Analysis by Dr. Nancy Yamaguchi

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended June 4, 2018. Prices leveled off and began to ease. On a national average basis, gasoline prices dropped by 2.2 cents, and diesel prices decreased slightly by 0.3 cents.

During the week ended June 1, WTI crude prices continued to weaken, shedding $1.74/b over the week. This followed an even sharper downward correction of $3.59/b during the prior week ended May 25. WTI prices closed the week at $65.81/b, the lowest market closing price since April 10. If the retreat in crude prices persists, a more significant relaxation in product prices is likely in the coming week. As of the time of this writing, WTI forward prices have dipped below $65/b.

US weekly crude production jumped by 44 kbpd during the week ended May 25, to reach an average of 10,769 kbpd. For the year to date, US crude output has expanded by 1.277 million barrels per day.

US crude stockpiles were drawn down by 3.62 mmbbls during the week ended May 25. Gasoline inventories rose by 0.534 mmbbls. Diesel inventories rose by 0.634 mmbbls.

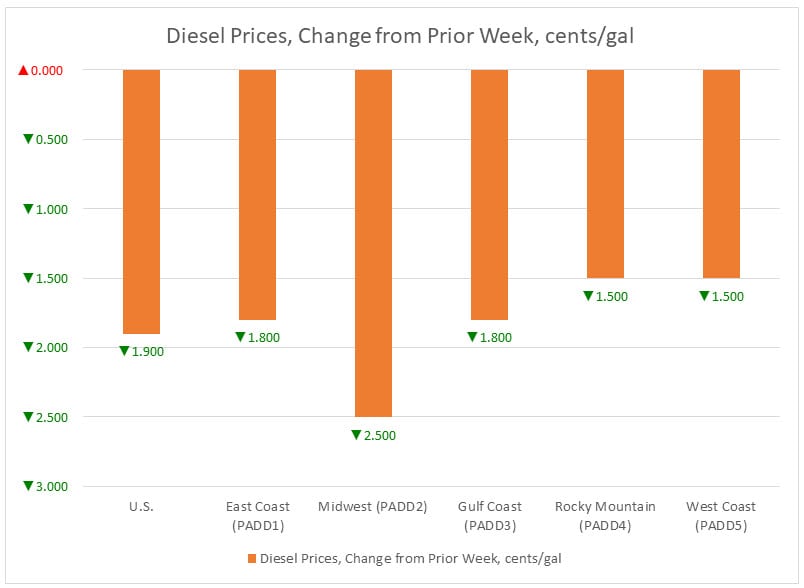

For the current week ended June 4th, diesel prices decreased slightly by 0.3 cents to arrive at an average price of $3.285/gallon. Prices declined in PADDs 1 and 2, rose in PADDs 3 and 4, and were unchanged in PADD 5. National average prices have exceeded $3/gallon for eleven consecutive weeks. The national average price was 72.1 cents per gallon higher than it was one year ago.

In the East Coast PADD 1, diesel prices decreased by 0.5 cents to arrive at an average price of $3.282/gallon. Within PADD 1, New England prices fell by 0.5 cents to average $3.302/gallon. Central Atlantic diesel prices decreased slightly by 0.1 cents to average $3.442/gallon. Lower Atlantic prices fell by 0.8 cents to arrive at an average price of $3.166/gallon. PADD 1 prices were 68.3 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 0.6 cents to average $3.224/gallon. Prices were 71.9 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices edged up by 0.1 cents to average $3.055/gallon. This price was 63.8 cents higher than for the same week in the previous year. Until the week ended May 14, PADD 3 had been the only market where diesel prices had remained below $3/gallon.

In the Rocky Mountains PADD 4 market, retail diesel prices rose by 0.6 cents to average $3.359/gallon. PADD 4 prices were 69.5 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices were unchanged at $3.784/gallon. This price was 94.8 cents above its level from last year. Prices excluding California fell by 0.6 cents to average $3.508/gallon. This price was 78.4 cents above the retail price for the same week last year. California diesel prices rose 0.6 cents to arrive at an average price of $4.003/gallon—107.6 cents above last year’s price. California is the only state where diesel prices are more than a dollar per gallon higher than they were last year. Until January, PADD 5 had been the only PADD to have diesel prices above $3 per gallon. As of the week ended May 14, all PADD-level averages exceeded the $3/gallon mark. California prices now are the first to surpass the $4/gallon mark.

U.S. retail gasoline prices fell by 2.2 cents to reach an average of $2.940/gallon during the week ended June 4th. Prices fell in PADDs 1, 2 and 5, while prices rose PADDs 3 and 4. The national average price was 52.6 cents per gallon higher than it was one year ago.

For the current week ended June 4, East Coast PADD 1 retail prices for gasoline shed 3.1 cents to average $2.879/gallon. The average price was 53.3 cents higher than last year’s price. Within PADD 1, New England prices decreased by 0.7 cents to average $2.973/gallon. Central Atlantic market prices decreased by 2.7 cents to average $3.000/gallon. Prices in the Lower Atlantic market dropped by 4.0 cents to average $2.778/gallon.

In the Midwest PADD 2 market, retail gasoline prices dropped by 3.4 cents to arrive at an average price of $2.847/gallon. Gasoline pump prices were 52.5 cents higher than they were one year ago.

In the Gulf Coast PADD 3 market, gasoline prices rose by 0.4 cents to average $2.725/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Prices for the week were 55.4 cents higher than for the same week in 2017.

In the Rocky Mountains PADD 4 market, gasoline pump prices rose 0.4 cents to average $2.995/gallon. PADD 4 prices were 56.4 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices decreased by 0.3 cents to arrive at an average of $3.460/gallon. This was 51.8 cents higher than at the same time a year ago. PADD 5 continues to have the highest gasoline prices among the five PADDs. During year to date, PADD 5 has been the only PADD where retail gasoline prices have exceeded $3/gallon. Excluding California, West Coast prices rose by 0.2 cents to average $3.250/gallon. This was 58.8 cents higher than at the same time in 2017. In California, pump prices decreased by 0.4 cents to average $3.632/gallon. California prices were 52.8 cents per gallon above their levels from last year.