Oil Prices Under Pressure

- Prices react to falling demand

- Iran sanctions and China tariffs potentially looming

- Propane consumption nearly halved for the most recent week

- Natural gas prices rally

Sincerely,

Al Levine, Chair

Powerhouse

(202) 333-5380

The Matrix

Oil futures continued to fall on Veterans Day, bottoming below $68 per barrel. This continues a pattern of prices softening since early July 2024 when they topped at $84.51.

Spot futures reached their last important high on October 8, at $78.46, following a typical autumn rally that took prices from $65.27 on September 10. Market weakness suggests a retest of that low before year-end.

The decline in the oil price reflects the softening of demand in the United States. EIA reported product demand of 19.7 million barrels daily for the week ended November 1. This was a decline of 1.9 million daily. Propane demand almost halved barrels, slightly less than the drop against a year ago.

The decline was seen in every usage category except K-Jet, which added 1.6 million barrels daily to demand. The declines in distillate fuel oil and propane were notable.

Distillate fuel demand clocked in at 3.4 million barrels daily, a drop of 475,000 barrels daily for the week. The loss of consumption of propane was even greater, where weekly demand fell 600,000 barrels per day, nearly as large as demand itself.

The results of the U.S. presidential election have answered some questions but opened others. Will the Trump Administration return to a policy of ‘maximum pressure’ on Iran and would that lead to sanctions that would affect the amount of Iranian oil hitting the market? If so, there is the possibility that currently idled Saudi Arabian production could be brought back into service to buffer any supply shocks. If the Trump Administration gives broad support to continue its military actions, this could keep geopolitical tensions in the region high.

The second major policy decision ahead is will the incoming administration resume the aggressive use of tariffs and specifically tariffs on China. With China’s economy still struggling to reignite after the Covid slowdown, it will be critical to monitor whether a new round of tit-for-tat tariffs further impairs the Chinese economy and its energy demand.

Supply/Demand Balances

Supply/demand data in the United States for the week ended November 1, 2024, were released by the Energy Information Administration.

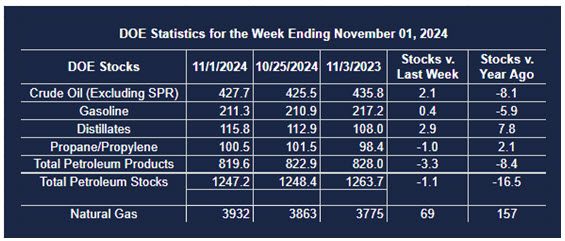

Total commercial stocks of petroleum decreased (⬇) 1.1 million barrels to 1.2472 billion barrels during the week ended November 1st, 2024.

Commercial crude oil supplies in the United States were higher (⬆) by 2.1 million barrels from the previous report week to 427.7 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.2 million barrels to 7.8 million barrels

PADD 2: Up (⬆) 1.1 million barrels to 106.7 million barrels

PADD 3: Up (⬆) 2.1 million barrels to 243.7 million barrels

PADD 4: Up (⬆) 0.6 million barrels to 22.8 million barrels

PADD 5: Down (⬇) 1.4 million barrels to 46.7 million barrels

Cushing, Oklahoma, inventories were up (⬆) 0.5 million barrels to 25.9 million barrels.

Domestic crude oil production remained unchanged (=) from the previous report at 13.5 million barrels per day.

Crude oil imports averaged 6.240 million barrels per day, a daily increase (⬆) of 265,000 barrels. Exports decreased (⬇) 1,411,000 barrels daily to 2.850 million barrels per day.

Refineries used 90.5% of capacity; an increase (⬆) of 1.4% from the previous report week.

Crude oil inputs to refineries increased (⬆) 281,000 barrels daily; there were 16.334 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 253,000 barrels daily to 16.579 million barrels daily.

Total petroleum product inventories decreased (⬇) by 3.3 million barrels from the previous report week, down to 819.6 million barrels.

Total product demand decreased (⬇) 1,899,000 barrels daily to 19.739 million barrels per day.

Gasoline stocks increased (⬆) 0.4 million barrels from the previous report week; total stocks are 211.3 million barrels.

Demand for gasoline decreased (⬇) 331,000 barrels per day to 8.828 million barrels per day.

Distillate fuel oil stocks increased (⬆) 2.9 million barrels from the previous report week; distillate stocks are at 115.8 million barrels. EIA reported national distillate demand at 3.406 million barrels per day during the report week, a decrease (⬇) of 475,000 barrels daily.

Propane stocks fell (⬇) 1.0 million barrels from the previous report to 100.5 million barrels. The report estimated current demand at 710,000 barrels per day, a decrease (⬇) of 600,000 barrels daily from the previous report week.

Natural Gas

Natural gas futures reacted positively to cooler weather. Prices rose to settle at $2.92 on Veteran’s Day on strong volume. The recent high of $3.019 (October 4, 2024) is well within reach.

It may be hard to sustain a significant rally with storage already 6% higher than the five-year average. Nonetheless, the dramatic rally cannot be ignored, especially in light of changes in the economic and political landscape now changing so rapidly.

E1

From the EIA Natural Gas Weekly Update,

- Net injections into storage totaled 69 Bcf for the week ended November 1, compared with the five-year (2019–2023) average net injections of 32 Bcf and last year’s net injections of 19 Bcf during the same week. Working natural gas stocks totaled 3,932 Bcf, which is 215 Bcf (6%) more than the five-year average and 157 Bcf (4%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 45 Bcf to 72 Bcf, with a median estimate of 65 Bcf.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2024 Powerhouse Brokers, LLC, All rights reserved