Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

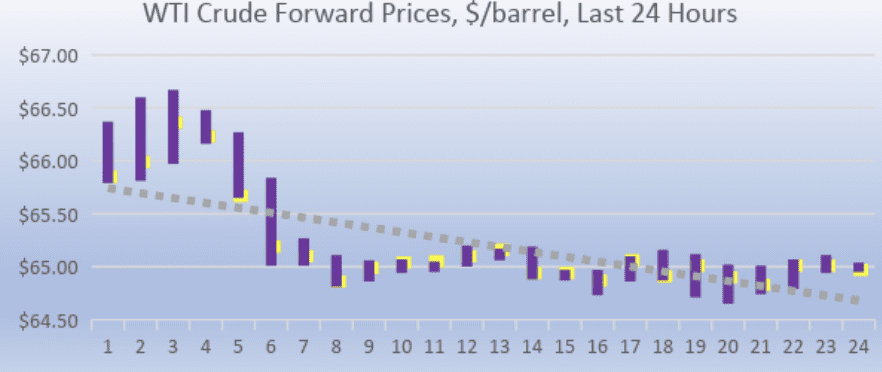

Oil prices dropped again today, but currently appear to be in a period of recovery. WTI (West Texas Intermediate) crude prices in today’s trading session opened at $64.88, down by $1.44 from yesterday’s opening price of $66.32/b. Note that futures contracts rolled over to December, so there is a data discontinuity between yesterday’s opening price and today’s price. Gasoline and diesel futures prices opened lower as well. Crude and product prices are recovering this morning. As of the time of this writing, WTI prices have risen back above $65/b. Global equities markets are opening with modest gains today, and likely will carry crude prices with them.

The Energy Information Administration (EIA) released official statistics on weekly supply and demand for the week ended October 26th. The EIA reported a 3.217-million-barrel (mmbbl) addition to crude oil inventories. However, the EIA also reported significant drawdowns in gasoline and diesel stocks, 3.161 mmbbls and 4.054 mmbbls respectively. The net effect was a 3.998-mmbbl reduction in US. oil inventories. Earlier, the American Petroleum Institute (API) had reported a 5.69-mmbbl addition to crude stocks, countered by a 3.5-mmbbl drawdown in gasoline stocks and a 3.1-mmbbl drawdown in diesel stocks, adding to a net drawdown of 0.910 mmbbls.

The official EIA data was more bullish than expected, yet prices weakened as November delivery contracts rolled to December delivery. This was the sixth week in a row that U.S. crude oil inventories rose. During those six weeks, crude oil inventories swelled by 31.9 mmbbls. In contrast, gasoline inventories have been reduced by nearly 8 mmbbls, and diesel inventories have been reduced by 13.8 mmbbls. The buildup in crude inventories and drawdown in product inventories is caused in part by the autumn refinery maintenance season.

Despite the thin margin of spare crude production capacity, today’s market appears well-supplied. The EIA reported that U.S. crude production rose by 300 kbpd last week, reaching 11.2 million barrels per day (mmbpd.) Output has grown by 1.29 mmbpd during the year to date. Moreover, Reuters conducted a survey and reported that OPEC appears to have boosted its October output to the highest level since 2016. According to the survey, the reduction in Iranian supplies has been replaced by increased production in the United Arab Emirates and Libya.

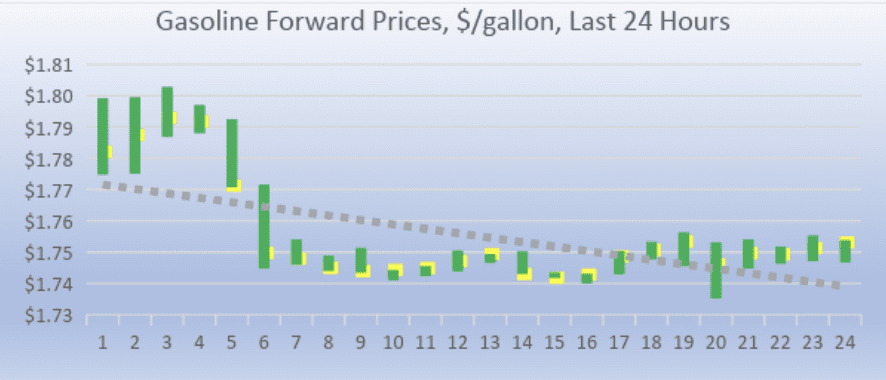

GASOLINE

Gasoline opened on the NYMEX at $1.7445/gallon today, a drop of 6.55 cents (3.58%) below yesterday’s opening price of 1.81. November contracts rolled over to December contracts today. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices dropped by 4.7 cents/gallon (2.61%.) Currently, gasoline prices are recovering. The latest price is $1.7543/gallon.

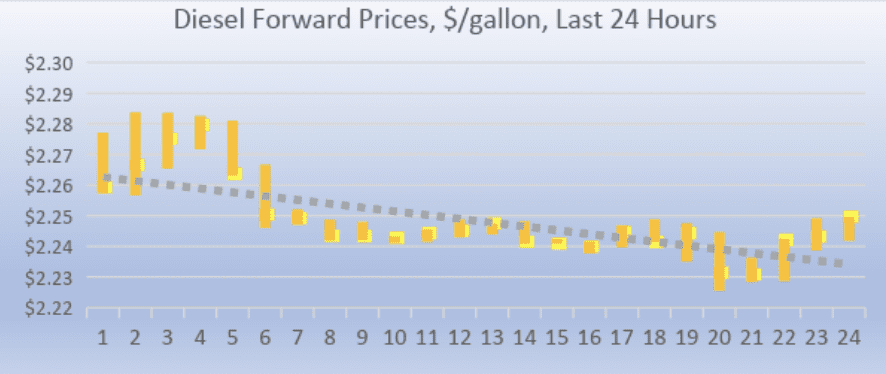

DIESEL

Diesel opened on the NYMEX at $2.2433/gallon today, down by 2.5 cents (1.1%) from yesterday’s opening. November contracts rolled over to December contracts today. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices fell by 3.4 cents/gallon (1.49%.) Currently, diesel prices are recovering. The latest price is $2.2492/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $64.88, down by $1.44 (2.17%) from yesterday’s opening price of $66.32/b. The last time WTI opened below this price was May 27th, 2015, nearly three and a half years ago. November contracts rolled over to December contracts today. Over the last 24-hour period from 9AM EST to 9AM EST, crude prices fell by $1.34/b (2.02%.) Currently, crude prices have bottomed out and are trending back up. The latest price is $65.23/b.