Energy Prices and Global Demand Come Down with Coronavirus

- Coronavirus, Covid-19 headlines dominating markets

- EIA lowers expectations of global liquid fuels demand

- Elliott Wave analysis targets $1.40 for ULSD futures

- Natural gas withdraws from storage are down 9 percent from the five-year average

The Matrix

Press reports about the coronavirus, Covid-19, have taken up all the oxygen in the room—or maybe more accurately, on the planet. It’s hard to determine from fundamental data what might be in train to affect the price and availability of oil.

A commonly cited measure of the impact of Covid-19 is the loss of oil demand. Some of that concern is appearing in the data on U.S. inventories.

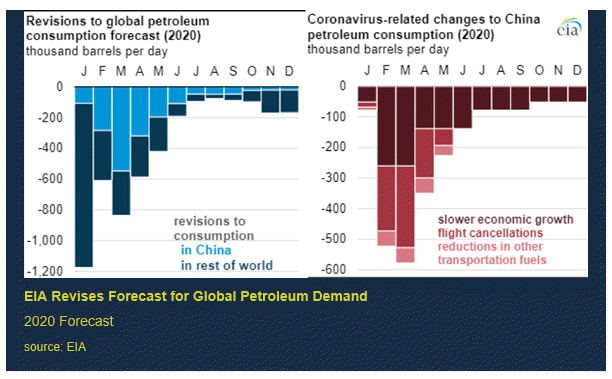

The Energy Information Administration has addressed this matter. It has revised its estimates of global liquid fuels demand. EIA estimated this demand at 102.1 million barrels daily in January, 2020. The February revision of the Short-Term Energy Outlook lowered that estimate to 101.7 million barrels per day. The Administration pointed out that this winter’s warmer-than-expected winter, a slowdown in general economic growth and the effects of Covid-19 led to this lowered result.

EIA also projected lower demand in China. A reduction of 190,000 daily barrels is now expected in 2020. In particular, EIA mentioned foregone jet fuel consumption and other transportation fuels.

Oil supply analyses have focused on OPEC. (Production in the United States has remained at 13 million barrels daily for several weeks.) February output fell to its lowest level in more than ten years, reflecting the virtual elimination of Libyan supply as ports and oilfields were blockaded. Moreover, Saudi Arabia and other OPEC nations produced even fewer barrels than required by the latest supply constraint agreement.

The extent to which fewer barrels produced and lower global demand might offset each other is not clear. Price charts could provide some guidance.

The chart for ULSD daily prices offers a stark picture of recent activity. And ULSD is particularly significant because of its importance in commercial activity. Prices topped on January 8 at $2.12. They have subsequently fallen to $1.44 on March 2, 2020. Chart patterns suggest further weakness with an objective around $1.40.

Supply/Demand Balances

Supply/demand data in the United States for the week ending Feb. 21, 2020, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell by 2.1 million barrels during the week ending Feb. 21, 2020.

Commercial crude oil supplies in the United States increased by 0.5 million barrels from the previous report week to 443.3 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Plus 0.3 million barrels to 10.5 million barrels

PADD 2: Plus 0.2 million barrels to 126.8 million barrels

PADD 3: Plus 1.9 million barrels to 232.6 million barrels

PADD 4: Down 0.4 million barrels to 20.4 million barrels

PADD 5: Down 3.5 million barrels to 53.1 million barrels

Cushing, Oklahoma inventories rose 0.9 million barrels from the previous report week to 39.1 million barrels.

Domestic crude oil production was unchanged from the previous report week at 13.0 million barrels daily.

Crude oil imports averaged 6.217 million barrels per day, a daily decrease of 330,000 barrels. Exports rose 93,000 barrels daily to 3.657 million barrels per day.

Refineries used 87.9 percent of capacity, down 1.5% from the previous report week.

Crude oil inputs to refineries decreased 202,000 barrels daily; there were 16.008 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 288,000 barrels daily to reach 16.524 million barrels daily.

Total petroleum product inventories fell 2.6 million barrels from the previous report week.

Gasoline stocks decreased 2.7 million barrels daily from the previous report week; total stocks are 256.4 million barrels.

Demand for gasoline rose 118,000 barrels per day to 9.035 million barrels per day.

Total product demand increased 294,000 barrels daily to 19.884 million barrels per day.

Distillate fuel oil stocks decreased 2.1 million barrels from the previous report week; distillate stocks are at 138.5 million barrels. EIA reported national distillate demand at 4.119 million barrels per day during the report week, an increase of 392,000 barrels daily.

Propane stocks decreased 0.7 million barrels from the previous report week; propane stocks are 73.6 million barrels. The report estimated current demand at 1.222 million barrels per day, a decrease of 405,000 barrels daily from the previous report week.

Natural Gas

According to EIA:

The net withdrawal from storage totaled 143 Bcf for the week ending February 21, compared with the five-year (2015–19) average net withdrawal of 122 Bcf and last year’s net withdrawal of 167 Bcf during the same week. Working natural gas stocks totaled 2,200 Bcf, which is 179 Bcf more than the five-year average and 637 Bcf more than last year at this time.

The average rate of withdrawal from storage is 9% lower than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawal from storage matched the five-year average of 8.3 Bcf/d for the remainder of the withdrawal season, the total inventory would be 1,876 Bcf on March 31, which is 179 Bcf higher than the five-year average of 1,697 Bcf for that time of year.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2020 Powerhouse, All rights reserved.