The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended February 10th, 2020. Prices continued to fall for both fuels. Gasoline prices fell by 3.6 cents/gallon, while diesel prices fell by 4.6 cents/gallon. The national average price for gasoline was $2.419/gallon, which was 14.3 cents/gallon above the price for the same week one year ago. Until November, gasoline prices had been below their levels from last year. Diesel prices had been above last year’s level also, but the recent downward price path has now sent diesel prices back below their levels of last year. Diesel prices fell further below the $3/gallon level. On a national average basis, the retail price for diesel averaged $2.910/gallon, which was 5.6 cents/gallon lower than the price in the same week last year.

Retail prices for diesel have now fallen for five consecutive weeks, shedding a total of 16.9 cents/gallon. Gasoline prices also have fallen for the past five weeks, with a total decline of 15.9 cents/gallon.

Futures Prices and Retail Price Outlook

During the week February 3, 2020 to February 7, 2020, West Texas Intermediate (WTI) crude oil futures prices fell by $0.10/barrel (0.2%.) Gasoline futures prices rose by 0.81 cents/gallon (0.5%.) Diesel futures prices rose by 5.24 cents/gallon (3.2%.) Price optimism midweek was based on reports of potential progress against coronavirus 2019-nCoV. The OPEC+ group also met to discuss deeper cuts. Last week’s optimism appeared premature, and prices subsided. Futures prices are rising today, however. Chinese President Xi Jinping warned that efforts to contain the coronavirus have gone too far, and now threaten the national economy. Idled factories have been urged to re-start, which is giving a boost to markets. As of Tuesday, February 11, WTI futures prices are hovering in the $50.25/b-$50.50/b range. While the relationship between futures prices and retail prices is not immediate or one-for-one, the current upward trend in futures prices may signal a flattening of the recent decline in gasoline and diesel retail prices in the coming week. Gasoline and diesel futures prices have fallen in five of the past six weeks.

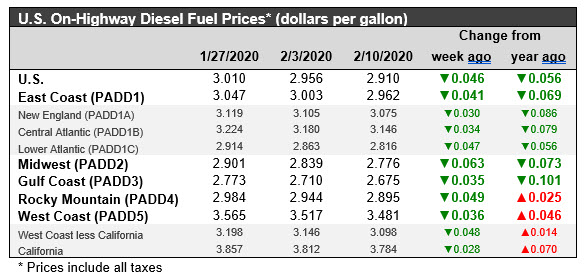

Retail Diesel Prices

Retail prices for diesel have now fallen or five consecutive weeks, shedding a total of 16.9 cents/gallon. For the current week ended February 10, retail diesel prices fell by 5.6 cents to settle at an average price of $2.910/gallon. Retail diesel prices had been below the $3/gallon mark until the attacks on Saudi Arabian oil facilities in mid-September. They remained above the $3/gallon mark until last week’s price report, and they retreated further below $3/b this week. Leading up to 2020, between mid-October 2018 and late-January 2019, retail diesel prices fell for fourteen consecutive weeks. During those fourteen weeks, the price decline totaled 42.9 cents/gallon. From February through April, diesel prices crept back up by 20.4 cents/gallon. The month of May brought a modest reversal in the upward trend in diesel prices. During the five weeks of June including the week ended July 1, diesel prices fell more substantially, declining by 10.9 cents/gallon. For the current week ended February 10th, diesel prices fell in all PADDs countrywide. The national average price for the week was 5.6 cents/gallon below where it was during the same week last year.

In the East Coast PADD 1, diesel prices fell by 4.1 cents to settle at an average price of $2.962/gallon. Within PADD 1, New England prices fell by 3.0 cents to average $3.075/gallon. Central Atlantic diesel prices dropped by 3.4 cents to average $3.146/gallon. Lower Atlantic prices fell by 4.7 cents to an average price of $2.816/gallon. PADD 1 prices were 6.9 cents/gallon below their levels for the same week last year.

In the Midwest PADD 2 market, retail diesel prices dropped by 6.3 cents to average $2.776/gallon. This was the largest price drop among the PADDs. Prices were 7.3 cents below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17 in having diesel prices fall below $3/gallon. These two PADDs were joined by PADD 4 two weeks ago and by PADD 1 last week in having diesel prices retreat below $3/gallon.

In the Gulf Coast PADD 3, retail diesel prices fell by 3.5 cents to arrive at an average of $2.675/gallon. PADD 3 continues to have the lowest diesel prices among the PADDs, currently 23.5 cents below the U.S. average. Prices were 10.1 cents below their level for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices dropped by 4.9 cents to settle at an average of $2.895/gallon. PADD 4 prices were 2.5 cents higher than for the same week in the prior year.

