Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

Readers, kindly note that we are changing our weekly review to show how the current week has developed. The charts now present hourly price trends from the previous Friday at 9AM EST to the current Friday at 6AM EST, consistent with our daily price trends column.

FUEL MARKETS TODAY – Market Overview

Crude oil futures prices rose modestly today at market opening, recapturing Wednesday’s small loss, then handing it back. WTI (West Texas Intermediate) crude forward prices opened at $64.48/b today, up by $0.26 (0.40%) from yesterday’s opening price of $64.22/b. Gasoline and diesel futures prices opened with more significant gains today. Gasoline futures prices have been particularly strong, opening again above $2/gallon. Yesterday was the first time in five months this had happened. However, markets appear to be refocusing on threats to global demand, and prices currently are declining. WTI crude prices have been dipping below the $64/b level.

The upward trend of crude oil prices levelled off yesterday when official statistics for the week showed a significant increase in crude oil inventories. In contrast, gasoline and diesel prices continued to rise upon news of inventory reductions. The Energy Information Administration (EIA) reported yesterday that U.S. crude oil stockpiles grew by 7.03 million barrels (mmbbls) during the week ended April 5th. This was the third consecutive week that oil inventories rose. Countering this, however, gasoline inventories were drawn down by a whopping 7.710 mmbbls, and diesel inventories were drawn down by 0.116 mmbbls. The net was a decrease of 0.797 mmbbls of oil in storage. Earlier, the American Petroleum Institute (API) reported a 4.1-mmbbl increase in crude oil inventories, more than countered by drawdowns of 7.1 mmbbls from gasoline inventories and 2.4 mmbbls from diesel inventories. Although the EIA data was less bullish than the API data, fuel prices retained much of their strength.

This morning, the International Energy Agency (IEA) refocused attention on the demand side of the global oil equation. Oil prices have been rising strongly, based on supply tightening. The IEA noted “an extraordinarily wide divergence of view as to how strong growth will be.” The IEA is maintaining its forecast of 1.4 million barrels per day demand growth (around 1.4%) in 2019, but it cautioned that it would accept the fact that there were “mixed signals about the health of the global economy.” This appears to be having a cooling effect on prices today.

GASOLINE

Gasoline opened on the NYMEX at $2.0624/gallon today, up by 5.19 cents (2.51%) from yesterday’s opening price of $2.0105 cents/gallon. Until yesterday, gasoline futures prices had not opened above $2/gallon since November 1st. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices rose by 1.36 cents (0.67%.) Gasoline forward prices currently are easing, with trades occurring mainly in the range of $2.04-$2.06/gallon. The latest price is $2.0437/gallon.

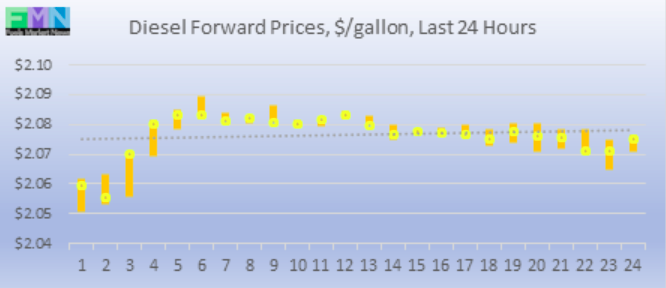

DIESEL

Diesel opened on the NYMEX at $2.0863/gallon today, up by 3.53 cents (1.69%) from yesterday’s opening price of $2.051/gallon. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices rose by 1.84 cents (0.90%.) Diesel prices currently are stable, trading mainly in the $2.07-$2.09/gallon range. The latest price is $2.078/gallon.

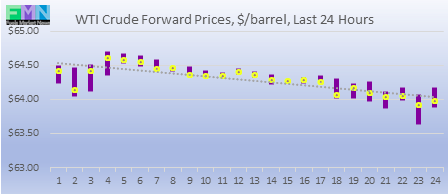

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $64.48/b today, up by $0.26 (0.40%) from yesterday’s opening price of $64.22/b. Today was the third day in a row that WTI prices opened above $64/b (which before had not occurred in five months.) However, currently prices are falling, hovering around the $64/b level and sometimes dipping below. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices fell by $0.38 (0.59%.) Currently, prices are easing, trading between $63.75/b-$64.25/b. The latest price is $64.05/b.