Dean Foreman | Energy Tomorrow Blog

September 16, 2019

An attack on a Saudi Arabian oil processing facility over the weekend has knocked out a significant part of Saudi production, at least temporarily, shaking oil markets. The precise amount and duration of the outage remains uncertain, and there are still unknowns about the attack that caused it, which in turn has inflated the risk premium on oil prices due to market fears about what may happen next within the region.

The market’s initial direction is clear, with Brent crude oil up more than $8 per barrel as of 3 p.m. Monday, per Bloomberg. Let’s break down what’s happened in context, recognizing that the U.S. energy revolution has fundamentally added to U.S. and global near-term deliverability of oil, natural gas and natural gas liquids, generally helping stabilize the global market against supply disruptions.

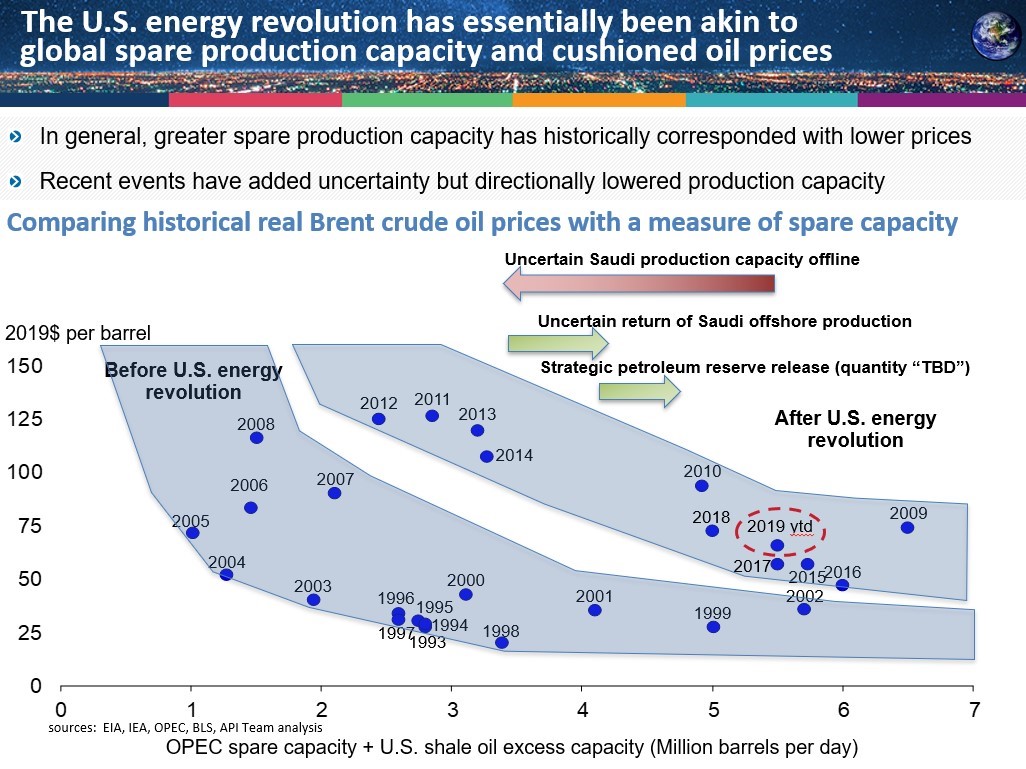

There is a long-standing and entrenched inverse relationship between oil spare production capacity and prices. As one might expect with economic fundamentals, greater spare production capacity or market cushion historically has eased the market and corresponded with lower prices. Conversely, periods of lower spare production capacity historically have led to tighter markets and higher prices.

The chart below shows the historical relationship that has shifted over time, before and after the U.S. energy revolution. From 1990 until 2008, before major market effects of the then-nascent U.S. energy revolution could take hold, there was a general pattern where lower OPEC spare capacity corresponded with higher prices, and vice versa.

This past weekend, the revelation that significant Saudi Arabian production capacity was lost was almost immediately offset in part by efforts to soothe global markets – first by the Saudis announcing they would bring additional offshore production capacity to market, and second by the Trump Administration indicating it would release an undetermined amount of the U.S. strategic petroleum reserve (SPR). Russia has reassured markets over inventories and supplies. Europe and China could follow suit and leverage their petroleum reserves. China, in particular, may need to resume purchases of U.S. crude oil that it stopped amid to the trade war with the U.S.

That global oil consumers turn to the United States for reliable supplies is a significant development from the U.S. energy revolution. As API’s Monthly Statistical Report for August (to be released Sept. 19) shows, U.S. oil production set new records at 12.3 million barrels per day (mb/d) for crude oil and an additional 4.8 mb/d of natural gas liquids. For a second year in a row, the U.S. has supplied virtually all global growth in oil demand – and now can backstop global oil markets during a potential crisis.

In many ways, the U.S. energy revolution has effectively provided spare oil production capacity to the world. It has shortened the time between initial drilling and delivery to market to days or weeks vs. months or years, as in the past. It also has segmented oil production into stages with a near-record backlog of drilled but uncompleted wells or so-called “DUCs.” DUCs represent production that can be brought on stream quickly, provided there is pipeline infrastructure to enable it. (As we’ve noted before, the fundamental value of enabling U.S. infrastructure via policies that enhance U.S. economic and national security.)

A market snapshot before and after the U.S. energy revolution follows – and it’s remarkable by measure. Who would have even thought it possible for the U.S. to reduce its reliance on imported oil by 10 million barrels per day over a decade, much less become a preferred supplier of crude oil and refined products to the world? This is a prime time for the U.S. oil and natural gas industry, which continues to deliver on behalf of American and global consumers the fuels and materials that are integral to human and economic development – and are expected by the Energy Information Administration (EIA) and International Energy Agency (IEA) to remain so for decades to come.

Dr. R. Dean Foreman is API’s chief economist, specializing in energy and global business. With a Ph.D. in economics from the University of Florida, he came to API from Saudi Aramco Strategy & Market Analysis in Dhahran, where he managed short-term market monitoring and the long-term oil demand outlook. Foreman has more than 20 years of industry experience in corporate strategic planning, forecasting, finance / risk management and regulatory policy at ExxonMobil, Talisman Energy and Sasol North America.