Oil Futures Seek to Recover

- Crude oil futures tested support at $61.5

- Crop drying demand uncertain

- Propane outlook aided by petrochemical demand

- Natural gas supply depends on U.S. shale production

Alan Levine—Chairman, Powerhouse

(202) 333-5380

The Matrix

Petroleum prices have moved steadily higher since December 2021, with crude oil futures continuing a rally that began in April 2020 with a negative crude oil price of $40.32. September crude oil prices fell to $62 in August, slicing nearly $12 from the WTI futures price. Support has not been broken but is nearby at $61.56.

Distillate fuel oil values also lost ground in August. Nearby support is $1.8325. The weakness represents the latest in the conflict between a recovering economy and the appearance of the delta variant that is creating a new spike in COVID-19 cases. This threatens the recovery (as do kinks in the supply of materials making manufactured goods harder to find).

Propane is something of an exception to the uncertainty facing other products.

Propane faces a highly seasonal demand pattern. The Energy Information Administration highlighted propane in its latest Short-Term Energy Outlook (STEO). Overall, the STEO expects an increase of 2% in consumption October through December, year-on-year. This reflects the growth of propane as petrochemical feedstock.

The increase in propane demand comes about despite expectations for reduced grain drying demand and a forecast for a warmer winter. EIA notes that non-feedstock propane use is likely to be focused on the Midwest (PADD 2), where 42% of U.S. homes use propane for space heating.

PADD 2 grows 90% of the U.S. corn crop and is a major user of propane for crop drying. But crop drying demand is notoriously uncertain. This year, the United States Department of Agriculture (USDA) expects the corn crop to mature earlier than the 10-year average, reflecting expectations of a relatively dry and warm autumn. An early October maturity allows farmers to harvest later, allowing the crop to dry in the field with less demand for propane.

EIA expects the expanded use of propane as a petrochemical feedstock to more than exceed reduced demand for drying and home heating. The use of propane is projected by EIA to average 1.3 million barrels daily for the first half of the 2021-22 winter heating season, 1.7% higher than the average of the past 10 years.

Supply/Demand Balances

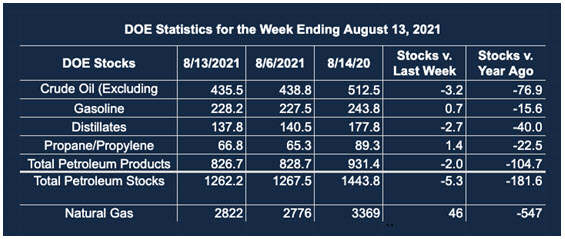

Supply/demand data in the United States for the week ended Aug. 13, 2021, were released by the EIA.

Total commercial stocks of petroleum fell 2.1 million barrels during the week ended Aug. 13, 2021.

Commercial crude oil supplies in the United States decreased by 3.2 million barrels from the previous report week to 435.5 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up 0.9 million barrels to 8.8 million barrels

PADD 2: Down 2.3 million barrels to 114.8 million barrels

PADD 3: Down 1.9 million barrels to 241.0 million barrels

PADD 4: Plus 0.2 million barrels to 24.4 million barrels

PADD 5: Down 0.3 million barrels to 46.5 million barrels

Cushing, Oklahoma, inventories were down 1.0 million barrels from the previous report week to 33.6 million barrels.

Domestic crude oil production was up 100,000 barrels per day from the previous report week to 11.3 million barrels daily.

Crude oil imports averaged 6.350 million barrels per day, a daily decrease of 46,000 barrels. Exports increased 768,000 barrels daily to 3.431 million barrels per day.

Refineries used 92.2% of capacity; 0.4 percentage points lower from the previous report week.

Crude oil inputs to refineries decreased 191,000 barrels daily; there were 16.006 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, rose 68,000 barrels daily to 16.716 million barrels daily.

Total petroleum product inventories fell 2.9 million barrels from the previous report week.

Gasoline stocks increased 0.7 million barrels from the previous report week; total stocks are 228.2 million barrels.

Demand for gasoline fell 97,000 barrels per day to 9.333 million barrels per day.

Total product demand increased 1.949 million barrels daily to 21.463 million barrels per day.

Distillate fuel oil stocks fell 2.7 million barrels from the previous report week; distillate stocks are at 137.8 million barrels. EIA reported national distillate demand at 4.323 million barrels per day during the report week, an increase of 589,000 barrels daily.

Propane stocks rose 1.4 million barrels from the previous report week; propane stocks are at 66.8 million barrels. The report estimated current demand at 1.165 barrels per day, an increase of 50,000 barrels daily from the previous report week.

Natural Gas

Natural gas futures traded around an early August top of $4.20 for several days. Values fell to first support at $3.73 last week, following the bearish pattern established by its liquid contract companions. An attempt to recover failed, and the week ended with Henry Hub futures at $3.85.

Even the prospect of heavy tropical storm activity was not enough to initiate a rally. Negative impact on demand could push prices lower, with natural gas’s next major support around $3.56. A significant rally to new highs could meet resistance as new crude oil output also adds to new supply from associated gas output.

According to the EIA:

Net [natural gas] injections into storage totaled 46 Bcf for the week ended August 13, compared with the five-year (2016–2020) average net injections of 42 Bcf and last year’s net injections of 45 Bcf during the same week. Working natural gas stocks totaled 2,822 Bcf, which is 174 Bcf lower than the five-year average and 547 Bcf lower than last year at this time.

The average rate of injections into storage is 12% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 9.2 Bcf/d for the remainder of the refill season, the total inventory would be 3,545 Bcf on October 31, which is 174 Bcf lower than the five-year average of 3,719 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

Powerhouse Futures & Trading Disclaimer

Copyright 2021 Powerhouse Brokerage, LLC, All rights reserved