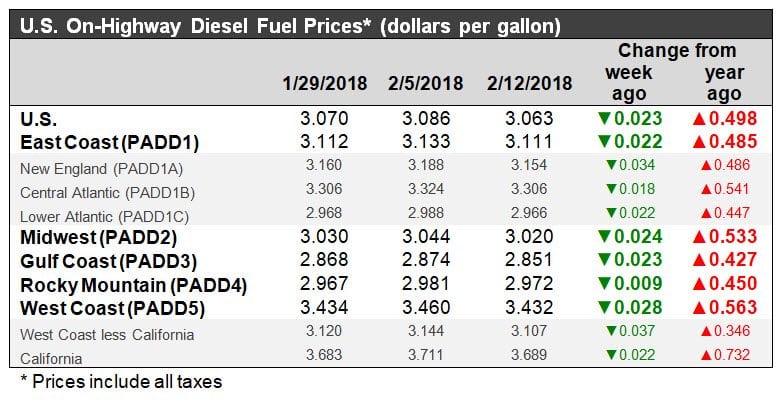

For the current week ended February 12, diesel prices fell by 2.3 cents to arrive at an average price of $3.063 gallon. US national average retail diesel prices have exceeded $3/gallon for five consecutive weeks now. These prices are the highest seen since the week ended January 5th in 2015.

In the East Coast PADD 1, diesel prices declined 2.2 cents during the week to average $3.111/gallon. In early January, PADD 1 joined PADD 5 in having diesel prices above $3/gallon. Within the PADD, New England prices fell by 3.4 cents to average $3.154/gallon. Central Atlantic diesel prices decreased by 1.8 cents to average $3.306/gallon. This submarket has had diesel prices above $3/gallon for the past fourteen weeks. Lower Atlantic prices decreased by 2.2 cents to arrive at an average price of $2.966/gallon. PADD 1 prices were 48.5 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 2.4 cents to average $3.020/gallon. Two weeks prior, PADD 2 became the third PADD, following PADD 5 and PADD 1, to have retail diesel prices exceed $3 per gallon. Prices were 53.3 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices decreased by 2.3 cents to average $2.851/gallon. This price was 42.7 cents higher than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices declined by 0.9 cents to average $2.972/gallon. PADD 4 prices were 45.0 cents higher than in the prior year.

In the West Coast PADD 5 market, retail prices decreased by 2.8 cents to average $3.432gallon. This price was 56.3 cents above its level from last year. Prices excluding California shed 3.7 cents to average $3.107/gallon, which was 34.6 cents above the retail price for the same week last year. California diesel prices fell by 2.2 cents to an average price of $3.689/gallon. This price was 73.2 cents higher than last year’s price. Until five weeks ago, PADD 5 had been the only PADD to have diesel prices above $3 per gallon. The upward trend around the country brought retail averages above the $3/gallon mark on the national level since the week ended January 15.

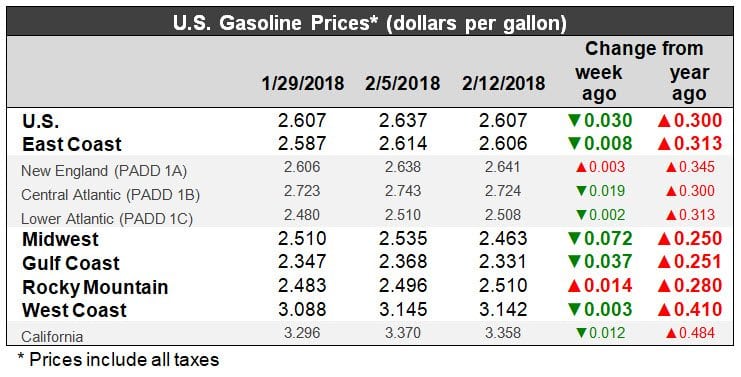

U.S. retail gasoline prices decreased by 3.0 cents during the week ended February 12, to arrive at an average price of $2.607/gallon.

For the current week ended February 12, East Coast PADD 1 retail prices for gasoline decreased by 0.8 cents to $2.606/gallon. The average price was 31.3 cents higher than last year’s price. Within PADD 1, prices edged up by 0.3 cents in New England to reach $2.641/gallon. Central Atlantic market prices fell by 1.9 cents to $2.724/gallon. Prices in the Lower Atlantic market receded slightly by 0.2 cents, to an average price of $2.508/gallon. This was 31.3 cents higher than last year’s average price for the same week.

In the Midwest PADD 2 market, retail gasoline prices dropped sharply by 7.2 cents to arrive at an average price of $2.463/gallon. Gasoline pump prices were 25.0 cents higher than they were one year ago.

In the Gulf Coast PADD 3 market, gasoline prices fell by 3.7 cents to average $2.331/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Prices for the week were 25.1 cents higher than for the same week in 2017.

The Rocky Mountains PADD 4 market was the only PADD where gasoline pump prices increased during the week, moving up by 1.4 cents to average $2.510/gallon. PADD 4 prices were 28.0 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices decreased marginally by 0.3 cents to arrive at an average price of $3.142/gallon. This was 41.0 cents higher than at the same time a year ago. PADD 5 typically has the highest gasoline prices among the five PADDs, and its retail gasoline prices exceeded $3/gallon for most of mid-November and early December. During the six weeks of 2018 to date, PADD 5 prices have exceeded $3/gallon. Excluding California, West Coast prices rose by 1.2 cents to an average of $2.768/gallon. This was 28.1 cents higher than at the same time in 2017. In California, prices fell by 1.2 cents to arrive at an average pump price of $3.358/gallon. California prices were 48.4 cents per gallon above their levels from last year.