Oil Futures Little Affected By Unprecedented Cold

- Major expansion of East Coast HDDs

- Cold weather inhibits crude oil production

- Six million barrels of propane taken from storage

- Natural gas posts all-time record weekly withdrawal

Sincerely, Alan Levine, Chairman of Powerhouse (202) 333-5380

The Matrix

2017 was the third warmest year on record for the United States. It also hosted six major hurricanes. How notable, then, was the opening of 2018. It continued the pattern of weather extremes that feeds into market uncertainty and volatility.

The Climate Prediction Center of the National Weather Service recorded a major expansion of Heating Degree Days for the week ending January 6, 2018. Every region of the country east-of-the-Rockies went very cold under the influence of a “bomb cyclone.” This weather phenomenon has rapidly falling low pressure and was accompanied by snow fall and ice.

During that week, cold temperatures created about 150 heating degree days more than last year all along the eastern seaboard. 156 HDDs more than last year were recorded in the Middle Atlantic states. Other regions experienced slightly lower HDDs.

Cold conditions with snow and ice are, of course, prime for expanded use of heating fuels and higher, even spiking prices. And while prices for ULSD did rally, the impact was modest at best. Moreover, EIA’s weekly Balance Sheet showed product data that would generally be construed bearishly.

Crude oil stocks fell nearly five million barrels during the report week, far less than estimates provided by the American Petroleum Institute (API.) This muted any bullish price reaction. Increasing stocks of both ULSD and gasoline were also inconsistent with this period of high weather-induced demand. Other generally bullish data were domestic crude oil production and exports.

U.S. crude oil production fell to 9.4 million barrels daily, a weekly drop of 400,000 barrels per day. Another drain on supply came from total petroleum exports that reached 6.1 million barrels daily. In particular, distillate fuel oil exports exceeded 1.2 million barrels per day.

Some market participants expressed surprise at the increase in inventories. And there is no doubt that dealers have been overwhelmed by the labor needed to service fuel oil users. The explanation of increasing stocks at a time of intensified demand could lie in the fact that all facilities have been tested to their fullest. Drivers have been called on for maximum overtime and equipment like trucks and wagons have been fully subscribed.

As weather eases and more typical patterns of demand and supply recur, prices should react in more traditional ways. The first quarter is typically when product prices bottom for the year. It is also the time when refineries enter a period of maintenance, another product-bullish action.

Supply/Demand Balances

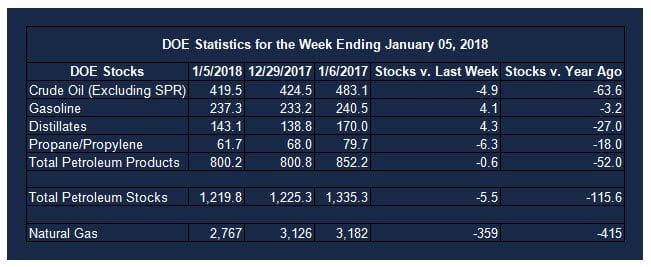

Supply/demand data in the United States for the week ending January 05, 2018 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 5.5 million barrels during the week ending January 05, 2017.

Builds were reported in stocks of gasoline, fuel ethanol, K-jet fuel, distillates, and residual fuel oil. Draws were reported in stocks of propane and other oils.

Commercial crude oil supplies in the United States decreased to 419.5 million barrels, a draw of 4.9 million barrels.

Crude oil supplies decreased in three of the five PAD Districts. PAD District 2 (Midwest) crude oil stocks declined 3.2 million barrels, PADD 3 (Gulf Coast) stocks fell 2.6 million barrels, and PADD 4 (Rockies) stocks retreated 0.3 million barrels. PADD 5 (West Coast) stocks increased 1.2 million barrels. PAD District 1 (East Coast) crude stocks were unchanged from the previous report week.

Cushing, Oklahoma inventories decreased 2.4 million barrels from the previous report week to 46.6 million barrels.

Domestic crude oil production decreased 290,000 barrels daily to 9.492 million barrels per day from the previous report week.

Crude oil imports averaged 7.658 million barrels per day, a daily decrease of 308,000 barrels. Exports fell 460,000 barrels daily to 1.015 million barrels per day.

Refineries used 95.3 per cent of capacity, a decrease of 1.4 percentage points from the previous report week.

Crude oil inputs to refineries decreased 285,000 barrels daily; there were 17.323 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, fell 254,000 barrels daily to 17.629 million barrels daily.

Total petroleum product inventories saw a decrease of 0.6 million barrels from the previous report week.

Gasoline stocks rose 4.1 million barrels from the previous report week; total stocks are 237.3 million barrels.

Demand for gasoline increased 164,000 barrels per day to 8.814 million barrels daily.

Total product demand increased 692,000 barrels daily to 20.639 million barrels per day.

Distillate fuel oil supply rose 4.3 million barrels from the previous report week to 143.1 million barrels. National distillate demand was reported at 3.655 million barrels per day during the report week. This was a weekly increase of 68,000 barrels daily.

Propane stocks decreased 6.3 million barrels from the previous report week to 61.7 million barrels. Current demand is estimated at 1.892 million barrels per day, an increase of 201,000 barrels daily from the previous report week.

Natural Gas

Natural gas spot futures have been trading in a range between 3.097 and 2.746 thus far in 2018. Technical analysis of the price charts shows development of a triangular pattern. A solid break to the upside could reach $3.34. Severe cold has not yet led to a trending market,but natural gas futures have broken first resistance at $3.00.

According to the Energy Information Administration:

Working gas stocks post all-time record weekly withdrawal

Net withdrawals from natural gas storage totaled 359 billion cubic feet (Bcf) for the week ending January 5, 2018, topping the previous record of 288 Bcf set four years ago by 25%. Weekly net withdrawals have totaled at least 249 Bcf only 10 times since 1993, most recently in January 2015, and have never exceeded 300 Bcf.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright © 2018 Powerhouse, All rights reserved.