Returning the Focus to Domestic Politics

- Focus on environmental regulation is highlighted

- EPA rulings on RVOs will drive RINs prices

- Final guidance on blender’s tax credit still pending

- AI power demand may end rangebound NG pricing

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

President-elect Trump’s early announcement of his nominee to head the Environmental Protection Agency (EPA) likely signals the importance the incoming Administration will place on energy market deregulation. EPA nominees are not typically among the first wave of senior nominations to be put forward.

POWERHOUSE will keep a sharp focus on three issues that can impact fuel marketers. How will the incoming EPA leadership shape the 2027 Renewable Volume Obligation (RVO) for 2026 and 2027? The RVO determines the volume of renewable fuel that must replace fossil-based fuel in transportation fuel, home heating oil, or jet fuel. This leads into the second issue to monitor.

Will the incoming Administration mirror the policies of the prior Trump term when it comes to allowing Small Refiner Exemptions from renewable fuel obligations? A more aggressive implementation of this policy could lead to downward pressure on RINs prices.

Last, but certainly not least, final guidance is still pending on the transition from the renewable fuel blender’s tax credit to a producer’s tax credit under section 45Z of the Inflation Reduction Act. This guidance is unlikely to occur until after the Trump team is in place.

Elections do have consequences, and this is especially true when a policy change can turn a $1/gallon credit for blenders of renewable road fuels into a $1.50/gallon credit to producers of sustainable aviation fuel—or not. POWERHOUSE expects a return to a period of headline driven trading for RINs prices. This will likely feed into NYMEX prices for RBOB and ULSD.

Supply/Demand Balances

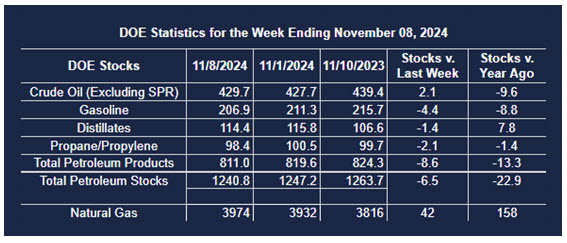

Supply/demand data in the United States for the week ended November 8, 2024, were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased (⬇) 6.5 million barrels to 1.2408 billion barrels during the week ended November 8th, 2024.

Commercial crude oil supplies in the United States were higher (⬆) by 2.1 million barrels from the previous report week to 429.7 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.1 million barrels to 7.7 million barrels

PADD 2: Down (⬇) 0.6 million barrels to 106.1 million barrels

PADD 3: Up (⬆) 2.5 million barrels to 246.2 million barrels

PADD 4: Up (⬆) 0.8 million barrels to 23.6 million barrels

PADD 5: Down (⬇) 0.5 million barrels to 46.2 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.7 million barrels to 25.2 million barrels.

Domestic crude oil production decreased (⬇) 100,000 barrels per day from the previous report at 13.4 million barrels per day.

Crude oil imports averaged 6.509 million barrels per day, a daily increase (⬆) of 269,000 barrels. Exports increased (⬆) 590,000 barrels daily to 3.440 million barrels per day.

Refineries used 91.4% of capacity; an increase (⬆) of 0.9% from the previous report week.

Crude oil inputs to refineries increased (⬆) 175,000 barrels daily; there were 16.509 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 175,000 barrels daily to 16.754 million barrels daily.

Total petroleum product inventories decreased (⬇) by 8.5 million barrels from the previous report week, down to 811.1 million barrels.

Total product demand increased (⬆) 1,899,000 barrels daily to 21.583 million barrels per day.

Gasoline stocks decreased (⬇) 4.4 million barrels from the previous report week; total stocks are 206.9 million barrels.

Demand for gasoline increased (⬆) 555,000 barrels per day to 9.383 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.4 million barrels from the previous report week; distillate stocks are at 114.4 million barrels. EIA reported national distillate demand at 4.098 million barrels per day during the report week, an increase (⬆) of 691,000 barrels daily.

Propane stocks fell (⬇) 2.1 million barrels from the previous report to 98.4 million barrels. The report estimated current demand at 1,319,000 barrels per day, an increase (⬆) of 609,000 barrels daily from the previous report week.

Natural Gas

Among the most dominant topics in business these days is the implementation of artificial intelligence (AI). A closely related subject is the power requirements that this massive shift will require. Perhaps the most headline-grabbing story was the announcement that Microsoft will source power from a re-started Unit 1 reactor at the Three Mile Island nuclear power plant in Pennsylvania. The additional electricity from a few restarted nuclear plants will fall far short of meeting the forecasted AI power demands.

The natural gas market is also responding. A small group of bank and industry analysts now estimate that Henry Hub prices will average $3.27 for 2025. This compares to $2.29 in 2024 and the high and low watermarks of $6.42 in 2022 and $2.03 in 2020.

After moving through prior resistance at $2.919, front-month natural gas futures have been stymied by the $3.02 price level. Price support is found at $2.66.

According to the EIA:

- Net injections into storage totaled 42 Bcf for the week ended November 8, compared with the five-year (2019–2023) average net injections of 29 Bcf and last year’s net injections of 41 Bcf during the same week. Working natural gas stocks totaled 3,974 Bcf, which is 228 Bcf (6%) more than the five-year average and 158 Bcf (4%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 26 Bcf to 56 Bcf, with a median estimate of 40 Bcf.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2024 Powerhouse Brokers, LLC, All rights reserved