Analysis by Dr. Nancy Yamaguchi

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended February 26, 2018. Refined fuel prices continued to decline gently, following the more significant declines seen last week. At the national level, gasoline prices fell by 0.9 cents per gallon, while diesel prices dropped by 2.0 cents per gallon. Gasoline prices fell in PADDs 1, 3 and 4, and rose in PADDs 2 and 5. Diesel prices fell in all PADDs countrywide.

Crude prices ran up quickly in January, made downward corrections in early and mid-February, and are slowly climbing in late February—a pattern roughly consistent with equities markets. Economists are awaiting the first formal address by newly appointed Fed Chairman Jerome Powell, to contemplate the future of interest rates and where the US Dollar will go relative to other currencies. A higher Dollar could suppress the current recovery in oil prices. WTI crude prices are currently approaching the $64/b level, after falling to lows of $59/b during the second week of February. The surge in US crude production levelled off during the week ended February 16, with output reported at 10.27 million barrels per day.

Product prices were somewhat more robust during the crude price downturns. Apparent demand for diesel rose by 142 kbpd during the week ended February 16, while apparent demand for gasoline fell by 57 kbpd.

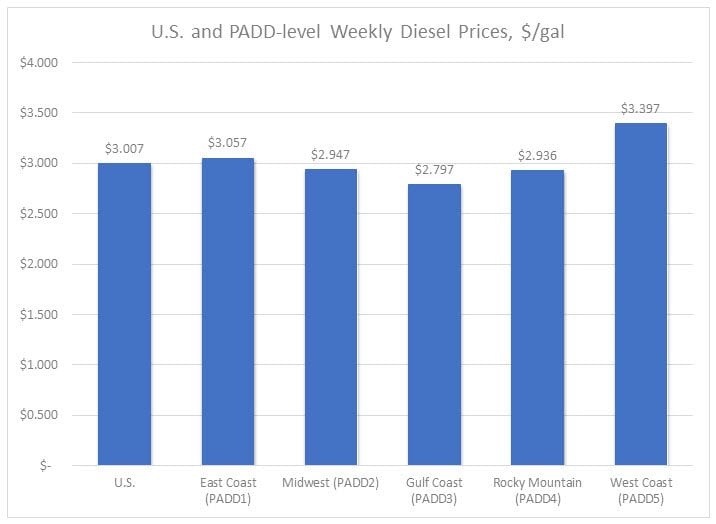

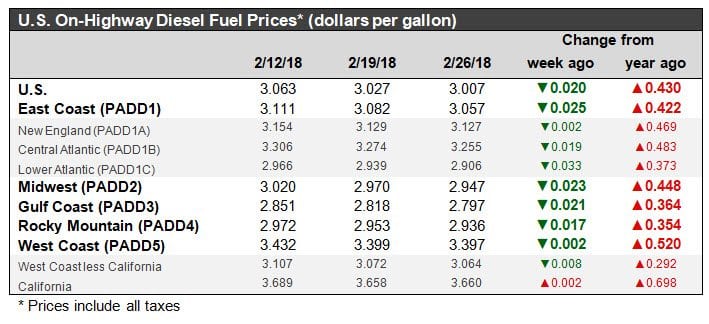

For the current week ended February 26, diesel prices fell by 2.0 cents to arrive at an average price of $3.007 gallon. US national average retail diesel prices have exceeded $3/gallon for seven consecutive weeks. With the recent rebound in crude prices, it is possible that prices will remain above $3/gallon next week as well.

In the East Coast PADD 1, diesel prices declined 2.5 cents during the week to average $3.057/gallon. In early January, PADD 1 joined PADD 5 in having diesel prices above $3/gallon. Within the PADD, New England prices edged down by 0.2 cents to average $3.127/gallon. Central Atlantic diesel prices decreased by 1.9 cents to average $3.255/gallon. This submarket has had diesel prices above $3/gallon for the past sixteen weeks. Lower Atlantic prices decreased by 3.3 cents to arrive at an average price of $2.906/gallon. PADD 1 prices were 42.2 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 2.3 cents to average $2.947/gallon. PADD 2 became the third PADD, following PADD 5 and PADD 1, to have retail diesel prices exceed $3 per gallon, but its prices have now receded below the $3/gallon level. Prices were 44.8 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices decreased by 2.1 cents to average $2.797/gallon. This price was 36.4 cents higher than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices declined by 1.7 cents to average $2.936/gallon. PADD 4 prices were 35.4 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices decreased slightly by 0.2 cents to average $3.397/gallon. This price was 52.0 cents above its level from last year. Prices excluding California fell by 0.8 cents to average $3.064/gallon, which was 29.2 cents above the retail price for the same week last year. California diesel prices rose by 0.2 cents to an average price of $3.660/gallon. This price was 69.8 cents higher than last year’s price. Until January, PADD 5 had been the only PADD to have diesel prices above $3 per gallon. Prices around the country climbed until the national retail average exceeded the $3/gallon mark as of the week ended January 15. Prices eased as crude oil prices fell, and this week’s average price is $3.007/gallon. Markets now are watching crude prices to judge whether the downward correction is over, and whether this will halt the downward trend in refined fuel prices.

