Hurricane Barry Barely Moves Crude Oil Futures

- Half of Gulf of Mexico production halted

- OPEC projects falling cartel demand

- Group assumes global demand growth

- U.S. holds 80 years of natural gas reserves

The Matrix

Dramatic changes in reserves and production in the U.S. oil industry showed clearly in the reaction of crude oil futures to Hurricane Barry. Press reports said more than half the Gulf of Mexico’s oil output was cut in the face of the developing storm. Nonetheless, WTI crude oil prices were remarkably flat, closing out trading on Thursday, July 11, 2019, around unchanged. Previous weather events of Barry’s magnitude presented large price rallies as a matter of course.

The flat price reaction to H. Barry comes on a day that OPEC released its estimate of next year’s demand for the group’s oil. In a nutshell, OPEC expects its demand to fall as non-OPEC producers expand crude oil production. Principal among these, of course, is the United States where daily production now routinely exceeds 12 million barrels.

OPEC believes that demand for its oil will fall 1.34 million barrels daily in 2020. Oil supplied by OPEC would move down to 29.97 million barrels per day. The decline comes at a time when OPEC, Russia, and its associates agree to extend the group’s output cuts until March 2020.

The group assumes that 2020 demand will grow at the same pace as in 2019. It calls for an expanding global economy, although it recognizes the possibility of slower growth in the U.S. and China.

The drop in output includes loss of supply from Iran, reflecting tightening screws from Washington. Saudi Arabia cut some supply to support prices. Other losses came from Venezuela, itself under diplomatic pressure from the United States.

Uncertainties abound in this projection. Trade issues and Brexit have not been resolved and could easily pressure demand and price lower. Another bearish factor noted by OPEC was rising oil inventories in developed countries. This raises concern over a developing oil glut.

Supply/Demand Balances

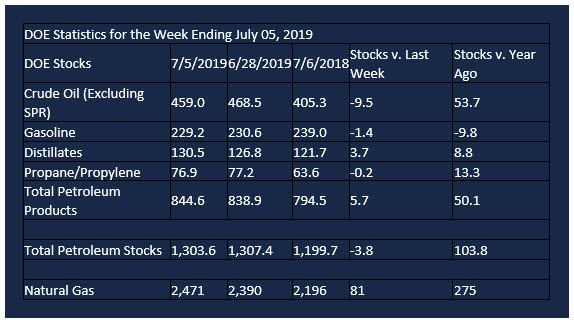

Supply/demand data in the United States for the week ending July 05, 2019, were released by the Energy Information Administration.

Total commercial stocks of petroleum fell 3.8 million barrels during the week ending July 05, 2019.

There were builds in stocks of fuel ethanol, K-jet fuel, distillates, residual fuel, and other oils. There were draws in stocks of gasoline and propane.

Commercial crude oil supplies in the United States fell 9.5 million barrels from the previous report week to 459.0 million barrels.

Crude oil supplies decreased in four of the five PAD Districts. PAD District 1 (East Coast) crude oil stocks declined 0.4 million barrels, PADD 2 (Midwest) stocks fell 2.0 million barrels, PADD 3 (Gulf Coast) stocks decreased 5.3 million barrels, and PADD 5 (West Coast) stocks declined 0.5 million barrels. PAD District 4 (Rockies) stocks increased 0.2 million barrels.

Cushing, Oklahoma inventories fell 0.3 million barrels from the previous report week to 52.2 million barrels.

Domestic crude oil production rose 100,000 barrels per day from the previous report week to 12.3 million barrels daily.

Crude oil imports averaged 7.302 million barrels per day, a daily decrease of 284,000 barrels. Exports increased 58,000 barrels daily to 3.048 million barrels per day.

Refineries used 94.7 percent of capacity, unchanged from the previous report week.

Crude oil inputs to refineries decreased 148,000 barrels daily; there were 17.438 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 90,000 barrels daily to 18.808 million barrels daily.

Total petroleum product inventories rose 5.7 million barrels from the previous report week.

Gasoline stocks decreased 1.5 million barrels daily from the previous report week; total stocks are 229.2 million barrels.

Demand for gasoline rose 262,000 barrels per day to 9.754 million barrels per day.

Total product demand increased 522,000 barrels daily to 21.292 million barrels per day.

Distillate fuel oil stocks increased 3.7 million barrels from the previous report week; distillate stocks are at 130.5 million barrels. EIA reported national distillate demand at 3.551 million barrels per day during the report week, a decrease of 277,000 barrels daily.

Propane stocks decreased 0.2 million barrels from the previous report week; propane stocks are 76.9 million barrels. The Report estimated current demand at 1.026 million barrels per day, an increase of 149,000 barrels daily from the previous report week.

Natural Gas

According to the Energy Information Administration:

Net injections into storage totaled 81 Bcf for the week ending July 5, compared with the five-year (2014–18) average net injections of 71 Bcf and last year’s net injections of 55 Bcf during the same week. Working gas stocks totaled 2,471 Bcf, which is 142 Bcf lower than the five-year average and 275 Bcf more than last year at this time.

The average rate of net injections into storage is 37% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 9.1 Bcf/d for the remainder of the refill season, total inventories would be 3,550 Bcf on October 31, which is 142 Bcf lower than the five-year average of 3,692 Bcf for that time of year.”

The expansion of domestic production of natural gas has increased reserves. EIA estimates that there were about 2,459 trillion cubic feet of technically recoverable resources of dry natural gas in the United States. This should be enough to last about 80 years.

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.

Powerhouse is a registered affiliate of Coquest, Inc.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Copyright© 2019 Powerhouse, All rights reserved.