MARKET SNAPSHOT

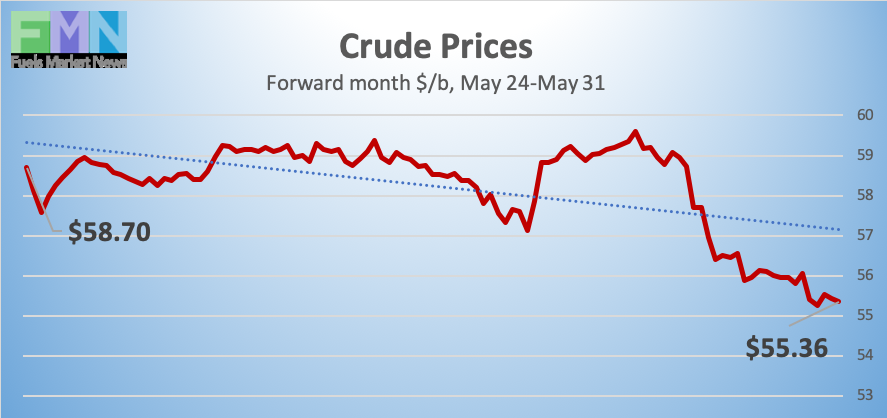

Oil prices continued to slide this week, and today is bringing heavy losses. Global markets are increasingly uneasy at the breakdown of U.S.-China trade negotiations. Adding to these concerns, President Trump today announced a plan to levy a 5% tariff on all Mexican goods. According to the President’s tweet “The Tariff will gradually increase until the Illegal Immigration problem is remedied,…” WTI crude prices opened this morning $1.75/b (-3.0%) below last Friday’s level, and currently, crude prices are dipping below $55/b. Our weekly price review covers hourly forward prices from 9AM EST Friday May 24th through 9AM EST Friday May 31st. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.9195/gallon on Friday May 24th, and prices opened at $1.8786/gallon on Friday May 31st, a drop of 4.09 cents (2.1%.) Gasoline forward prices have dropped by 18.9 cents/gallon over the past two weeks. Gasoline prices are continuing to fall today, alongside crude and diesel, in response to planned tariffs on goods from Mexico. Trades are occurring mainly in the range of $1.83-$1.87/gallon. The latest price is $1.8321/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.966/gallon on Friday May 24th and opened on Friday May 31st at $1.90/gallon, a significant decline of 6.6 cents (3.4%.) Diesel prices followed crude prices down in response to the impasse in U.S.-China negotiations. Today is expected to bring a continuation of the downward trend in response to new plans for tariffs on Mexican goods. Diesel forward prices have plummeted by 22.73 cents/gallon over the last two weeks. Diesel prices currently are trading in the $1.87-$1.90/gallon range. The latest price is $1.8728/gallon.

WEST TEXAS INTERMEDIATE PRICES

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices continued to slide this week, adding to the losses seen last week. This week’s prices never cracked the $60/b level at the highs, and they have been dipping below the $55/b level. Global markets are increasingly uneasy about the severity and duration of the U.S.-China trade war. China is retaliating for the U.S. escalation of tariffs. A Chinese newspaper suggested that the country could ban exports of rare earth metals to the U.S. China may also target soybean imports from the U.S., striking at U.S. agriculture.

Prices strengthened midweek upon fears of flooding-related supply hiccups, and upon Tuesday’s data release from the American Petroleum Institute (API.) API reported that U.S. crude oil inventories were drawn down by 5.26 million barrels (mmbbls,) gasoline inventories rose by 2.71 mmbbls, and diesel inventories were drawn down by 2.1 mmbbls. The API net draw from inventories was 4.65 mmbbls.

Official statistics were more bearish. The U.S. Energy Information Administration (EIA) reported a much smaller draw of 0.282 mmbbls from crude oil inventories, 2.204 mmbbls added to gasoline inventories, and 1.615 mmbbls added to diesel inventories. The net addition was 0.307 mmbbls. Oil prices resumed their downward trend.

Today, U.S. President Trump announced that the U.S. planned to levy a 5% tariff on all Mexican goods, starting on June 10th. According to the President’s tweet “The Tariff will gradually increase until the Illegal Immigration problem is remedied, at which time the Tariffs will be removed.” The tariff would increase to 25% by October 1st unless the flow of illegal immigrants was not substantially reduced. Dow Jones Futures immediately dropped by 100 points. Markets are expected to see selling today. The Dow Jones Industrial Average opened at 24,893.68 today, down by 276.2 points (1.1%.) Today’s Dow Jones opening was 454.09 points below Tuesday’s opening.