MARKET SNAPSHOT

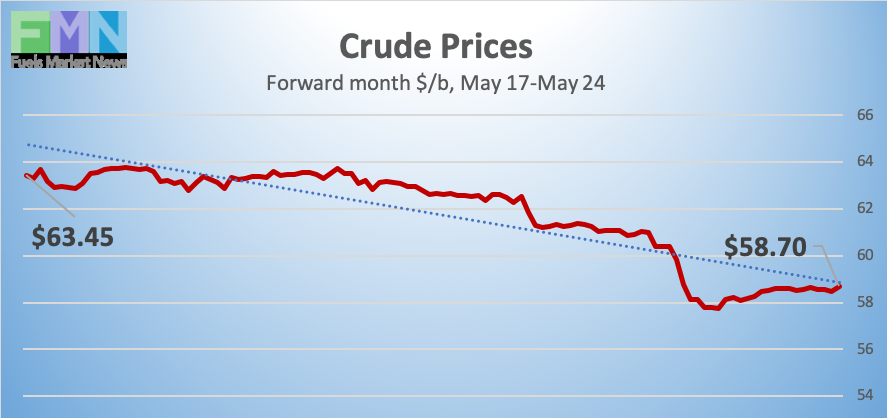

Oil prices collapsed this week. Global markets grew increasingly uneasy at the breakdown of U.S.-China trade negotiations and the escalation of tariffs. U.S. supplies rose yet again. Markets were also discouraged by another Brexit failure. Last week, prices had received support from geopolitical tensions in the Middle East and potential supply disruptions, but this fear did not prevent investors from selling off oil and other assets. WTI crude prices this morning dropped to $4.91/b (-7.8%) below last Friday’s level, and currently, crude prices remain below $59/b. Our weekly price review covers hourly forward prices from 9AM EST Friday May 17th through 9AM EST Friday May 24th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

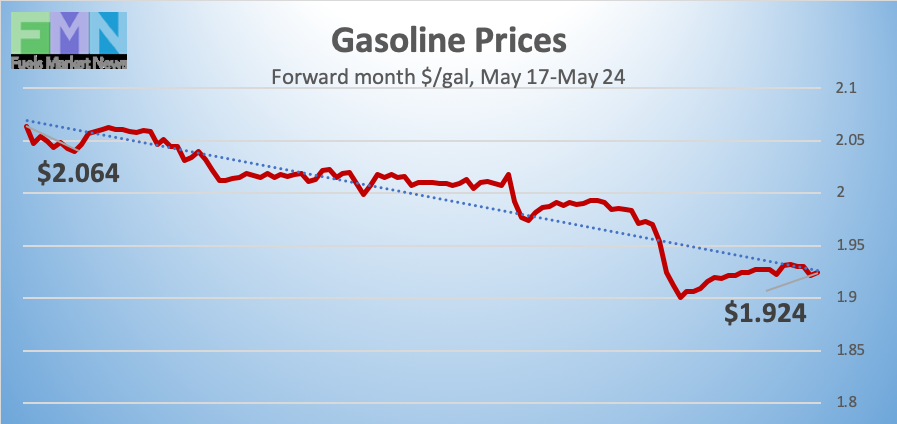

GASOLINE PRICES

Gasoline opened on the NYMEX at $2.0675/gallon on Friday May 17th, and prices opened at $1.9195/gallon on Friday May 24th, a major collapse of 14.8 cents (7.2%.) Gasoline forward prices currently are stabilizing after the collapse, with trades occurring mainly in the range of $1.92-$1.94/gallon. The latest price is $1.9256/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $2.1273/gallon on Friday May 17th and opened on Friday May 24th at $1.966/gallon, a major drop of 16.13 cents (7.6%.) Diesel prices had followed crude prices up in response to geopolitical tension last week, but the impasse in U.S.-China negotiations coupled with ample oil supplies caused prices to reverse course. Prices have fallen to two-month lows. Diesel prices currently are trading in the $1.96-$1.98/gallon range. The latest price is $1.9734/gallon.

WEST TEXAS INTERMEDIATE PRICES

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices collapsed this week, retreating to approximately two-month lows. Prices began the week flat, with WTI crude prices struggling to maintain the $63/b level. Prices collapsed midweek. The U.S. and China both escalated tariffs as trade talks broke down. The U.S. blacklisted Chinese telecommunications giant Huawei Technologies Co. Ltd. Analysts believe that blocking trade of necessary components could hamper the rollout of 5G wireless networks. There is no schedule for resumption of trade talks.

U.S. oil inventories continued to rise, forcing prices down. Market experts had predicted a drawdown of inventories, but the American Petroleum Institute (API) reported Tuesday that U.S. crude oil inventories rose instead by 2.4 million barrels (mmbbls,) gasoline inventories rose by 0.35 mmbbls, and diesel inventories were drawn down by 0.237 mmbbls. The API net addition to inventories was 2.513 mmbbls.

Official statistics were even more bearish. The U.S. Energy Information Administration (EIA) reported across-the-board stock additions: 4.74 mmbbls added to crude oil inventories, 3.716 mmbbls added to gasoline inventories, and 0.768 mmbbls added to diesel inventories. The net addition was 9.224 mmbbls. Oil prices plunged to lows of $58.01/b, the lowest prices since mid-April.

European markets were also depressed over the political fallout in the U.K. from another Brexit failure. Prime Minister Theresa May will resign as Conservative party leader on June 7th.