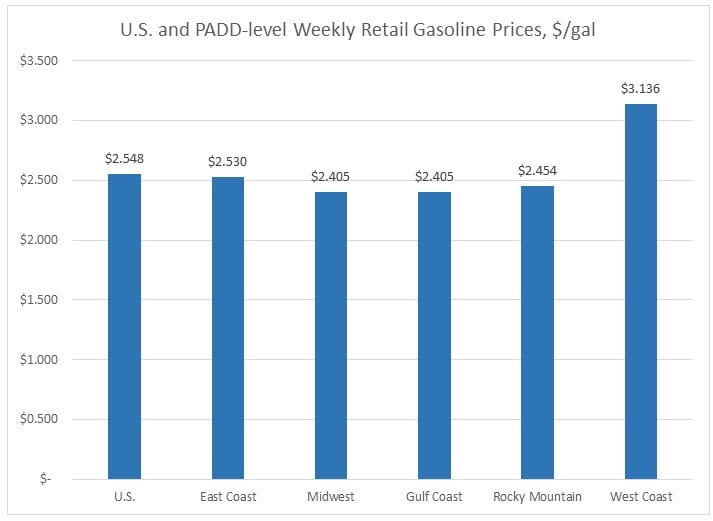

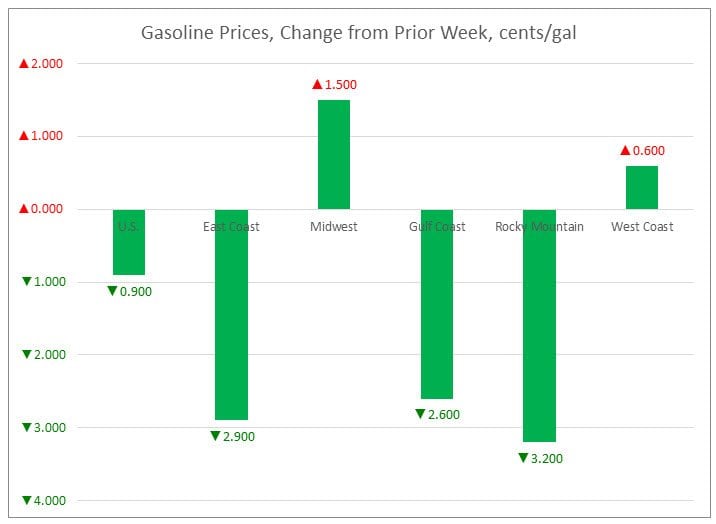

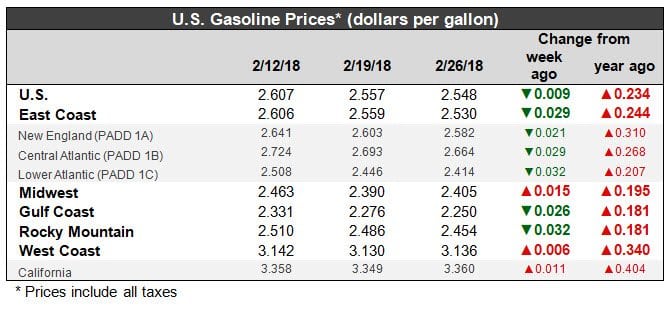

U.S. retail gasoline prices eased by 0.9 cents during the week ended February 26, to arrive at an average price of $2.548/gallon.

For the current week ended February 26th, East Coast PADD 1 retail prices for gasoline decreased by 2.9 cents to $2.548/gallon. The average price was 24.4 cents higher than last year’s price. Within PADD 1, prices declined by 2.1 cents in New England to reach $2.582/gallon. Central Atlantic market prices fell by 2.9 cents to $2.664/gallon. Prices in the Lower Atlantic market fell significantly by 3.2 cents, to an average price of $2.414/gallon. This was 20.7 cents higher than last year’s average price for the same week.

In the Midwest PADD 2 market, retail gasoline prices rebounded by 1.5 cents, following last week’s sharp drop of 7.3 cents, reaching an average price of $2.405/gallon. Gasoline pump prices were 19.5 cents higher than they were one year ago.

In the Gulf Coast PADD 3 market, gasoline prices fell by 2.6 cents to average $2.250/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Prices for the week were 18.1 cents higher than for the same week in 2017.

In the Rocky Mountains PADD 4 market, gasoline pump prices decreased by 3.2 cents to average $2.454/gallon. PADD 4 prices were 18.1 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices increased by 0.6 cents to arrive at an average price of $3.136/gallon. This was 34.0 cents higher than at the same time a year ago. PADD 5 typically has the highest gasoline prices among the five PADDs. During the eight weeks of 2018 to date, PADD 5 has been the only PADD where prices have exceeded $3/gallon. Excluding California, West Coast prices decreased slightly by 0.1 cents to an average of $2.751/gallon. This was 22.9 cents higher than at the same time in 2017. In California, prices rose by 1.1 cents to arrive at an average pump price of $3.360/gallon. California prices were 40.4 cents per gallon above their levels from last year.