Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

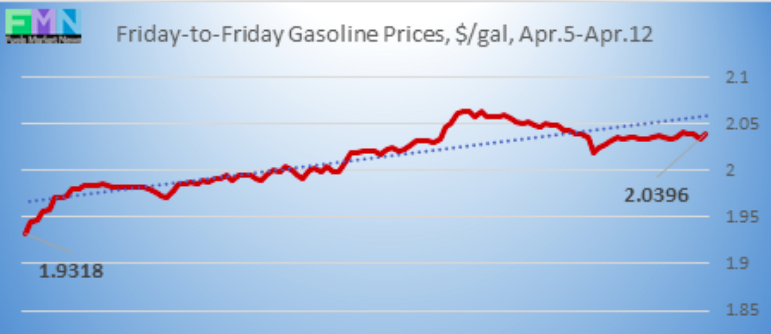

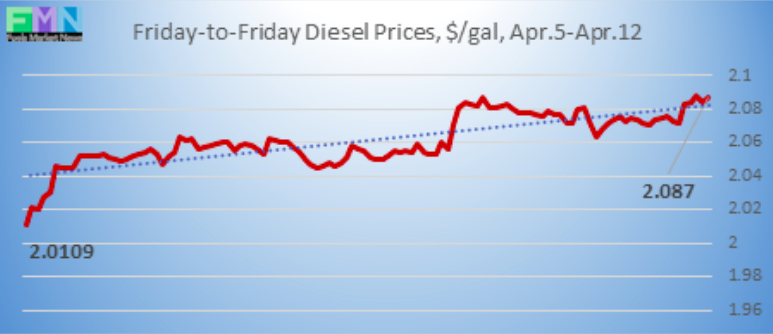

Readers, kindly note that we are changing our weekly review to show how the current week has developed. The charts now present hourly price trends from the previous Friday at 9AM EST to the current Friday at 6AM EST, consistent with our daily price trends column.

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices fell below $64/b at today’s market opening, but prices this morning have reclaimed the $64/b level. WTI (West Texas Intermediate) crude forward prices opened at $63.71/b today, down by $0.77 (1.19%) from yesterday’s opening price of $64.48/b. Gasoline and diesel futures prices opened with losses as well today, though gasoline futures prices have been very strong, opening for the third day above $2/gallon. The past three days have brought the highest gasoline futures prices in five months. WTI crude prices dropped midweek upon news of a significant addition to inventories, combined with warnings of demand-side risk. However, prices this morning are heading back up.

This week brought another significant addition to U.S crude oil stockpiles. The dampening effect on prices was mollified by a major drawdown from gasoline stocks, plus a modest reduction in diesel inventories. Crude oil, gasoline and diesel futures prices all appear to be heading for a week solidly in the black. As of the time of this writing, WTI crude futures prices are up by $1.27/b (2.0%) for the week. Diesel futures prices are up by 4.03 cents/gallon (2.0%) for the week. Gasoline futures prices are up by 5.55 cents/gallon (2.8%) for the week. For two weeks now, WTI crude prices have remained steadily above the $60/b level, the highest prices since late October and early November.

Yesterday, the International Energy Agency (IEA) recognized additional uncertainty about demand-side risk. Prices eased, but subsequently rebounded on positive news about Chinese economic performance. Chinese exports grew in March, as did its trade surplus with the U.S. Chinese crude oil imports also rose.

Attention shifted back to supply-side constraints, with growing concern over the future of Algerian output. After escalating protests, Algerian President Abdelaziz Bouteflika stepped down this month after twenty years in power. The state-run oil company, Sonatrach, is closely tied to his regime, and it is regarded as corrupt. Foreign oil companies are backing away from investing in Algeria, and they likely will not make decisions until the new elections, scheduled for July. If the new regime is not stable and business-friendly, Algeria’s oil industry may stagnate.

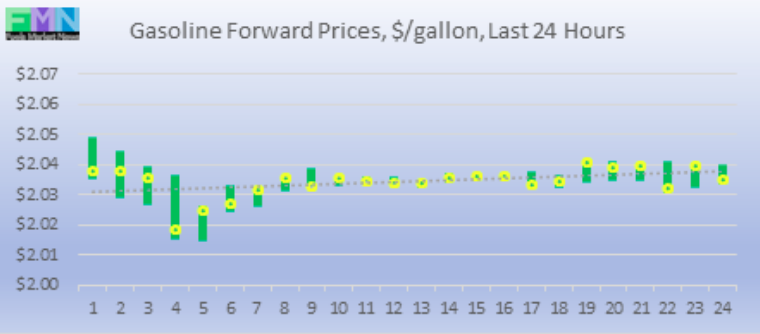

GASOLINE

Gasoline opened on the NYMEX at $2.0361/gallon today, down by 2.63 cents (1.27%) from yesterday’s opening price of $2.0624 cents/gallon. Until this week, gasoline futures prices had not opened above $2/gallon since November 1st. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices rose by 0.64 cents (1.00%.) Gasoline forward prices currently are easing, with trades occurring mainly in the range of $2.02-$2.05/gallon. The latest price is $2.0275/gallon.