In the West Coast PADD 5 market, retail diesel prices fell by 3.6 cents to average $3.481/gallon. PADD 5 prices were 4.6 cents above their level from last year. Until December 2019, PADD 5 had been the only district where diesel prices were higher than they were in the same week last year. Prices rose until this was true in all other PADDs, but prices have been falling steadily, and the national average price is now below its level of last year. Prices excluding California fell by 4.8 cents to arrive at an average of $3.098/gallon. This price was 1.4 cents above the retail price for the same week last year. California diesel prices fell by 2.8 cents to arrive at an average price of $3.784/gallon. Until the week ended June 24th, California had been the only major market where diesel prices were above $4/gallon, where they had been for nine weeks. California prices retreated below $4/gallon from July through October, rose above $4/gallon again during the first three weeks of November, and eased since then. California diesel prices were 7.0 cents higher than they were at the same week last year.

Retail Gasoline Prices

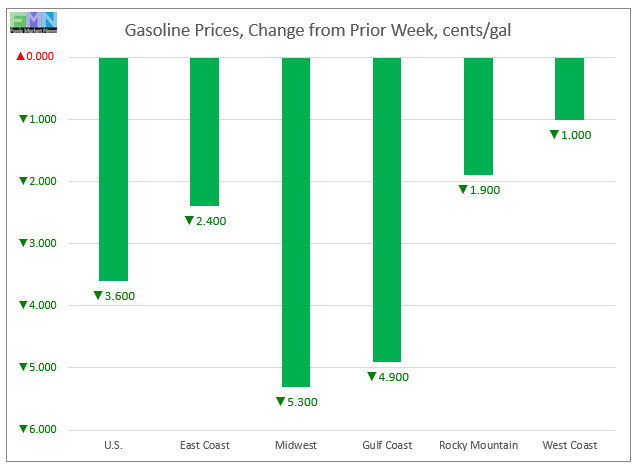

Retail gasoline prices also have fallen for the past five weeks, with a total decline of 15.9 cents/gallon. U.S. retail gasoline prices fell by 3.6 cents to average $2.419/gallon during the week ended February 10. Prices fell in all PADDs. Retail prices for the current week were 14.3 cents per gallon higher than they were one year ago. Until November, gasoline prices had been below their levels of last year. Prices in all PADDs are now higher than they were one year ago.

Gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for fourteen weeks in a row, shedding a total of 66.6 cents per gallon. In the next seventeen weeks, prices marched back up by 66.0 cents/gallon. Prices came very close to the peak they hit in early October. However, the months of May and the June brought an easing of prices amounting to 23.3 cents per gallon. The week ended July 1 reversed that downward trend and sent prices up once again.

For the current week ended February 10th, East Coast PADD 1 gasoline retail prices fell by 2.4 cents to settle at an average of $2.369/gallon. The average price was 13.3 cents/gallon above where it was during the same week last year. Within PADD 1, New England prices decreased by 2.5 cents to average $2.454/gallon. Central Atlantic market prices dropped by 3.7 cents, arriving at an average of $2.511/gallon. Prices in the Lower Atlantic market declined by 1.5 cents to average $2.257/gallon.

In the Midwest PADD 2 market, retail gasoline prices fell by 5.3 cents to average $2.260/gallon. This was the largest price decline among the PADDs. PADD 2 prices for the current week were 11.0 cents/gallon higher than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices dropped by 4.9 cents to average $2.087/gallon. PADD 3 continues to have the lowest average prices among the PADDs, currently 33.2 cents/gallon below the average U.S. price. Prices for the week were 12.8 cents higher than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices fell by 1.9 cents to settle at an average price of $2.507/gallon. This week’s PADD 4 prices were 34.1 cents higher than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices fell by 1.0 cent to settle at $3.145/gallon. This was 22.4 cents higher than last year’s price. (Note: the EIA data contain a discrepancy this week, since the reported price declines in California and the rest of PADD 5 were reported at only a fraction of a cent, but the PADD total price was reported to have fallen by 1.0 cent.) Prices excluding California were reported to have eased by 0.3 cents to average $2.895/gallon, which was 25.1 cents/gallon above last year’s price. California prices were reported to have fallen by 0.5 cents to average $3.366/gallon. California prices rose dramatically in late September and early October, attributed to refinery issues, hitting levels above $4/gallon. Prices have been retreating in recent weeks. California prices were 24.0 cents per gallon above their levels from the same week last year. Until November, PADD 5 had been the only PADD where prices were higher than they were one year ago. Currently, average retail gasoline prices in all PADDs are higher than they were last year.