Exclusive Analysis by Dr. Nancy Yamaguchi

West Texas Intermediate (WTI) crude oil futures prices are struggling to hold above $41 a barrel this morning. Global stock markets are pulling oil prices down. All month, WTI crude has traded at prices usually within a one-dollar range above and below $40 a barrel. The supply and demand equation has many moving parts, and prices have found at least a temporary equilibrium in the $39-$41 a barrel range. Price strength this week has come from news about COVID-19 vaccine trials, continued demand recovery, and the European Union economic stimulus program. Counteracting this, the U.S. coronavirus relief package was postponed. COVID-19 cases are rising relentlessly. Initial jobless claims reversed their downward trend. Tensions between the U.S. and China are rising. However, the optimistic news came early in the week, while the pessimistic news came late in the week, and the result is that prices today are moving down. A critical concern now is whether the U.S. will face a second wave of economic damage. WTI crude prices so far have managed to remain above $41 a barrel, but crude oil futures may finish the week roughly flat.

Economic concerns rose this week when statistics revealed that the quest for job recovery has been set back. The Department of Labor reported that 1,416,000 people filed initial unemployment claims during the week ended July 18, an increase of 109,000 from the prior week’s upward-revised level of 1,307,000. This was the first week with an increase since the week of March 28. Most economists had forecast a steady decrease in unemployment claims, hoping that weekly jobless claims would finally fall below one million. Unfortunately, the relentless increase in COVID-19 infections is shutting some economic activities down. During the 18 weeks since U.S. states began to issue shelter-in-place orders, 55.1 million Americans have filed initial jobless claims.

Is it possible that the U.S. will suffer a second wave of economic damage? Most of the states that moved forward with early economic re-opening thought that their programs were necessary and safe. Small businesses are spending extraordinary amounts of time and money on COVID-19 safety. For example, convenience stores are essential businesses, small in scale, with rapid transactions, doing daily deep cleaning and often providing hand sanitizers and gloves at fuel pumps. NACS reports that convenience stores account for over 34% of all retail outlets in the U.S. They sell approximately 80% of fuel in the country and provide 2.4 million jobs. These businesses may suffer disproportionately if the coronavirus cuts into the hoped-for recovery in fuel and convenience store sales.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 shot past the 15.5 million mark, and deaths have surpassed 633,000. Confirmed cases in the U.S. have risen to 4,034,864, and U.S. deaths attributed to the disease have reached 144,305. Over 70,000 new cases were reported on Wednesday, and over 71,000 new cases were reported on Thursday. Texas reported its highest-ever death toll. Hong Kong has effectively banned travel from the U.S.

WTI crude futures prices opened at $41.06 a barrel today, up by $0.16 a barrel (0.4%) from last Friday’s open of $40.90 a barrel. Today, prices may come under pressure, and WTI may retreat below $41 a barrel for September contracts, while remaining somewhat stronger for October contracts. Oil prices may end the week roughly flat. Our weekly price review covers hourly forward prices from Friday, July 17 through Friday, July 24. Three summary charts are followed by the Price Movers This Week briefing, which provides a more thorough review.

Gasoline Prices

Gasoline Prices

Gasoline futures prices opened at $1.263 per gallon today on the NYMEX, compared with $1.2339/gallon on Friday, July 17. This was a gain of 2.91 cents (2.4%.) March brought a crippling collapse of nearly 87 cents per gallon, but prices gradually crept back up in April and May. U.S. average retail prices for gasoline retreated by 0.9 cents/gallon during the week ended July 20. Six weeks ago, retail prices reclaimed the territory above $2 per gallon. Retail prices averaged $2.186/gallon at the national level. Gasoline futures prices have a downward tilt today, trading in the range of $1.256/gallon to $1.275/gallon. The week appears to be heading for a finish in the black. The latest price is $1.2578/gallon.

Source: Prices as reported by DTN Instant Market

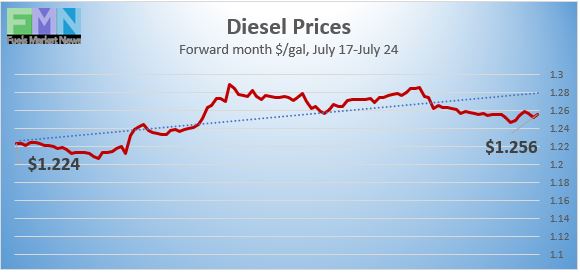

Diesel Prices

Diesel Prices

Diesel opened on the NYMEX today at $1.2576/gallon, up by 2.9 cents, or 2.4%, from last Friday’s open of $1.2286/gallon. U.S. average retail prices for diesel fell by 0.5 cents per gallon during the week ended July 20 to average $2.433/gallon. Diesel prices have weakened this year, missing some of the price recovery seen in crude and gasoline markets. Diesel futures prices today are weakening, but prices appear to be heading for a finish in the black. Currently, diesel is trading in the range of $1.242-$1.262/gallon. The latest price is $1.249/gallon.

