Oil prices surged this week, heartened by several bullish items: OPEC+ restraint, job market improvements, a decline in crude oil inventories, good news in the fight against COVID-19, and progress toward another federal COVID-19 relief package. Oil prices quickly recouped the losses seen over the prior two weeks, then continued to rise. On the global supply front, the OPEC+ group committed to extend deep cuts through February and March, seeking to bring down inventories. Moreover, the producers have been achieving high rates of compliance (101%) with their production caps. WTI crude futures prices opened Monday at $52 a barrel, passed $54 a barrel on Tuesday, passed $55 a barrel on Wednesday, then passed $56 a barrel on Thursday, which was the highest price level in over a year. Prices are continuing to rise today, and the highs are touching $57 a barrel. Product prices also have risen steadily this week, with diesel prices given an added boost by severe winter storms in the Northeast.

There is good news about job formation this morning. The U.S. Bureau of Labor Statistics released the Employment Situation Report for January 2021, also known as the Jobs Report. According to the BLS, “The unemployment rate fell by 0.4 percentage point to 6.3 percent in January, while nonfarm payroll employment changed little (+49,000).” One year ago, the unemployment rate was at an historically low level of just 3.5%.

Initial jobless claims are heading down, finally retreating below 800,000 during the last week of January. According to data collected by the Department of Labor, 779,000 people filed initial unemployment claims during the week ended January 30, down significantly by 33,000 from the prior week’s revised level of 812,000. Initial weekly claims had finally subsided below the one-million mark at the end of August, but it took until mid-October before claims finally fell below 800,000. By November, COVID-19 infections began to surge again, and initial unemployment claims rose again. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the 46 weeks since U.S. states began to issue shelter-in-place orders, approximately 77.3 million Americans have filed initial jobless claims.

The COVID-19 pandemic already has brought untold suffering to the country. Its economic impact will be long-lasting as well. The following chart compares U.S. government expenditures with receipts on a quarterly basis from 2018 through the third quarter of 2020. The U.S. government habitually spends more than it collects. The gap between expenditures and receipts was growing steadily, but the second and third quarters of 2020 brought a huge leap in spending, alongside a small decline in revenues. Expenditures exceeded revenues by a whopping $5,360 billion in the second quarter and $3,782 billion in the third quarter. The fourth quarter brought continued COVID-19 relief spending, and the White House is proposing an additional $1.3 trillion relief package. Although the price tag is hard to bear, large-scale federal programs and stimulus are essential to COVID-19 recovery, and the current market rally is attributed in part to the increasing likelihood of another federal infusion. The cost of the current package may be reduced by tightening the income threshold for families and individuals receiving stimulus checks.

Source: U.S. Bureau of Economic Analysis

The U.S. is making headway in the fight against COVID-19. According to the COVID Tracking Project, last week’s data showed a 16% drop in new cases compared to the prior week, and new cases for the week finally dropped below one million. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 are approaching 105 million, with 2,287,003 deaths. The U.S. continues to lead the world with 26,680,261 cases and 455,875 deaths. The Centers for Disease Control (CDC) reports that nearly 57.5 million doses of vaccine have been distributed, with 35.2 million doses administered.

WTI crude futures prices opened at $56.46 a barrel today, up significantly by $4.31 a barrel (8.3%) from last Friday’s open of $52.15 a barrel. WTI futures have not opened above $56 a barrel in over a year. This surge more than recoups the losses of the prior two weeks, and prices are continuing to rise today. WTI crude is trading in the range of $56.43-$57.18 a barrel currently. The week is heading for a finish in the black. Our weekly price review covers hourly forward prices from Friday, January 29 through Friday, February 5. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Gasoline Prices

Source: Prices as reported by DTN Instant Market

Gasoline futures prices opened at $1.6535 a gallon today on the NYMEX, compared with $1.5725 a gallon last Friday. This was a significant increase of 8.1 cents (5.2%.) Gasoline futures prices have been trending mainly up since November; futures prices have risen by approximately 63 cents per gallon over the past three months. U.S. average retail prices for gasoline rose by 1.7 cents to average $2.409/gallon during the week ended February 1. Gasoline futures prices remain strong this morning, trading in the range of $1.6516/gallon to $1.6708/gallon. This week is heading for a finish in the black. The latest price is $1.6658/gallon.

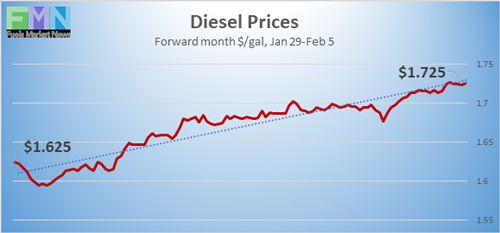

Diesel Prices

Source: Prices as reported by DTN Instant Market

Diesel opened on the NYMEX today at $1.7079/gallon, up significantly by 11.31 cents, or 7.1%, from last Friday’s open of $1.5948/gallon. Diesel futures prices have been trending generally up over the past three months, and they have gained roughly 63 cents per gallon since the beginning of November. U.S. average retail prices for diesel rose by 2.2 cents per gallon during the week ended February 1 to reach an average of $2.738/gallon. Currently, diesel futures prices are rising. The week is headed for a finish in the black. Contracts are trading in the range of $1.7079-$1.7332/gallon. The latest price is $1.7329/gallon.

