From The Desk Of The Publisher

We’ve listened to input by our readers and are making a few changes to our format. First, we’re changing from a daily fuels analysis to a more in-depth and nuanced weekly publishing schedule. We will still offer the exclusive analysis of the entire downstream fuel industry by Dr. Nancy Yamaguchi that you’ve come to trust and as you can see, we’ve actually expanded the analysis.

If you would like to subscribe to our free Friday newsletter, please click here!

Sincerely,

Gary Bevers, Publisher

MARKET SNAPSHOT

Oil prices have been pushed and pulled this week. Inventory drawdowns and geopolitical concerns are lending some price support, but a setback in U.S.-China trade negotiations is causing markets to tumble. WTI crude prices this morning opened $0.09/b above last Friday’s level, but currently, crude prices have fallen below $62/b. Our weekly price review covers hourly forward prices from 9AM EST Friday May 3rd through 9AM EST Friday May 10th. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $2.0116/gallon on Friday May 3rd and opened on Friday May 10th at $1.9721, down by 3.95 cents (2.0%.) Gasoline forward prices currently are trending down, with trades occurring mainly in the range of $1.97-$2.00/gallon. The latest price is $1.9924/gallon.

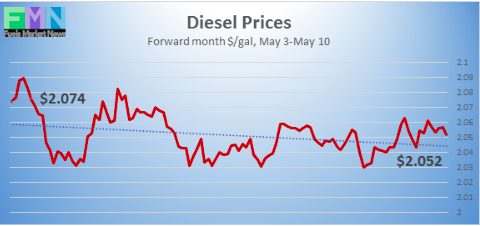

DIESEL PRICES

Diesel Prices. Diesel opened on the NYMEX at $2.0675/gallon on Friday May 3rd and opened on Friday May 10th at $2.0434, down by 2.41 cents (1.2%.) As crude prices weaken, diesel prices are following. Diesel prices currently are trading in the $2.04-$2.06/gallon range. The latest price is $2.055/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI Crude Prices. WTI (West Texas Intermediate) crude forward prices opened on the NYMEX at $61.55/barrel on Friday May 3rd and opened on Friday May 10th at $61.64/barrel, up slightly by $0.09/b (0.1%.) Two weeks ago, prices surged upon news that the U.S. would not extend waivers on purchases of Iranian crude. Yet supplies quickly were deemed sufficient, and market volatility is rising in response to a setback in U.S.-China relations. Prices struggled to maintain levels of around $62/b this week, and currently, prices have fallen below $62/b. WTI is trading mainly in the range of $61.50/b-$62.25/b. The latest price is $61.81/b.

PRICE MOVERS THIS WEEK : BRIEFING

Following last week’s slump, prices this week showed early signs of recovery, based on signs of tightening supply. Indeed, there are a surprising number of risk factors with potential to cause a price spike. Libya remains locked in civil violence, Venezuela remains in freefall, the U.S. is working to shut in as much Iranian oil as possible, and Russia’s Druzhba Pipeline has been found to be contaminated with chlorides, causing at least ten European refiners to halt imports.

But market uncertainty rose as President Donald Trump announced that China “broke the deal,” placing the agreement in jeopardy even as Chinese officials are in Washington DC to continue negotiations.

Prices stagnated when the American Petroleum Institute (API) reported that U.S. crude oil inventories rose by 2.8 million barrels (mmbbls,) though this was more than offset by drawdowns of 2.8 mmbbls from gasoline inventories and 0.834 mmbbls from diesel inventories. The API net drawdown from inventories was 0.834 mmbbls. The API report was followed by a bullish set of official statistics from U.S. Energy Information Administration (EIA.) The EIA reported across-the-board drawdowns: 3.963 mmbbls from crude oil inventories, 0.596 mmbbls from gasoline inventories, and 0.159 mmbbls from diesel inventories. The net draw was 4.718 mmbbls. This helped overcome last week’s net addition of 9.544 to oil inventories.

Although there had been some optimism that the U.S. and China would quell tensions, today, the U.S. made good its threat to raise tariffs on $200 billion worth of Chinese goods to 25%. China retaliated by adding support to its local stock market, which is rallying. Other global equities markets are mixed. In the U.S., all major stock indices dropped. The Dow Jones Industrial Average has fallen by over 750 points so far this week. Initially, China had stated that it would not purchase Iranian crude in May, but it would not be surprising if China continued to import oil from Iran and Venezuela despite U.S. sanctions, further easing supply side concerns.