MARKET SNAPSHOT

By Dr. Nancy Yamaguchi

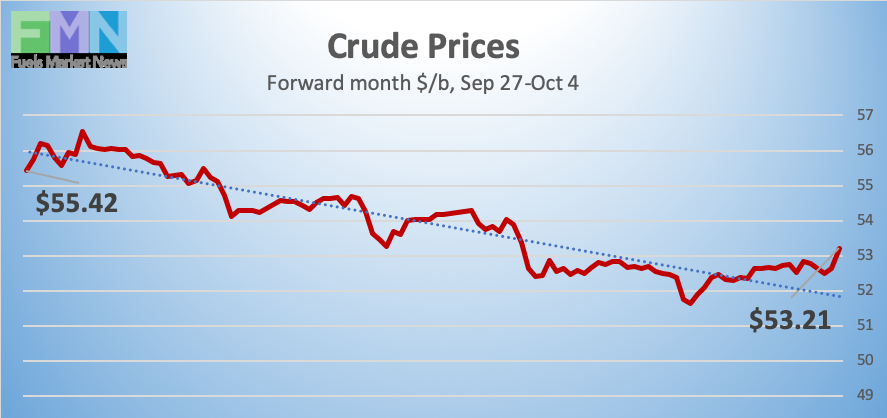

October 4, 2019: Crude prices trended down this week, falling by approximately $4/b. WTI futures crude prices opened on Monday at around $56.50/b, and prices fell each day thereafter, dipping as low as $50.99/b on Thursday. WTI prices currently have regained the $53/b level. Crude and product prices are trending back up this morning, though the week appears to be heading for another finish in the red. The global oil market is well-supplied, and demand-side concerns have risen as global economic indices continue to show signs of slowdown. Today’s U.S. Jobs Report was mixed: jobs formation was below forecast, but the unemployment rate dropped to 3.5%–one of the lowest rates in the past five decades. Our weekly price review covers hourly forward prices from Friday September 27. through Friday October 4. Three summary charts are followed by the Price Movers This Week briefing for a more thorough review.

GASOLINE PRICES

Gasoline opened on the NYMEX at $1.6575/gallon on Friday, September 27, and prices opened at $1.5477/gallon on Friday, October 4. This was a major drop of 10.98 cents (6.6%.) U.S. average retail prices eased only slightly, by 1.2 cents/gallon, during the week ended September 30th, indicating that retail prices have not fully followed futures prices back down. Futures prices for gasoline are recovering this morning, though the week is heading for a finish in the red. Trades are occurring mainly in the range of $1.55-$1.60/gallon. The latest price is $1.5858/gallon.

DIESEL PRICES

Diesel opened on the NYMEX at $1.9563/gallon on Friday, September 27, and opened on Friday, October 4, at $1.8761/gallon, a significant drop of 8.02 cents (4.1%.) Until the past two weeks, diesel forward prices had opened higher for six consecutive weeks. The attacks on Saudi oil facilities two weeks ago caused diesel prices to spike above $2/gallon. Restoration of supply, coupled with demand-side weakness, is bringing prices back down. Prices this morning are recovering, though the week appears to be heading for a finish in the red. Contracts currently are trading in the $1.88-$1.91/gallon range. The latest price is $1.9057/gallon.

WEST TEXAS INTERMEDIATE PRICES

WTI (West Texas Intermediate) crude forward prices opened on the NYMEX on Friday, September 27, at $56.51/barrel and fell to an open of $52.29/barrel on Friday, October 4, a large decline of $4.22/b (7.5%.) Futures prices fell each day from Tuesday through Friday. Crude oil supplies expanded during the week. Saudi Aramco announced full restoration of production capacity, adding an additional buffer of supply to a global market that appeared already well-supplied. This morning, prices are stabilizing and trending back up. The week appears to be heading for a finish in the red nonetheless. WTI crude is trading mainly in the range of $52.50/b-$53.50/b. The latest price is $53.05/b.

PRICE MOVERS THIS WEEK : BRIEFING

Another eventful week was dominated by signs of economic cooling, an amply-supplied oil market, and the impeachment inquiry of President Donald Trump. Economic indices continue to display signs of a slowdown, with manufacturing down in the U.S. and Germany. Equities markets had a tumultuous week. The Dow Jones Industrial Average rose by approximately 96 points on Monday, plunged by 344 points on Tuesday, continued to freefall by 494 points on Wednesday and came back by 122 points on Thursday. Futures markets pointed to a positive market opening today, and investors were not disappointed: The Dow Jones opened at 26,344, and it is up by around 130 points currently.

The Bureau of Labor Statistics just released the Employment Situation Report for September. Total nonfarm payroll employment rose by 136,000, missing the estimate of 145,000 jobs. However, the unemployment rate fell to 3.5%, one of the lowest rates in nearly five decades. Employment in health care and in professional and business services continued to rise. Employment was also boosted by seasonal hiring for the U.S. Census.

Saudi Aramco announced full restoration of its drone-damaged oil infrastructure, bringing production capacity back to 11.3 million barrels per day (MMBPD). A well-supplied market and demand-side concerns are placing downward pressure on oil prices.

Prices strengthened briefly on Tuesday when the American Petroleum Institute (API) reported an unexpected drawdown of 5.29 million barrels (mmbbls) from crude inventories. Market experts had predicted a 1.4-mmbbls addition to stockpiles. The API also reported an addition of 2.1 mmbbls to gasoline inventories, and a drawdown of 1.7 mmbbls from diesel inventories. The API’s net inventory draw was 5.52 mmbbls.

The Energy Information Administration (EIA) released official statistics on Wednesday, showing instead an addition of 3.104 mmbbls to crude inventories. This was largely countered by drawdowns of 0.228 mmbbls of gasoline and 2.418 mmbbls of diesel. The net result was a modest inventory build of 0.047 mmbbls.

The EIA also reported that during the week ended September 27th, U.S. crude oil production eased slightly to 12.4 million barrels per day (mmbpd.) Baker Hughes reported on Friday that the U.S. active oil and gas rig count fell by 8 during the week ended September 27th. This was the sixth consecutive week that the rig count had fallen.