MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

May 1, 2020: This week brought a ray of hope in the COVID-19 pandemic, with potential for an experimental treatment drug and progress on vaccine research that could bring a vaccine by January 2021. This news combined with gradual re-opening of various economic activities to feed a significant jump in equities markets midweek. Some gains were handed back Thursday, however, when data was released showing worse-than-expected unemployment numbers, and this morning saw markets open lower. The gradual opening of the economy and the relaxation of travel restrictions is expected to bring a gradual increase in fuel demand. However, oil markets remain subdued by overwhelming inventories. U.S. crude oil stockpiles grew this week by another 8.99 mmbbls of crude, bringing crude in storage to 527.6 mmbbls. Crude inventories have grown every week this year since the week ended January 24th, adding 100.7 mmbbls to supply. The drop in demand was exceptionally steep, but the recovery in demand is not expected to bounce back at the same trajectory. WTI crude futures prices in February were over $50/b, and prices now are struggling to regain the territory above $20/b.

Experts warn that the COVID-19 pandemic has not been contained, and that potential vaccines are months away. The experimental antiviral drug Remdesivir is not a cure, but it may be able to shorten recovery times. Global cases have risen to 3,274,747, with 233,792 deaths attributed to the virus. The U.S. remains the center of the pandemic, with the grim news that there are now more than one million confirmed cases (1,070,032) and 63,019 deaths. Some states are relaxing stay-at-home orders, but others are extending their mandatory social distancing rules. Cases continue to rise in all states. The attention on possible vaccines and treatments this week may be premature, but it is natural to focus on good news amidst all the bad news.

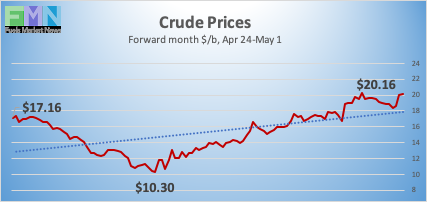

WTI (West Texas Intermediate) crude futures prices opened at $16.78/b on Friday, April 24, and rose to an open of $19.04 on Friday, May 1, an increase of $2.26/b (13.5%). This week appears to be heading for a finish in the black, recouping some of the $9.64/b loss of the prior week. Our weekly price review covers hourly forward prices from Friday, April 24, through Friday, May 1. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $0.6797/gallon on Friday, April 24, and prices rose to open at $0.7801/gallon on Friday, May 1. This was a significant recovery of 10.04 cents (14.8%). The month of March brought a crippling collapse of nearly 87 cents per gallon, and prices gradually crept back in April. U.S. average retail prices for gasoline fell by 3.9 cents/gallon during the week ended April 27th, averaging $1.733/gallon at the national level. Gasoline futures prices dropped on Thursday alongside crude, but prices recovered modestly this morning as various states begin to relax shelter-in-place rules. The return to employment and travel are not expected to come rapidly. Gasoline futures prices are trading in the range of $0.74/gallon to $0.80/gallon. This week should finish in the black. The latest price is $0.7537/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $0.7878/gallon on Friday, April 24, and opened on Friday, May 1, at $0.8389/gallon, a recovery of 5.11 cents (6.5%) following last week’s major collapse of 23.96 cents (24.9%) based on May contracts. U.S. average retail prices for diesel fell by 4.3 cents/gallon during the week ended April 27th, averaging $2.437/gallon. Retail prices for diesel have fallen for sixteen consecutive weeks. Diesel futures prices plummeted last week, pulled down by the crude price collapse, and diesel prices recovered modestly as crude prices trended back up. Diesel prices this week appear to be heading for a finish in the black. Currently, diesel is trading in the range of $0.81-$0.87/gallon. The latest price is $0.8386/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, April 24, at $16.78/b, strengthening to open at $19.04/b on Friday, May 1. This was a recovery of $2.26/b (13.5%,) following last week’s collapse of $9.64/b (36.5%). Prices strengthened midweek on optimism over gradual lifting of COVID-19 shelter-in-place orders, plus the potential for a treatment drug. Inventories continued to swell, but it did not affect the price rally, perhaps because the volume was lower than expected. The price rally was set back on Thursday by a major increase in unemployment claims and the retreat of a Wall Street rally. Nonetheless, crude prices appear to be holding and heading for a finish in the black. WTI prices are trading in the $18.00-$20.50/b range currently. The latest price is $19.53/b.

