By Joe Petrowski

A recent headline based on an EIA report citing reserves may peak in next 20 years revived the discussion of “peak” oil six months after the markets shuddered with a $60/barrel drop in price and the idling of wells and new drilling because of the “glut” of supply. The “Peakonistas” and their political sycophants came out of hibernation like cicada bugs chattering doom and gloom. Since I have been bullish oil in the mid to high 40s, I felt I might have to reverse my position and get bearish oil based on the contrarian theory that no one has had a worse record of forecasting the supply or price of a commodity than these market-challenged alarmists.

Let’s examine the record and where we are today.

In 1798 Thomas Malthus famously said food demand would outstrip population causing massive starvation. While there has been hunger, and some starvation, it has been driven by political, poverty and distribution factors. In fact, in most of the 19th century countries fought trade wars to access markets for their surplus commodities. The corn wars in Britain and the South fighting the Civil War (as much for access to European textile mills as for the right to preserve slavery) are but two prime examples.

In 1865 two members of the British parliament grimly predicted the peak of coal production and the dire consequences that would follow. At the same time some U.S. politicians predicted oat production for horses would peak, and other politicians predicted that if we would not limit the horse population the streets of N.Y. would be covered in manure. Oat production in the United States did peak (in 1980) when farmers switched to corn. Food processors (except Cherrios) used other grains and we lifted the ban on importing Canadian and Polish oats.

There were also concerns over our dependence on whale oil either based on concern for the whales or fisherman, but we survived that scare (though it did depress land prices in Nantucket for a while).

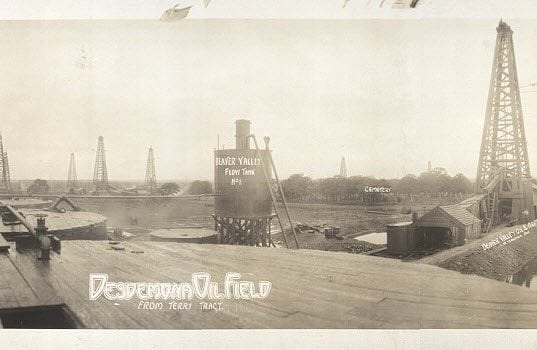

Our first peak oil call came in 1956. What followed was 30 years of unprecedented growth in both production and proven reserves culminating in $20/barrel oil, 30-cent retail diesel and $1 gasoline (less if you took out taxes). Only crazy government designed market schemes (old oil/new oil), several Mideast wars and the formation of OPEC derailed that train. As little as 5 years ago $100/barrel oil was going to be $200 by the prognosticators, so the solution crafted was to have billions of subsidies for solar and wind (to those companies supporting the agitated politicians), higher café standards and higher taxes to discourage usage.

The shale revolution was the skunk that showed up at the subsidy garden party hosted by the alarmists and would be energy czars. And despite every attempt to squash badly needed pipelines to move our new found abundance from where it is produced to where it is needed, we have oil and natural gas prices at 25-year lows and proven reserves at all-time high.

What do these nervous Nostradamus’ miss?

Two factors always blow up peak forecasts:

1) Technology: 1.5% of the world is carbon which is the 5th most abundant element on earth (hydrogen at 7% is the most abundant and we are creating economic hydrogen infrastructure and vehicles today). Hydrocarbons are everywhere. All the dinosaurs did not go to Saudi Arabia to die—we drilled there because of geology and cost (early Pennsylvania oil was called “rock oil” because it bubbled to the surface). Our ability to find oil, drill in multiple directions, fracture rock and extract it economically was a technological breakthrough. Currently Texas and California—two of our oldest producing regions—are producing higher percentages of our national production as we are able to recover more hydrocarbons from existing wells. This is why despite a drop in price our production level has held reasonably well, and our reserves have actually gone up.

2) Price and Markets. Most politicians struggle with economics. The cure for high prices is high prices. The cure for low prices is low prices. As Sheik Yamani the Saudi Oil minister famously said, “The stone age did not end when we ran out of stones.” It ended when we found substitutes that were better or cheaper. The oil age will end, but not any time soon and it will be when we switch to natural gas (already one-third the price of oil on a per-barrel equivalent); hydrogen; electricity or something that we simply cannot foresee today. And while the supply response is more easily understood driven by price levels, the demand response is often more powerful. Energy efficiency and demographics have been as big a contributing factor to this current energy revolution as has technology.

In conclusion, the only peak we have experience in this country was a peak in political intelligence by our elected officials, and that occurred between July 4th 1826 and April 15, 1865. And we have survived that.

Joe Petrowski has had a long career in international commodity trading, energy and retail management and public policy development. In 2005, he was named President and CEO of Gulf Oil LP and elected to the Gulf Oil LP Board of Directors. In October of 2008 he was named CEO of the now combined Gulf Oil and Cumberland Farms whose annual revenues exceed $11 billion and that now operates in 27 states. In September 2013, Petrowski stepped down as CEO of The Cumberland Gulf Group. He is now managing director of Mercantor Partners, a private equity firm investing in convenience and energy distribution.

Joe Petrowski has had a long career in international commodity trading, energy and retail management and public policy development. In 2005, he was named President and CEO of Gulf Oil LP and elected to the Gulf Oil LP Board of Directors. In October of 2008 he was named CEO of the now combined Gulf Oil and Cumberland Farms whose annual revenues exceed $11 billion and that now operates in 27 states. In September 2013, Petrowski stepped down as CEO of The Cumberland Gulf Group. He is now managing director of Mercantor Partners, a private equity firm investing in convenience and energy distribution.