Excerpted from EIA’s This Week In Petroleum, Nov. 1 2023

On October 23, the U.S. District Court of Delaware initiated a process that will see the sale of three refineries owned by Citgo parent company PDV Holdings, the U.S. subsidiary of Venezuelan state-owned oil company, Petróleos de Venezuela SA (PdVSA). Together, the three refineries account for about 5% of U.S. refining capacity. The sale of Venezuela’s refining assets follows a decision by the U.S. Treasury Department to provisionally lift most energy-related sanctions on Venezuela as part of an agreement on the country’s electoral process, although the two issues are not directly related. That change could see more Venezuelan crude oil enter the United States.

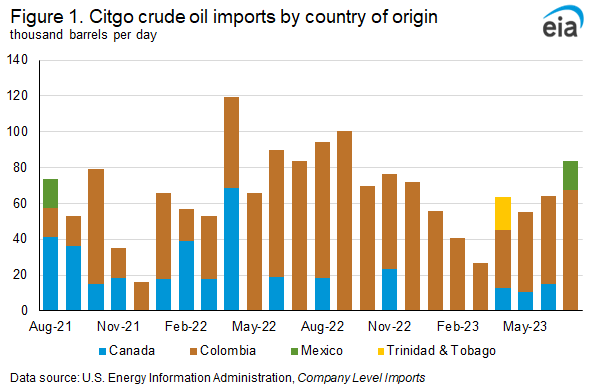

In 2018, the U.S. District Court of Delaware ordered PDV Holdings to auction off Citgo to satisfy an arbitration award granted to a Canadian mining company, Crystallex. Following that decision, other creditors have sought similar compensation from PdVSA or the Venezuelan government. On October 23, the distribution of marketing materials to potential buyers marked the formal beginning of the process to auction off Citgo, which will likely last several months. Citgo’s refinery assets possess significant coking capacity and process relatively heavy crude oil slates. All three refineries process imported crude oil, which had initially been supplied by PdVSA. Since 2019, however, Citgo refineries have switched to processing imported crude oil from other countries, particularly Colombia and Canada (Figure 1).

Colombia was the largest supplier of imported crude oil to Citgo refineries in 2022 (62,000 barrels per day [b/d]) and so far in 2023 (45,000 b/d). Canada supplied 5,500 b/d of crude oil to Citgo refineries in the United States this year, mainly to the company’s Lemont refinery. Most of Citgo’s crude oil imports are heavy, sour grades, which accounted for all the company’s crude oil imports last year. Heavy, sour crude oil has been in short supply and has had significant price increases in recent months, despite normally selling at a significant discount to light, sweet grades.

Citgo reported no imports from Venezuela into any of its U.S. refineries in 2023. Citgo was established as a refining and marketing arm of PdVSA in the United States, and its Gulf Coast refineries have historically been the largest importers of Venezuela’s crude oil. Citgo had made significant investments in the complex refinery units needed to process the heavy, sour grades of Venezuela’s crude oil. In 2018, Citgo was the largest importer of Venezuela’s crude oil at 179,000 b/d. The company’s three refineries are its 455,000-barrel per calendar day (b/cd) Lake Charles refinery in Louisiana, its 167,500-b/cd Corpus Christi refinery in Texas, and its 182,685-b/cd Lemont refinery in Illinois (Figure 2).

Beginning in 2020, the Treasury Department kept creditors from pursuing an auction or other settlement against PDV Holdings or Citgo. However, in May 2023, the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC) indicated that it would not halt an auction of Citgo or stop other negotiated settlements against PDV Holdings.

According to reporting by Reuters and Bloomberg, more than 20 plaintiffs have filed for compensation from PdVSA or PDV Holdings, with combined claims of at least $20 billion. Claimants include ConocoPhillips, which is reportedly seeking over $10 billion in payments. Valuations of Citgo’s net worth vary significantly, but many trade press reports estimate the company is valued at between $10 billion and $14 billion. The tentative sale hearing date is July 15, 2024.

The beginning of the Citgo auction process follows a decision on October 18 from OFAC that could see more Venezuelan oil imported into the United States. That decision was based on an agreement over Venezuela’s electoral roadmap, and the Treasury Department can reimplement the sanctions at any point.

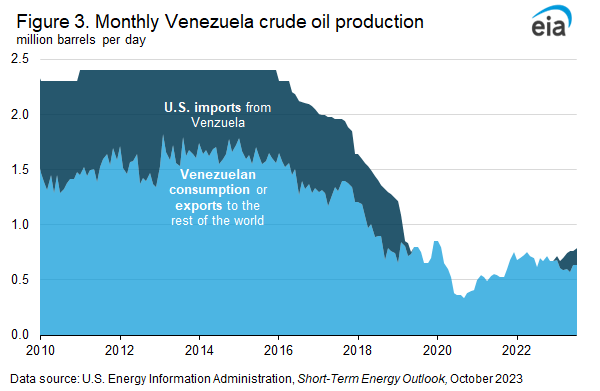

If the sanctions relief remains in place, it could pave the way for additional exports of Venezuela’s crude oil beyond the partial relief granted late last year (Figure 3).

U.S. crude oil imports from Venezuela fell sharply after January 2019 when the United States imposed sanctions on Venezuela and PdVSA. After the United States imposed the sanctions, all U.S. crude oil imports from Venezuela—including volumes already in transit from the country—stopped by May 2019. Consequently, 2018 was the last full year in which the United States imported crude oil from Venezuela (Figure 4).

The United States eased those sanctions in November 2022 when OFAC granted waivers to Chevron so it could resume exporting crude oil from its joint venture operations in Venezuela to U.S. refineries. Chevron resumed exporting crude oil from Venezuela to the United States in January 2023. Data through July of this year show that U.S. crude oil imports from Venezuela averaged 117,000 b/d, well below the 2018 annual average of 506,000 b/d. Chevron has imported an estimated 43,000 b/d so far this year, just over half of the 74,000 b/d that the company was importing in 2018. Chevron’s imports from Venezuela have primarily flowed to its refinery in Pascagoula, Mississippi.

Chevron has not been the largest importer of crude oil from Venezuela in 2023. The largest importer this year has been Valero, which imported an average of 52,000 b/d of crude oil through July. Valero’s current import volumes most likely reflect cargoes purchased from Chevron, although the company also reportedly sought a sanctions exemption from the Treasury to allow it to purchase crude oil directly from PdVSA.

Valero possesses a substantial refining portfolio on the U.S. Gulf Coast, including its refineries in Meraux, Norco, Port Arthur, Corpus Christi, Houston, and Texas City. Together, these facilities account for almost 1.4 million b/d of refinery distillation capacity. In 2018, Valero had imported an average of 179,000 b/d, more than double Chevron’s import volume and just 200 b/d less than Citgo, the largest importer from Venezuela in 2018.