Release Date: September 10, 2019

Forecast Highlights

Global liquid fuels

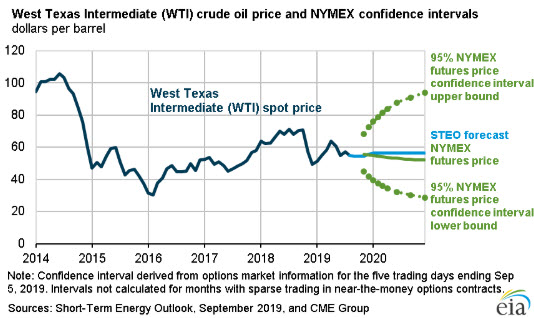

- Brent crude oil spot prices averaged $59 per barrel (b) in August, down $5/b from July and $13/b lower than the average from August of last year. EIA forecasts Brent spot prices will average $60/b in the fourth quarter of 2019 and $62/b in 2020. EIA forecasts that West Texas Intermediate (WTI) prices will average $5.50/b less than Brent prices in 2020.

- EIA forecasts that global liquid fuels consumption will increase by 0.9 million barrels per day (b/d) in 2019, down from year-over-year growth of 1.3 million b/d in 2018. The slowing liquid fuels demand growth reflects EIA’s assumption (based on forecasts from Oxford Economics) of decelerating growth in global oil-weighted gross domestic product (GDP). EIA expects that global liquid fuels demand will increase by 1.4 million b/d in 2020 as a result of an expected increase in global GDP growth.

- EIA forecasts U.S. crude oil production will average 12.2 million b/d in 2019, up by 1.2 million from the 2018 level. Forecast crude oil production then rises by 1.0 million b/d in 2020 to an annual average of 13.2 million b/d. The slowing rate of crude oil production growth reflects relatively flat crude oil price levels and slowing growth in well-level productivity.

Natural gas

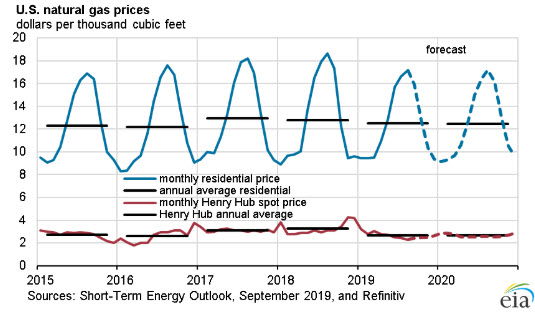

- The Henry Hub natural gas spot price averaged $2.22 per million British thermal units (MMBtu) in August, down 15 cents/MMBtu from July. This summer, prices have declined amid rising natural gas production, despite high levels of both natural gas exports and consumption in the electricity generation sector. Based on recent price movements and EIA’s assessment that natural gas production will be sufficient to meet expected demand and export levels at a lower price than previously forecasted, EIA lowered its Henry Hub spot price forecast for 2020 to an average of $2.55/MMBtu, 20 cents/MMBtu lower than the August forecast.

- EIA forecasts that U.S. dry natural gas production will average 91.4 billion cubic feet per day (Bcf/d) in 2019, up 8.0 Bcf/d from 2018. EIA expects monthly average natural gas production to grow in late 2019 and then decline slightly during the first quarter of 2020 as the lagged effect of low prices in the second half of 2019 reduces natural gas-directed drilling. However, EIA forecasts that growth will resume in the second quarter of 2020, and natural gas production in 2020 will average 93.2 Bcf/d.

- Natural gas storage injections have outpaced the five-year (2014–18) average so far during the 2019 injection season as a result of rising natural gas production. At the beginning of April, the natural gas inventory injection season started with working inventories 28% lower than the five-year average for the same period. By the week ending August 30, working gas inventories were 82 billion cubic feet (Bcf), or 3%, lower than the five-year average of 3,023 Bcf. EIA forecasts that natural gas storage levels will be 3,769 Bcf by the end of October, which is slightly higher than the fiveyear average and 16% higher than October 2018 levels.