Factors Beyond the Fundamentals of Oil

- U.S. dollar strength may affect the course of WTI crude oil prices

- U.S. refiners output back to pre-pandemic levels

- LNG exports could be frustrated by slow terminal construction pace

Alan Levine—Chairman, Powerhouse

(202) 333-5380

The Matrix

The shifting assessment of the global crude oil supply & demand balance has led the news for many months. Energy prices, however, are also influenced by factors beyond the fundamentals of oil. The U.S. dollar has made an impressive move higher in the days after Halloween. The well-cited, inverse relationship between the price of WTI crude oil and Dollar Index is more nuanced than many pundits suggest, yet sustained dollar strength over time often stanches WTI price rallies.

WTI crude oil futures finished out the week of Nov. 12 at $80.79. This value remains within the range between $85.41 (Oct. 25, 2021) and $78.25 (Nov. 4, 2021). These levels will have to be breached to get a clue of next directions.

Gasoline and diesel marketers focus on the price of refined products more than crude oil, but they must also consider the linkage between the two, namely the crack spreads. Strengthening crack spreads have offered refiners incentives to increase refinery utilization.

Refinery throughputs came in at 15.4 million barrels per day for the most recent report week. Last year at this time, inputs were put at 13.4 million daily barrels. Two years ago, runs were 15.9 million barrels daily; domestic refiners are now churning out refined products at nearly pre-pandemic levels.

Outright inventory levels as well as days of supply readings for U.S. gasoline and diesel stocks remain tight. If increased refinery output can ease this situation, then the current price correction could take on a more bearish tone. It would not be out of character for this time of year.

Supply/Demand Balances

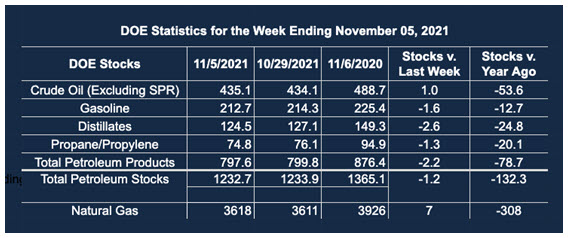

Supply/demand data in the United States for the week ended Nov. 5, 2021, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 1.2 million barrels during the week ended Nov. 5, 2021.

Commercial crude oil supplies in the United States increased by 1.0 million barrels from the previous report week to 435.1 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Plus 0.2 million barrels to 8.6 million barrels

PADD 2: Plus 0.9 million barrels to 107.4 million barrels

PADD 3: Down 1.8 million barrels to 247.5 million barrels

PADD 4: Down 0.1 million barrels to 23.5 million barrels

PADD 5: Plus 2.0 million barrels to 48.2 million barrels

Cushing, Oklahoma, inventories were unchanged from the previous report week at 26.4 million barrels.

Domestic crude oil production was unchanged from the previous report week at 11.5 million barrels daily.

Crude oil imports averaged 6.108 million barrels per day, a daily decrease of 63,000 barrels. Exports rose 128,000 barrels daily to 3.053 million barrels per day.

Refineries used 86.7% of capacity; 0.4 percentage points higher from the previous report week.

Crude oil inputs to refineries decreased 31,000 barrels daily; there were 15.366 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 69,000 barrels daily to 15.715 million barrels daily.

Total petroleum product inventories fell 2.2 million barrels from the previous report week.

Gasoline stocks decreased 1.6 million barrels from the previous report week; total stocks are 212.7 million barrels.

Demand for gasoline declined 245,000 barrels per day to 9.259 million barrels per day.

Total product demand decreased 0.708 million barrels daily to 19.290 million barrels per day.

Distillate fuel oil stocks declined 2.6 million barrels from the previous report week; distillate stocks are at 124.5 million barrels. EIA reported national distillate demand at 4.280 million barrels per day during the report week, a gain of 594,000 barrels daily.

Propane stocks decreased 1.3 million barrels from the previous report week; propane stocks are at 74.8 million barrels. The report estimated current demand at 1.449 million barrels per day, a decrease of 133,000 barrels daily from the previous report week.

Natural Gas

Natural gas spot futures ended last week at $4.791, the bottom of a range in place since early September. Prices have been driven by weather expectations in the short term.

The situation for LNG, however, could hinge more on the construction of LNG export facilities. Not one new project for 2022 has been approved. Capital spending on new projects has withered recently, reflecting low prices during the pandemic. This was reflected in the reluctance of buyers to sign long-term supply concerns.

Nearby major technical support is found in the $4.73-$4.77 range, based on the front month contract and below that at $4.18-$4.22.

According to the EIA:

Working gas in storage was 3,618 Bcf as of Friday, Nov. 5, 2021, according to EIA estimates. This represents a net increase of 7 Bcf from the previous week. Stocks were 308 Bcf less than last year currently and 119 Bcf below the five-year average of 3,737 Bcf. At 3,618 Bcf, total working gas is within the five-year historical range.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2021 Powerhouse Brokerage, LLC, All rights reserved