Source: Prices as reported by DTN Instant Market

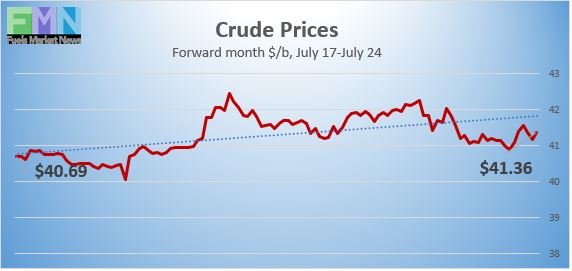

WTI Crude Prices

WTI Crude Prices

WTI crude forward prices opened on the NYMEX today at $41.06 a barrel, compared with $40.90 a barrel last Friday. This was a gain of $0.16 a barrel (0.4%.) Prices managed to stay above the $41 a barrel level most of this week, but markets are feeling pressure today from the continued increase of COVID-19 infections, the rise in initial unemployment claims, rising U.S.-China tensions, and the postponement of the next U.S. economic stimulus bill. Note that WTI contracts are shifting to the next forward month of October delivery. These prices are struggling to remain above $41 a barrel, trading in the $40.90–$41.75 a barrel range currently. The latest price is $41.18 a barrel.

Source: Prices as reported by DTN Instant Market

PRICE MOVERS THIS WEEK: BRIEFING

West Texas Intermediate (WTI) crude oil futures prices are struggling to hold above $41 a barrel this morning. All month, WTI crude has traded at prices usually within a one-dollar range above and below $40 a barrel. The supply and demand equation has many moving parts, and prices have found at least a temporary equilibrium in the $39-$41 a barrel range. Price strength this week has come from promising news about COVID-19 vaccine trials, continued demand recovery, and the successful agreement among the European Union for an economic stimulus program. Counteracting this, the U.S. Senate planned to announce its coronavirus relief package on Thursday, but it was unable to gain White House support. Negotiations will resume next week.

COVID-19 cases are rising relentlessly, and initial jobless claims reversed their downward trend and rose again. Tensions between the U.S. and China are rising. The U.S. closed the Chinese consulate in Houston this week, and China retaliated by ordering the closure of the U.S. consulate in Chengdu. Global stock markets are showing declines. A critical concern now is whether the U.S. will face a second wave of economic damage. WTI crude prices so far have managed to remain above $41 a barrel for October contracts, while September contracts have retreated below $41 a barrel as they phase out. Crude oil futures may be roughly flat this week, with early gains being given back today. Stock markets may pull down commodity prices.

Economic concerns rose this week when statistics revealed that the quest for job recovery has been set back. The Department of Labor reported that 1,416,000 people filed initial unemployment claims during the week ended July 18, an increase of 109,000 from the prior week’s upward-revised level of 1,307,000. This was the first week with an increase since the week of March 28, when initial jobless claims hit a peak of 6,867,000. Most economists had forecast a steady decrease in unemployment claims, and there were hopes that weekly jobless claims would finally fall below one million. Unfortunately, the relentless increase in COVID-19 infections is shutting some economic activities down again. During the 18 weeks since U.S. states began to issue shelter-in-place orders, 55.1 million Americans have filed initial jobless claims.

Is it possible that the U.S. will suffer a second wave of economic damage? Most of the states that moved forward with early economic re-opening thought that their programs were necessary and safe. Small businesses are spending extraordinary amounts of time and money on COVID-19 safety. For example, convenience stores are essential businesses, small in scale, with rapid transactions, doing daily deep cleaning and often providing hand sanitizer and gloves at fuel pumps. NACS reports that convenience stores account for over 34% of all retail outlets in the U.S. and sell approximately 80% of fuel in the country. They provide 2.4 million jobs. These businesses may suffer disproportionately if uncontrolled coronavirus cuts into the hoped-for recovery in fuel and convenience store sales.

As of the time of this writing, the Johns Hopkins Coronavirus Resource Center reports that global cases of COVID-19 have risen to 15,526,057, with 633,565 deaths. Confirmed cases in the U.S. have risen to 4,034,864. U.S. deaths attributed to the disease have reached 144,305. Over 70,000 new cases were reported on Wednesday, and over 71,000 new cases were reported on Thursday. Texas reported its highest-ever death toll. Hong Kong has effectively banned travel from the U.S.

The American Petroleum Institute (API) released information on Tuesday showing an unexpected addition to crude oil inventories. According to the API, 7.5 mmbbls of crude flowed back into stockpiles. This was partly counteracted by drawdowns of 2 mmbbls from gasoline stockpiles and 1.4 mmbbls from diesel inventories. The API’s net addition to inventories was 4.1 mmbbls. Market analysts had predicted drawdowns from crude and gasoline inventories plus an addition to diesel inventories, adding to a net drawdown.

The U.S. Energy Information Administration (EIA) published official inventory data on Wednesday. The EIA statistics showed an addition of 4.892 mmbbls to crude oil inventories and an addition of 1.074 mmbbls to diesel inventories. Gasoline inventories were drawn down by 1.074 mmbbls. The EIA net result was an inventory addition of 4.164 mmbbls. Crude oil inventories have expanded in 21 of the 28 weeks since the first week of January, sending a total of 109.62 mmbbls of crude oil into storage.

During the worst of the oversupply, the EIA reported that crude oil in storage at Cushing rose from 35,501 barrels during the week ended January 3, 2020, to 65,446 barrels during the week ended May 1, 2020, an increase of 29,124 barrels. Cushing stocks fell to 45,582 mmbbls during the week ended June 26, but the downward trend was reversed during the past three weeks, and Cushing stocks are back up to 50,112 mmbbls.

After remaining flat at 11.0 mmbpd for four weeks, U.S. crude production notched up by 0.1 mmbpd last week. The EIA reported that U.S. crude production during the week ended July 17 averaged 11.1 mmbpd. According to the EIA’s weekly data series, U.S. crude production averaged 13.025 mmbpd in February, the highest total ever. Production fell to 12.25 mmbpd in April, 11.52 mmbpd in May, and 10.9 mmbpd in June. Production during the first three weeks of July rose modestly to an average of 11.03 mmbpd.