PRICE MOVERS THIS WEEK : BRIEFING

This week brought a ray of hope in the COVID-19 pandemic, with potential for an experimental treatment drug and progress on vaccine research that could bring a vaccine by January 2021. Bill Gates elevated the country’s optimism when he stated that a coronavirus vaccine may take less time than expected, perhaps as little as nine months. Eighty-nine companies are working to develop a coronavirus vaccine, in what is being called “The Great Vaccine Race.” Mr. Gates believes that upwards of ten of these show promise. The experimental antiviral drug Remdesivir is not a cure, but it may be able to shorten recovery times. It was developed originally as a possible treatment for the Ebola virus. It is not yet licensed or approved anywhere in the world. Scientists are analyzing data from a current experiment. Five hospitals in Australia will be receiving the drug for experimental treatments. Global cases have risen to 3,274,747, with 233,792 deaths attributed to the virus. The U.S. remains the center of the pandemic, with the grim news that on April 28 that U.S. cases hit the one million mark. Confirmed cases currently stand at 1,070,032 with 63,019 deaths. Some states are relaxing stay-at-home orders, but others are extending their mandatory social distancing rules. U.S. confirmed cases are still rising is all states. Still, the experiments with a possible antiviral treatment and the accelerated progress in vaccine development is some of the best news available, and it is only natural for a good-news-starved people to focus upon it.

Optimism over progress in treating COVID-19, anticipation of relaxing stay-at-home rules, and a few stronger-than-expected corporate earnings reports fed a significant jump in equities markets midweek. The Dow Jones Industrial Average gained 532 points on Wednesday. On Thursday, however, 288 points were handed back, when data was released showing worse-than-expected unemployment numbers. The Labor Department reported that initial jobless claims totaled 3.84 million during the week ended April 25, whereas economists had predicted 2 million to 3.5 million. The six-week total is over 30 million. The Dow opened Friday morning down again by another 427 points.

The gradual opening of the economy and the relaxation of travel restrictions is expected to bring a gradual increase in fuel demand. However, oil markets remain subdued by overwhelming inventories. U.S. crude oil stockpiles grew this week by another 8.99 mmbbls of crude, bringing crude in storage to 527.6 mmbbls. Crude inventories have grown every week this year since the week ended January 24, adding 100.7 mmbbls to supply. The drop in demand was exceptionally steep, but the recovery in demand is not expected to bounce back at the same trajectory. WTI crude futures prices in February were over $50/b, and prices now are struggling to regain the territory above $20/b. Local crude producers also are concerned that prices will weaken if an estimated 28 Saudi Arabian oil tankers now at sea arrive at the U.S. There are reportedly already 76 oil tankers waiting to offload cargo at U.S. ports.

The EIA reports that crude oil in storage at Cushing has risen from 35,501 thousand barrels during the week ended January 3, 2020, to 63,378 thousand barrels during the week ended April 24, 2020, an increase of 27,056 thousand barrels. This is the highest level of inventory at Cushing since November 2017. The amount of oil storage at Cushing is approximately 90 mmbbls, but the remaining capacity is at a premium, and some market participants fear that readily available storage will be full in the coming month. Some surplus crude will be stored in May and June in the National Strategic Petroleum Reserve (SPR).The U.S. government has announced that it plans to take advantage of low prices and support the oil industry by purchasing up to 11.3 mmbbls of sweet crude and up to 18.7 mmbbls of sour crude for the SPR. This is not necessarily domestic crude. The delivery date is between May 1 and June 30. Current SPR stocks are 634.987 mmbbls.

The American Petroleum Institute (API) released information on Tuesday showing another huge crude inventory build, amounting to 10.0 mmbbls. The API also reported a build of 5.5 mmbbls of diesel. However, contrary to industry expectation, the API reported a drawdown from gasoline inventories amounting to 1.1 mmbbls. The API’s net inventory build was 14.4 mmbbls. Market analysts had predicted across-the-board inventory additions, with a total addition to inventories of 17.5 mmbbls.

U.S. Energy Information Administration (EIA) official statistics showed a smaller inventory build than the API. The addition to crude stocks was 8.991 mmbbls. The addition to distillate stockpiles was 5.092 mmbbls. Moreover, the draw from gasoline stocks was significantly larger, at 3.669 mmbbls. The EIA net result was an inventory build of 10.414 mmbbls. While large, it was below industry expectations, which might be seen as the first bullish news in a hugely bearish market. Crude oil inventories have expanded in 15 of the 17 weeks so far this calendar year, sending a total of 100.67 mmbbls of crude oil into storage, with no end in sight.

U.S. crude production now is in decline, but at a slow pace as of the week ended April 24. The EIA reported that U.S. crude production during the week ended April 24, fell to 12.1 mmbpd, down 0.1 mmbpd from the prior week’s level of 12.2 mmbpd. According to this weekly data series, U.S. crude production averaged 13.025 mmbpd in February 2020, the highest total ever. Production has fallen to 12.25 mmbpd during the first four weeks of April. Baker Hughes reports that the active oil and gas rig count fell by 64 during the week ended April 24. For the year to date, 331 rigs have exited the field.