WTI Crude Prices

Source: Prices as reported by DTN Instant Market

WTI crude futures prices opened at $56.46 a barrel today, up significantly by $4.31 a barrel (8.3%) from last Friday’s open of $52.15 a barrel. WTI prices have not opened above $56 a barrel in over a year. This week’s surge quickly recouped the losses seen in the prior two weeks, then continued to move up. The price rally is being driven by several factors, including OPEC+ production caps and high compliance rates, good news on the COVID-19 fight, improvement in the jobs market, and progress toward another federal COVID-19 relief package. Futures contracts are trading in the range of $56.43-$57.10 a barrel currently. The week is heading for a finish in the black. The latest price is $57.06 a barrel.

PRICE MOVERS THIS WEEK: FULL BRIEFING

Oil prices surged this week, heartened by several bullish items: OPEC+ restraint, job market improvements, a decline in crude oil inventories, good news in the fight against COVID-19, and progress toward another federal COVID-19 relief package. Oil prices quickly recouped the losses seen over the prior two weeks, then continued to rise. On the global supply front, the OPEC+ group committed to extend deep cuts through February and March, seeking to bring down inventories. Moreover, the producers have been achieving high rates of compliance with their production caps. The OPEC members (led by Saudi Arabia) achieved 104% compliance and the allied members (led by Russia) achieved a 95% compliance rate. The OPEC+ group as a whole achieved a 101% compliance rate. WTI crude futures prices opened Monday at $52 a barrel, passed $54 a barrel on Tuesday, passed $55 a barrel on Wednesday, then passed $56 a barrel on Thursday, which was the highest price level in over a year. Prices are continuing to rise today, and the highs are touching $57 a barrel. Product prices also have risen steadily this week, with diesel prices given an added boost by severe winter storms in the Northeast.

There is good news about job formation this morning. The U.S. Bureau of Labor Statistics released the Employment Situation Report for January 2021, also known as the Jobs Report. According to the BLS, “The unemployment rate fell by 0.4 percentage point to 6.3 percent in January, while nonfarm payroll employment changed little (+49,000)… The labor market continued to reflect the impact of the coronavirus (COVID-19) pandemic and efforts to contain it. In January, notable job gains in professional and business services and in both public and private education were offset by losses in leisure and hospitality, in retail trade, in health care, and in transportation and warehousing.” One year ago, the unemployment rate was at an historically low level of just 3.5%.

Initial jobless claims are heading down, finally retreating below 800,000 during the last week of January. According to data collected by the Department of Labor, 779,000 people filed initial unemployment claims during the week ended January 30, down significantly by 33,000 from the prior week’s revised level of 812,000. Initial weekly claims had finally subsided below the one-million mark at the end of August, but it took until mid-October before claims finally fell below 800,000. By November, COVID-19 infections began to surge again, and initial unemployment claims rose again. Prior to the pandemic, initial claims were typically 200,000–220,000 each week. During the 46 weeks since U.S. states began to issue shelter-in-place orders, approximately 77.3 million Americans have filed initial jobless claims.

The COVID-19 pandemic already has brought untold suffering to the country. Its economic impact will be long-lasting as well. The following chart compares U.S. government expenditures with receipts on a quarterly basis from 2018 through the third quarter of 2020. The U.S. government habitually spends more than it collects. The gap between expenditures and receipts was growing steadily, but the second and third quarters of 2020 brought a huge leap in spending, alongside a small decline in revenues. Expenditures exceeded revenues by a whopping $5,360 billion in the second quarter and $3,782 billion in the third quarter. The fourth quarter brought continued COVID-19 relief spending, and the White House is proposing an additional $1.3 trillion relief package. Although the price tag is hard to bear, large-scale federal programs and stimulus are essential to COVID-19 recovery, and the current market rally is attributed in part to the increasing likelihood of another federal infusion. The cost of the current package may be reduced by tightening the income threshold for families and individuals receiving stimulus checks.

Source: U.S. Bureau of Economic Analysis

The U.S. is making headway in the fight against COVID-19. According to the COVID Tracking Project, last week’s data showed a 16% drop in new cases compared to the prior week, and new cases for the week finally dropped below one million. The Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 are approaching 105 million, with 2,287,003 deaths. The U.S. continues to lead the world with 26,680,261 cases and 455,875 deaths. The Centers for Disease Control (CDC) reports that nearly 57.5 million doses of vaccine have been distributed, with 35.2 million doses administered.

U.S. crude oil inventories were drawn down by 0.994 million barrels (mmbbls) this week. The Energy Information Administration (EIA) also reported a minuscule drawdown of 0.009 mmbbls from distillate inventories. However, gasoline stocks rose by 4.467 mmbbls. The net inventory build was 3.464 mmbbls. Oil prices remained strong despite the build. The official data painted a less rosy picture than indicated by the earlier data reported by the American Petroleum Institute (API.) The API reported across-the-board draws of 4.261 mmbbls from crude stockpiles, 0.24 mmbbls from gasoline inventories, and 1.622 mmbbls from distillate inventories.

U.S. crude oil production remained unchanged at 10.9 million bpd last week. Production averaged 10.96 mmbpd in January 2021, 2.0 mmbpd lower than the 12.96 achieved during in January 2020. Apparent oil product demand in January 2021 was 1.172 mmbpd below its level of one year ago, most of this coming from drops in gasoline demand (down by 0.878 mmbpd) and jet fuel demand (down by 0.551 mmbpd.)