As Labor Day Approaches, Prices Under Pressure

- ULSD trendline resistance in force for now

- Open interest and volume rising as diesel prices fall

- Natural gas prices finishing summer on a weak note

Sincerely

Elaine Levin,

President

Powerhouse

(202) 333-5380

The Matrix

As we approach Labor Day, the last holiday weekend of summer, petroleum prices are under pressure. Usually, as we begin to think about sweater weather and home heating, prices of ULSD have started their fall rally. Will this year be different?

ULSD prices have been decreasing since topping near $2.66 right around our last national holiday, the Fourth of July. Price action has found resistance in the form of a downtrend line. As the market trends lower, prices made a series of lower highs and lower lows. Increasingly, sellers have become aggressive on any rally in price. A line can connect the resulting series of lower highs. This line becomes an area of price resistance – a level where price advances run out of steam.

The most recent bounce in price tested the downtrend line, but buyers did not have enough conviction to push prices at the end of the session for a settlement above the trendline. The downtrend remains in place for now.

Continuation ULSD prices, NYMEX Source: FutureSource

Continuation ULSD prices, NYMEX Source: FutureSource

Chart watchers also look to volume and open interest trends to validate price patterns and changes in trends. Open interest, the number of contracts outstanding in the futures market, has been rising during this time. Volume has typically been higher on the down days. Price intensity comes from the sell side.

Contango (or carry) has returned to the price curve. Short hedgers are no longer being hurt when rolling hedges at month’s end, which encourages adding to storage. Until something changes, this feedback loop adds to the bearish sentiment.

From a fundamental standpoint, there are plenty of issues that could turn the tide. Refiners will soon head into turnaround. Hurricane season is only now approaching its peak. The Middle East is unsettled. As the war in Ukraine continues, the threats to energy infrastructure continue. A decisive move above the downtrend line, ideally on a high-volume day, could be one of the first signs of a change in trend.

Just because prices are trending lower is no reason for long hedgers to be complacent. Call option premiums are relatively cheap, especially compared to the past several years.

Supply/Demand Balances

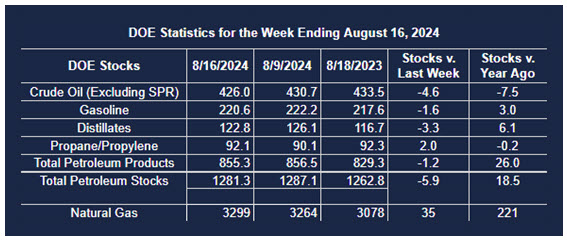

Supply/demand data in the United States for the week ended August 16, 2024, were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased (⬇) 5.9 million barrels to 1.2813 billion barrels during the week ended August 16th, 2024.

Commercial crude oil supplies in the United States were lower (⬇) by 4.6 million barrels from the previous report week to 426 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.9 million barrels to 7.7 million barrels

PADD 2: Down (⬇) 1.5 million barrels to 106.6 million barrels

PADD 3: Down (⬇) 4.2 million barrels to 239.7 million barrels

PADD 4: Down (⬇) 0.5 million barrels to 22.4 million barrels

PADD 5: Up (⬆) 2.4 million barrels to 49.6 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.6 million barrels to 28.2 million barrels.

Domestic crude oil production increased by 100,000 barrels (⬆) to 13.3 million barrels per day.

Crude oil imports averaged 6.652 million barrels per day, a daily increase (⬆) of 366,000 barrels. Exports increased (⬆) 289,000 barrels daily to 4.045 million barrels per day.

Refineries used 92.3% of capacity; 0.8 percentage point more (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 222,000 barrels daily; there were 16.689 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 146,000 barrels daily to 16.907 million barrels daily.

Total petroleum product inventories decreased (⬇) by 1.2 million barrels from the previous report week, down to 855.3 million barrels.

Total product demand decreased (⬇) 101,000 barrels daily to 20.422 million barrels per day.

Gasoline stocks decreased (⬇) 1.6 million barrels from the previous report week; total stocks are 220.6 million barrels.

Demand for gasoline increased (⬆) 147,000 barrels per day to 9.193 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 3.3 million barrels from the previous report week; distillate stocks are at 122.8 million barrels. EIA reported national distillate demand at 3.576 million barrels per day during the report week, an increase (⬆) of 27,000 barrels daily.

Propane stocks rose (⬆) 2.0 million barrels from the previous report to 92.1 million barrels. The report estimated current demand at 429,000 barrels per day, a decrease (⬇) of 438,000 barrels daily from the previous report week.

Natural Gas

As the September contract comes to a close, natural gas prices continue to fall. Prices once again have moved under $2.00. A break of $1.856 July low opens the door to a test below $1.800. The front month future will roll over to October before Labor Day, most likely moving the price back above $2.00 with it. We are in the final innings of storage refill season. Even with current injections running 20% lower than the 5 year average rate, the $2 handle for October futures will have its challenges.

According to the EIA:

- Working gas in storage was 3,299 Bcf as of Friday, August 16, 2024, according to EIA estimates. This represents a net increase of 35 Bcf from the previous week. Stocks were 221 Bcf higher than last year at this time and 369 Bcf above the five-year average of 2,930 Bcf. At 3,299 Bcf, total working gas is within the five-year historical range.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2024 Powerhouse Brokers, LLC, All rights reserved