Hurricane Experts Revise Expectations

- Energy prices loses nearly 15% of value in first half, 2023

- Hurricane probabilities have been boosted

- A 50% chance of a major hurricane hitting the United States.

- Injections into natural gas storage exceed expectations by nearly 10%

Sincerely,

Alan Levine, Chairman

Powerhouse

(202) 333-5380

The Matrix

Energy prices fell in the first half of 2023. A composite index of energy commodities trading on U.S. futures exchanges showed a 14.44% loss. The balance of the year focuses on consumption and winter weather. And this year, this focus has been heightened by record warmth and rising seas surface temperatures.

Hurricane forecasters have boosted their estimates of activity. Gasoline prices can become volatile should weather influence transportation adversely, especially in the Southeast.

Domestic product inventories are at low levels. Distillate fuel oil is particularly tight. End-of-June supplies were 113.4 million barrels, very close to “minimum operating level,” the point where oil in the system is so low as to imperil the efficient operation of downstream operations. This is generally understood to be around 100 million barrels.

Refineries in the United States are operating at 91% of capacity, and they have been working at more than 90% of capacity since March. This has not been enough to improve the inventory situation for distillate fuel oil significantly. More intense hurricane activity, with its potential impact on refinery operations, could tighten stocks even more, with serious implications for price, notwithstanding the possibility of fewer degree days this winter. Strategies, including buying calls should be considered as a preventive measure.

Powerhouse reviewed expectations for hurricanes in the Weekly Energy Market Situation on May 15, 2023. “Last year’s hurricane season was the third-costliest tropical cyclone season on record. There were 14 storms recorded, of which eight were hurricanes and two were Major Hurricanes, listed as Category 3+.”

Meteorologists then called for a subdued 2023 season. That benign view has been overtaken by “extremely warm Atlantic water temperatures, which have catapulted into record territory.”

The Colorado State University, original predictor of a quiet season, changed its outlook:

- 18 named storms, including four that have already happened. The 1991-2020 average is 14.4.

- Nine hurricanes. At the start of the season, the University had been predicting only six. The long-term average is 7.2 per season.

- Four major hurricanes, or twice what was initially expected. A season has 3.2 major hurricanes on average. Major hurricanes are Category 3 or greater storms with winds of 111 mph or greater.

- A 50% chance of a major hurricane hitting the United States. The full-season odds averaged from 1880 to 2020 is 43% in a given season.

- A 25% chance of a major East Coast hit, and a 32% chance of a major hurricane hitting the U.S. Gulf Coast.

There are several reasons to expect higher petroleum prices for the rest of this year. Notwithstanding increased use of renewables, global usage still relies on fossil fuels. OPEC+ has been proactively adjusting production to support prices. The United States has yet to refill the Strategic Petroleum Reserve. A faltering global economy could sap these bullish expectations.

Supply/Demand Balances

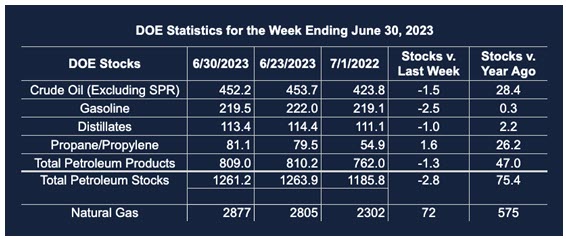

Supply/demand data in the United States for the week ended June 30, 2023, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 2.8 million barrels to 1.2612 billion barrels during the week ended June 30, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 1.5 million barrels from the previous report week to 452.2 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.4 million barrels at 7.9 million barrels

PADD 2: Up (⬆) 0.5 million barrels to 127.3 million barrels

PADD 3: Down (⬇) 1.8 million barrels to 244.5 million barrels

PADD 4: Down (⬇) 0.1 million barrels at 25.1 million barrels

PADD 5: Down (⬇) 0.6 million barrels to 47.4 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.4 million barrels from the previous report week to 42.8 million barrels.

Domestic crude oil production was up (⬆) 200,000 barrels at at 12.4 million barrels daily.

Crude oil imports averaged 7.038 million barrels per day, a daily increase (⬆) of 459,000 barrels. Exports decreased (⬇) 1.437 million barrels daily to 3.901 million barrels per day.

Refineries used 91.1% of capacity; 1.1 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 224,000 barrels daily; there were 16.030 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 199,000 barrels daily to 16.648 million barrels daily.

Total petroleum product inventories decreased (⬇) by 1.2 million barrels from the previous report week, down to 809.0 million barrels.

Total product demand increased (⬆) 929,000 barrels daily to 21.235 million barrels per day.

Gasoline stocks decreased (⬇) 2.5 million barrels from the previous report week; total stocks are 219.5 million barrels.

Demand for gasoline increased (⬆) 293,000 barrels per day to 9.599 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.0 million barrels from the previous report week; distillate stocks are at 113.4 million barrels. EIA reported national distillate demand at 3.811 million barrels per day during the report week, an increased (⬆) of 497,000 barrels daily.

Propane stocks increased (⬆) by 1.6 million barrels from the previous report week to 81.1 million barrels. The report estimated current demand at 1.154 million barrels per day, an increased (⬆) of 821,000 barrels daily from the previous report week.

Natural Gas

July 4 was the hottest day ever recorded globally. It’s ironic then that in the same week, EIA reported increased injections of 72 Bcf into underground natural gas storage, fully seven Bcf more than expected by industry observers. At the same time, demand for natural gas reportedly fell in Europe.

Short-term price action was soft. Spot Henry Hub natural gas prices fell in response to the gain in storage, ended the week at $2.59. This was a loss of 21.6 cents for the week, and 41.6 cents from the recent high of $2.94, reached on June 26.

Short-term price action stands in contrast to Elliott Wave counts of natural gas action shown as of July 5, 2023. GET (Gann-Elliott Trader) charts measure the amplitude of price movements, looking for five-wave patterns. Such five-wave patterns constitute a total directional price thrust. Moreover, they allow for an estimate of the potential reach of the total move, including extensions.

Natural gas prices fell massively from August 2022 when they reached $9.99 per MMcf/d to April 2023, bottoming just under $1.95. Values have recovered since then. There has also been enough price volatility to establish a rising trend. GET views this as a price thrust with three completed legs and a fourth, corrective, leg now in process.

Generally, if prices hold support around $2.50, a fifth wave rally could occur. GET estimates an objective of $4.00 for such a move.

P2 Fundamentals indicate an improved outlook for natural gas. U.S. LNG exports, for example, were curtailed in June because of maintenance at several LNG export facilities. This added to domestic storage and pressured prices.

With recovery of facilities, exports of LNG can be expected to recover. One analyst expects feed gas to exceed 14 bcf/d in the third quarter of 2023.

According to the EIA:

Working [natural] gas in storage was 2,877 Bcf as of Friday, June 30, 2023, according to EIA estimates. This represents a net increase of 72 Bcf from the previous week. Stocks were 575 Bcf higher than last year at this time and 366 Bcf above the five-year average of 2,511 Bcf. At 2,877 Bcf, total working gas is within the five-year historical range.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2023 Powerhouse Brokerage, LLC, All rights reserved