MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

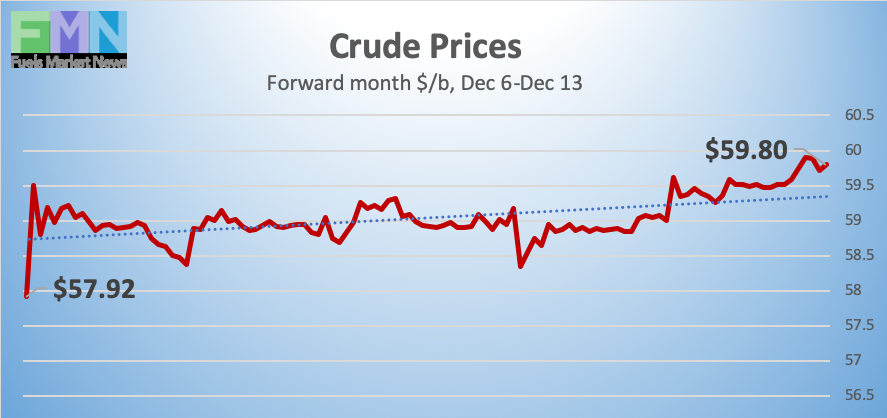

December 13, 2019: Oil prices bounced up and down daily this week, but prices are firmly above $59/b today on news of a phase-one trade deal with China. The week started on an up note carried over from last week’s strong U.S. Jobs Report, plus the adoption of deeper crude production cuts by the OPEC+ group. The original cuts, amounting to 1.2 million barrels per day (mmbpd,) are set now at 1.7 mmbpd. The price rally stalled midweek as the reality of oversupply reasserted itself: U.S. stockpiles of crude oil, gasoline and diesel all expanded, U.S. production averaged 12.8 mmbpd, and the U.S. Energy Information Administration announced that the U.S. was on track to become a net exporter of petroleum in 2020. Equities and commodities prices rose today, however, upon news that the U.S. and China have reached a “phase-one accord” in the trade war. Although the legal wording has not been finalized, the agreement will forestall the introduction of the new set of tariffs that the U.S. would have imposed on Sunday the 15th, roll back existing tariffs, and increase Chinese purchases of U.S. goods. Prices are up, but markets are showing caution this morning, waiting for a press conference in China. Crude and product prices are up, and the week appears to be heading for a finish in the black.

WTI futures crude prices opened on Friday, December 6, at $58.32/b, and prices rose to an open of $59.36/b today, up by $1.04/b. WTI futures prices regained and surpassed the $59/b level, and briefly hit a high of $60/b. WTI futures prices have not cracked the $60/b barrier since mid-July. This week should finish with oil prices in the black. Gasoline and diesel prices followed crude up today. Our weekly price review covers hourly forward prices from Friday December 6 through Friday December 13. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.6213/gallon on Friday, December 6, and prices opened at $1.6325/gallon on Friday, December 13. This was an increase of 1.12 cents (0.7%.) U.S. average retail prices declined by 1.4 cents/gallon during the week ended December 9th. The week appears to be headed for a finish in the black. Trades are occurring mainly in the range of $1.63-$1.66/gallon. The latest price is $1.6470/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.932/gallon on Friday, December 6, and opened on Friday, December 13, at $1.9553/gallon, up by 2.33 cents (1.2%.) U.S. average retail prices for diesel fell by 2.1 cents/gallon during the week ended December 9th. Diesel futures prices started the week in a slump, then began to climb by Thursday and Friday. The week appears to be heading for a finish in the black. Contracts currently are trading in the $1.955-$1.988/gallon range. The latest price is $1.9713/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, December 6, at $58.32/b. Prices rose to an open of $59.36/b today, up by $1.04/b (1.8%.) During the week, prices slackened when U.S. supplies rose, but they are now rising based on the phase-one agreement in the U.S.-China trade war, which in principle will cancel the next set of tariffs that the U.S. had scheduled to take effect on December 15th, roll back existing tariffs by 50%, and increase Chinese purchases of U.S. agricultural and energy products in 2020. Currently, WTI futures prices are holding above $59/b, with a note of caution as markets await a press conference in China. WTI crude is trading mainly in the range of $59.30/b-$59.75/b. Highs have hit the $60/b mark, which has not happened since mid-July. The latest price is $59.31/b.

PRICE MOVERS THIS WEEK : BRIEFING

Oil prices bounced up and down daily this week, but prices are strong today based on the phase-one agreement in the U.S.-China trade war. The week began on an up note after last week’s excellent U.S. Jobs Report, followed by the outcome of the OPEC+ group meeting. The OPEC+ group announced that the oil production cut agreement would be extended, with the production caps formally reduced by 500,000 barrels per day. The initial cut was 1.2 mmbpd from an agreed-upon baseline, and the new agreement calls for a 1.7 mmbpd cut. This level is a reflection of current production, rather than a deep cut that would take oil off the market. However, formalizing the cuts and the agreement fomented a price rally. The agreement was backed by the strength of Saudi Arabia, which admonished fellow producers who had failed to adhere to their production caps.

Oil prices weakened midweek based on news of increased supply. On Tuesday, the American Petroleum Institute (API) reported across-the-board additions to U.S. oil inventories: 1.41 million barrels (mmbbls) to crude stocks, 4.92 mmbbls to gasoline inventories and 3.24 mmbbls to diesel stockpiles. Industry experts had anticipated a crude stock drawdown and stock builds of gasoline and diesel. The API’s net inventory build was a hefty 9.57 mmbbls. This dampened the price rally.

The EIA released official statistics on Wednesday, corroborating the API data by also showing across-the-board stock builds: 0.822 mmbbls of crude, 5.405 mmbbls of gasoline, and 4.118 mmbbls of diesel. The net result was an inventory build of 10.345 mmbbls.

By Thursday evening, however, reports came out that the U.S. and China had reached a “phase-one accord” in the trade war. Wall Street reacted positively, sending stocks and equities skyward. December 15 had been the date for additional U.S. tariffs on $160 billion in consumer goods, and these tariffs now will be canceled. The formal language has not been approved, but the agreement in principle calls for the U.S. to scale back the existing $375 billion in tariffs by half, while China agrees to purchase $50 billion in U.S. agricultural goods and energy in 2020. Oil prices rose, and the week appears headed for a finish in the black.

The EIA also reported that U.S. crude production eased slightly to 12.8 mmbpd during the week ended December 6th. Production had hit a new record-high 12.9 mmbpd during the second half of November. Approximately 1.1 mmbpd has been added to U.S. supply this year. This has been accomplished despite a steady downward trend in active oil and gas rigs. The Baker Hughes rig count showed a drop of 3 active rigs during the week ended December 6th. For the year to date, 276 rigs have exited the field. Nonetheless, the U.S. Energy Information Administration announced that the U.S. is on track to become a net exporter of petroleum in 2020.