Energy Markets Bracing for Recession in Europe and Nord Stream 1 Maintenance

- Petroleum prices fall as the U.S. dollar rallies

- ULSD futures break trendline support

- Russia will shut Nord Stream 1 natural gas pipeline for maintenance

- Natural gas futures find support at $5.50

Sincerely,

Elaine Levin, President

Powerhouse

(202) 333-5380

The Matrix

The sell-off in petroleum prices accelerated last week as global recession fears outweighed the concerns of low inventories and the supply impact of the ongoing war in Ukraine. Heavy selling early in the week moved ULSD futures down over $0.52 in two trading sessions. RBOB witnessed a loss of $0.45. An uptrend line that had supported the price of diesel futures since December was breached. Oil prices are correcting, yet many upside risks remain.

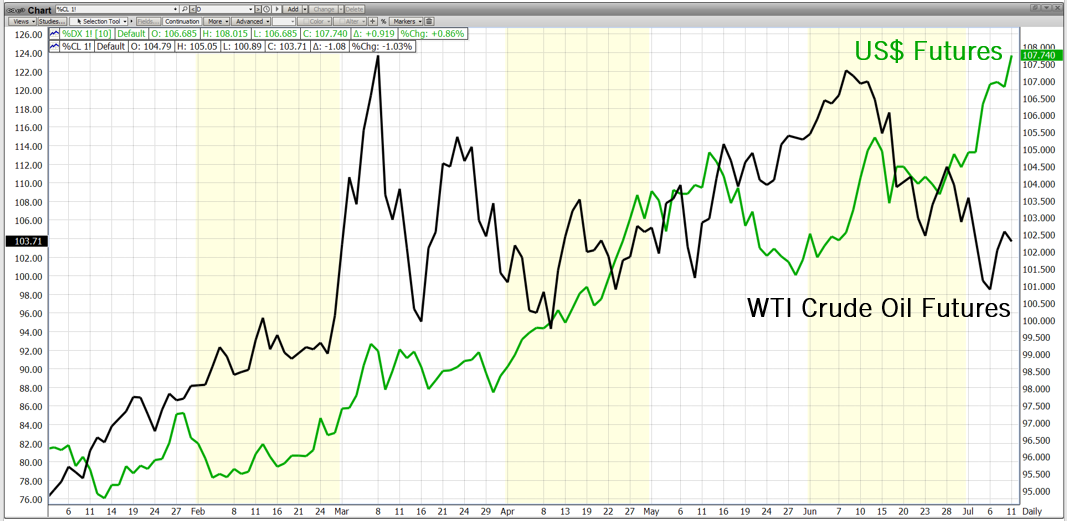

The U.S. dollar rallied as recession fears in Europe pushed buyers into the greenback. Dependence on gas and oil from Russia is front and center concern. Nord Stream 1, the pipeline carrying Russian gas into Germany, will be shut for ten days for annual maintenance. The worry is that Russia could extend the downtime or, worse, keep the pipeline shut. Last week, British Prime Minister Boris Johnson was forced to resign after mass government and ministerial resignations. As of writing, a replacement PM has not been selected. Markets do not like uncertainty, and the U.S. dollar was a safe haven. Expectations that the Federal Reserve would continue to raise rates were also a bullish factor.

The inverse correlation between a strong U.S. dollar and oil prices comes in and out of fashion. Oil is typically bought and sold globally using the U.S. dollar. As Europe looks for supply, a stronger dollar makes importing diesel and natural gas even more expensive, adding to recession fears.

ULSD futures broke below trendline support. Technically this could lead to further price weakness. But there is plenty of news to support prices. During the weekend ended July 1st, the EIA reported already low distillate inventories declined by 1.3 million barrels. Demand was above 4 million barrels per day for the first time in fourteen weeks. Traders are nervously watching for any sign of tropical disturbance that could ultimately impact refining or production in the Gulf of Mexico. The shutdown of Nord Stream 1 is bullish for diesel, which can be used as a substitute for natural gas. Reuters reports companies in France are making contingency plans for a prolonged disruption by converting gas boilers to run oil. Old trendline support is new resistance. A settlement above $4.00 would be bullish.

Supply/Demand Balances

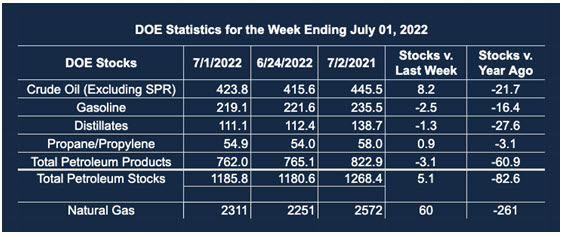

Supply/demand data in the United States for the week ended July 01, 2022, were released by the Energy Information Administration.

Total commercial stocks of petroleum grew 5.1 million barrels during the week ended July 01, 2022.

Commercial crude oil supplies in the United States increased by 8.2 million barrels from the previous report week to 423.8 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Plus 0.4 million barrels to 8 million barrels

PADD 2: Plus 2.3 million barrels to 103.2 million barrels

PADD 3: Plus 5.5 million barrels to 241.7 million barrels

PADD 4: Plus 0.2 million barrels to 23.8 million barrels

PADD 5: Down 0.1 million barrels to 47.1 million barrels

Cushing, Oklahoma, inventories were UNCH from the previous report week at 21.3 million barrels.

Domestic crude oil production was up 100,000 barrels from the previous report week to 12.1 million barrels daily.

Crude oil imports averaged 6.839 million barrels per day, a daily increase of 841,000 barrels. Exports decreased 768,000 barrels daily to 2.612 million barrels per day.

Refineries used 94.5% of capacity; 0.5 percentage points lower than the previous report week.

Crude oil inputs to refineries decreased 228,000 barrels daily; there were 16.438 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 84,000 barrels daily to 16.958 million barrels daily.

Total petroleum product inventories fell by 3.1 million barrels from the previous report week, rising to 762 million barrels.

Total product demand increased 467,000 thousand barrels daily to 20.464 million barrels per day.

Gasoline stocks decreased 2.5 million barrels from the previous report week; total stocks are 219.1 million barrels.

Demand for gasoline rose 491,000 barrels per day to 9.413 million barrels per day.

Distillate fuel oil stocks decreased 1.3 million barrels from the previous report week; distillate stocks are at 111.1 million barrels. EIA reported national distillate demand at 4.382 million barrels per day during the report week, an increase of 814,000 barrels daily.

Propane stocks were up 0.9 million barrels from the previous report week at 54.9 million barrels. The report estimated current demand at 0.589 million barrels per day, a decrease of 527,000 barrels daily from the previous report week.

Natural Gas

August Natural gas prices fished the week back above $6. The sell-off that began on news of an explosion at the Freeport LNG plant found support at $5.50. The EIA reported an injection into storage of 60 Bcf, which was 15 Bcf lower than expected. Forecasts for above-normal temperature over most of the central to the eastern U.S. is also supportive. Prices of European gas continue to move higher on the closure of Nord Stream 1 but are still 30% lower than the record high made near the start of the war in Ukraine.

According to the EIA:

Working gas in storage was 2,311 Bcf as of Friday, July 1, 2022, according to EIA estimates. This represents a net increase of 60 Bcf from the previous week. Stocks were 261 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,633 Bcf. At 2,311 Bcf, total working gas is within the five-year historical range.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2022 Powerhouse Brokerage, LLC, All rights reserved