New Factors Influencing Crude Oil Prices

- Oil export sanctions may be imposed on Venezuela

- New pipeline distribution capability stabilizing regional basis

- Gasoline inventory reaches new level

- Coldest Midwest weather in a decade

The Matrix

Oil traders have been focusing on long-established factors like OPEC/ Russian production and domestic U.S. output to project oil prices. In recent days, however, the possibility of regime change in Venezuela, new transportation capabilities and shifting market realities are adding new considerations to the price forecast. Venezuela may have a change in government with important implications for crude oil output and destination. Advances in pipeline capacity and some markets, notably gasoline, are changing too.

The United States government is reportedly considering imposing sanctions on Venezuelan crude oil. Limiting shipments to the Gulf Coast would put heavy Venezuelan oils on global markets and create demand for heavy oils domestically. In all, the United States took about 500 thousand barrels daily as recently as last October. No matter how the Venezuelan situation resolves, changes in sources and disposition of crude oil supply could create uncertainty in global crude oil allocation and price.

Another source of instability in petroleum pricing has been insufficiency in pipeline transportation. Expansion of production in West Texas has outstripped offtake capability. As new capacity comes available basis price differences will harmonize. Similar pipeline projects are underway in Wyoming and Colorado to Cushing, Oklahoma. This pipeline system should help normalize supply in the Mountain west.

Gasoline stocks in the United States have achieved a record level of 259.6 million barrels daily. This comes at a time when refinery operations are slowing as spring turnaround advances. This year is unusual too, in that imports were greater than exports for the most recent EIA reporting week.

Supply/Demand Balances

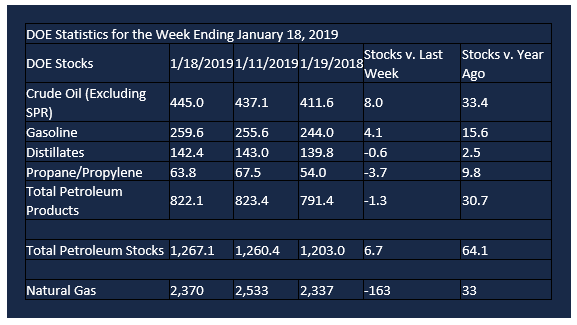

Supply/demand data in the United States for the week ending January 18, 2019 were released by the Energy Information Administration.

Total commercial stocks of petroleum increased 6.7 million barrels during the week ending January 18, 2019.

There were builds in stocks of gasoline, fuel ethanol, K-jet fuel, and residual fuel. There were draws in stocks of distillate fuel, propane, and other oils.

Commercial crude oil supplies in the United States increased 8.0 million barrels from the previous report week to 445.0 million barrels.

Crude oil supplies increased in all five of the PAD Districts. PADD 1 (East Coast) stocks rose 2.0 million barrels, PADD 2 (Midwest) stocks expanded by 0.4 million barrels, PADD 3 (Gulf Coast) stocks advanced 3.1 million barrels, PADD 4 (Rockies) stocks grew 0.4 million barrels, and PADD 5 (West Coast) stocks increased 2.0 million barrels.

Cushing, Oklahoma inventories decreased 0.2 million barrels from the previous report week to 41.3 million barrels.

Domestic crude oil production was unchanged from the previous report week at 11.9 million barrels per day.

Crude oil imports averaged 8.191 million barrels per day, a daily increase of 664,000 barrels per day. Exports fell 931,000 barrels daily to 2.035 million barrels per day.

Refineries used 92.9 per cent of capacity, a decrease of 1.7 percentage points from the previous report week.

Crude oil inputs to refineries decreased 174,000 barrels daily; there were 17.049 million barrels per day of crude oil run to facilities.

Gross inputs, which include blending stocks, declined 314,000 barrels daily to 17.285 million barrels daily.

Total petroleum product inventories fell 1.3 million barrels from the previous report week.

Gasoline stocks increased 4.1 million barrels from the previous report week; total stocks are 259.6 million barrels.

Demand for gasoline increased 303,000 barrels per day to 8.868 million barrels per day.

Total product demand increased 596,000 barrels daily to 21.460 million barrels per day.

Distillate fuel oil stocks decreased 0.6 million barrels from the previous report week; distillate stocks are at 142.4 million barrels. National distillate demand was reported at 4.668 million barrels per day during the report week. This was a weekly increase of 219,000 barrels daily.

Propane stocks decreased 3.7 million barrels from the previous report week; propane stock are 63.8 million barrels. Current demand is estimated at 1.742 million barrels per day, an increase of 168,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

The average rate of net withdrawals from storage is 28% lower than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawals from storage matched the five-year average of 14.4 Bcf/d for the remainder of the withdrawal season, total inventories would be 1,331 Bcf on March 31, which is 305 Bcf lower than the five-year average of 1,636 Bcf for that time of year.

As noted in our most recent weekly energy situation, weather signs mark colder. A natural gas trader said , “The Midwest will see the coldest weather in more than a decade this week as a polar vortex plunges south toward the Great Lakes.”

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.