Bullish Factors Continue to Control the Market

- NATO expansion heightens geopolitical risk to supply

- Russian crude oil output fell 9% in April

- East Coast U.S. ULSD supply fighting lower refining capacity

- New opportunities created as Europe turns from Russian natural gas

Sincerely,

Alan Levine, Chairman

Powerhouse

(202) 333-5380

The Matrix

Oil prices, already trading over $100 per barrel, could see a further advance because of new factors in European geopolitical arrangements. Finland and Sweden have requested NATO to accept their applications for membership.

Finland has been a neutral state between the NATO bloc and Russia for many years. Joinder with NATO would create an 830-mile border with Russia. A common border could lead to significant confrontations and further impacts on energy supply. Other nations are now considering NATO membership.

If Ukraine is seen as the victor in the current conflict, the impact could be, literally, earth shaking. Some analysts suggest that a Ukraine win could destabilize Russia and heighten the potential for nuclear escalation. Separately, Russian oil output fell about 9% in April according to OPEC+ data.

More bullish news comes from expectations of a hot, dry summer. Key agricultural regions in the E.U. could see drought conditions. Cooling degree days could ramp up, heightening demand for air conditioning this summer.

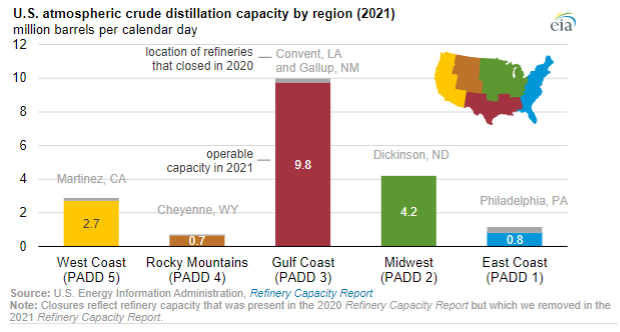

Petroleum product supply is also at risk in the United States. While supplies of distillate fuel oil remain tight, in the last two weeks, inventories of gasoline have plunged beneath the lows of the 5-year range. Refineries are operating around 90% to meet product needs. Additional capacity will be hard to come by because refiners have lost about one million barrels per day of refining capacity.

The Northeast stands particularly exposed. Tragedies like the fire at Philadelphia Energy Solutions, general slowdowns related to the pandemic, and conversions to production of renewable diesel have had a powerfully negative effect on capacity.

The chart below shows regional losses of crude distillation capacity in 2021. East Coast capacity, already small, has been further diminished by closures last year.

Supply/Demand Balances

Supply/demand data in the United States for the week ended May 13, 2022, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 2.9 million barrels during the week ended May 13, 2022.

Commercial crude oil supplies in the United States decreased by 3.4 million barrels from the previous report week to 420.8 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down 1.3 million barrels to 8.0 million barrels

PADD 2: Down 0.8 million barrels to 106.1 million barrels

PADD 3: Plus 0.2 million barrels to 234.1 million barrels

PADD 4: Plus 0.3 million barrels 23.9 million barrels

PADD 5: Down 2.7 million barrels to 48.7 million barrels

Cushing, Oklahoma, inventories were down 2.4 million barrels from the previous report week to 25.8 million barrels.

Domestic crude oil production was up 100,000 barrels per day from the previous report week to 11.9 million barrels daily.

Crude oil imports averaged 6.568 million barrels per day, a daily increase of 299,000 million barrels. Exports increased 641,000 barrels daily to 3.520 million barrels per day

Refineries used 91.8% of capacity; 1.8 percentage points higher from the previous report week.

Crude oil inputs to refineries increased 239,000 barrels daily; there were 15.935 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 317,000 barrels daily to 16.147 million barrels daily.

Total petroleum product inventories were plus 0.5 million barrels from the previous report week, rising to 732.6 million barrels.

Total product demand increased 430,000 thousand barrels daily to 19.661 million barrels per day.

Gasoline stocks decreased 4.8 million barrels from the previous report week; total stocks are 220.2 million barrels.

Demand for gasoline rose 325,000 barrels per day to 9.027 million barrels per day.

Distillate fuel oil stocks increased 1.2 million barrels from the previous report week; distillate stocks are at 105.3 million barrels. EIA reported national distillate demand at 3.816 million barrels per day during the report week, an increase of 39,000 barrels daily.

Propane stocks increased 0.3 million barrels from the previous report week; propane stocks are at 44.5 million barrels. The report estimated current demand at 1.061 million barrels per day, an increase of 284,000 barrels daily from the previous report week.

Natural Gas

Concerns about domestic natural gas availability fueled speculation over the direction of futures prices. The European Commission has proposed a new arrangement of LNG supplies into the E.U. This is in response to the Russo/Ukrainian conflict.

New commercial LNG deals have emerged in the United States as building export capacity grows apace. Moreover, US sentiment towards natural gas could speed government permits.

A warmer weather forecast from the Copernicus Climate Change Service suggests that summer drought should boost cooling demand and thus, natural gas prices. The group said, “there’s a 70% to 100% probability that temperatures across the northeastern U.S., Spain, France and Italy will be well above average from June to August. At the same time, the chance of below-normal rainfall across swathes of central Europe, France, Spain and the U.S. Northwest was more than 50%.”

According to the EIA:

Net injections into [natural gas] storage totaled 89 Bcf for the week ended May 13, compared with the five-year (2017–2021) average net injections of 87 Bcf and last year’s net injections of 71 Bcf during the same week. Working natural gas stocks totaled 1,732 Bcf, which is 310 Bcf lower than the five-year average and 358 Bcf lower than last year at this time.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2021 Powerhouse Brokerage, LLC, All rights reserved