Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

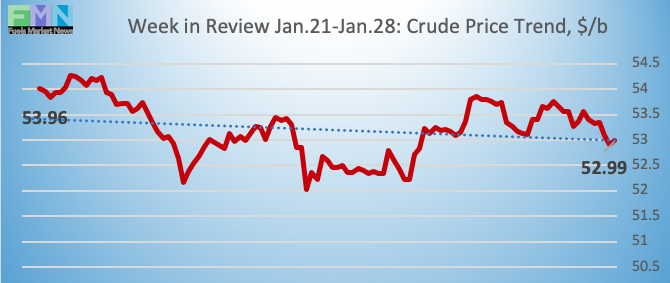

Crude oil prices are modestly lower this morning, but they are creeping back up after a surge and pullback cycle yesterday. WTI (West Texas Intermediate) crude forward prices opened at $54.01/b today, down by $0.27 (0.50%) from yesterday’s opening price of $54.28/b. Gasoline and diesel futures prices showed a similar pattern, with a run-up in prices yesterday followed by a retreat. Prices currently appear to be creeping back up.

The oil complex appears likely to end this week in the black. As of the time of this writing, WTI crude prices are up by $1.56 (3.0%) for the week. Gasoline prices are up by 5.16 cents (3.9%) for the week. Diesel prices are up by 2.77 cents (1.5%) for the week.

Oil prices this week rose in response to the rise of Venezuela’s opposition party leader, Juan Guidó, who declared that the re-election of President Nicolas Maduro was illegitimate. The U.S. quickly backed Guidó, and launched sanctions intended to prevent the Maduro administration from receiving oil revenues. Today, the U.S. announced that non-U.S. entities have until April 28th to phase out their purchases of oil from PDVSA, the state oil company. Venezuelan output has been declining in any case, but additional cuts will tighten the market even more, given the already-in-motion cuts by the Saudi-led OPEC-NOPEC group.

Concerns remain over the U.S. and global economies. The U.S.-China meetings in Washington ended with positive statements on both sides, but no solid agreements. This week, Fed Chair Jerome Powell announced that the Fed would not raise interest rates this quarter, and perhaps not for the year. President Trump had criticized the Fed for 2018’s rate hikes, but the cessation of hikes is interpreted as a sign of a risky economic environment—not a validation of “Trumponomics.”

The Bureau of Labor Statistics (BLS) just released the January 2019 Jobs Report, showing the addition of an unexpectedly high 304,000 non-farm payrolls in January. The unemployment rate ticked up slightly to 4.0%. On the surface, this is a strong report. However, economists are pondering the numbers, since the 35-day partial government shutdown muddied data collection and definitions. Furloughed workers were counted as employed, since their back pay was guaranteed. The numbers may be subject to revision in next month’s report.

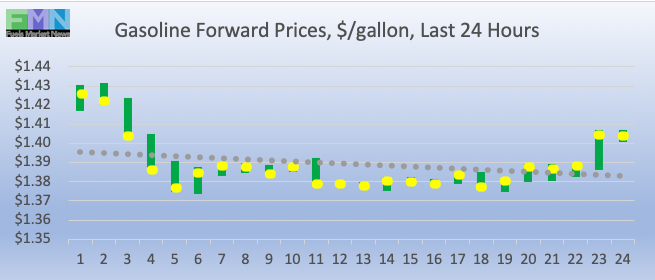

GASOLINE

Gasoline opened on the NYMEX at $1.386/gallon today, down by 0.65 cents (0.46%) from yesterday’s opening price of $1.3925 cents/gallon. Over the past 24 hours from 9AM EST to 9AM EST, gasoline prices fell by 1.22 cents (0.86%.) Prices currently are pulling out of yesterday’s up-down cycle. The latest price is $1.4033/gallon.

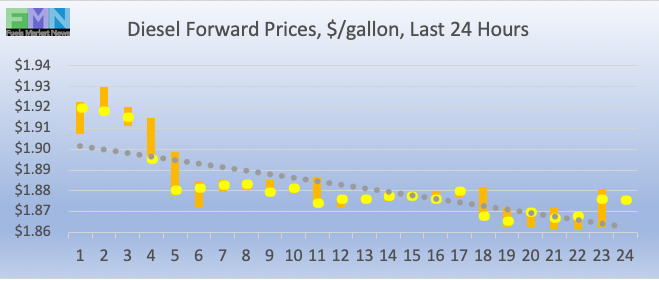

DIESEL

Diesel opened on the NYMEX at $1.8845/gallon today, down by 2.59 cents (1.36%) from yesterday’s opening price of $1.9104/gallon. Over the past 24 hours from 9AM EST to 9AM EST, diesel prices fell by 3.15 cents (1.65%.) Diesel prices currently are stabilizing after yesterday’s pullback. The latest price is $1.8780/gallon.

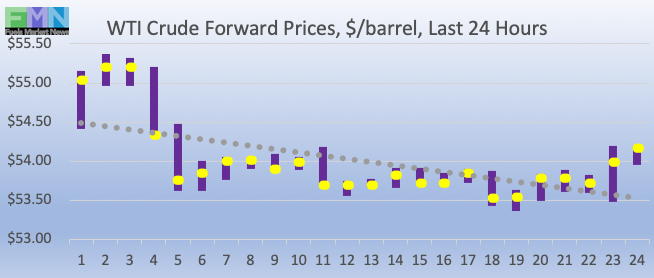

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $54.01/b today, down by $0.27 (0.50%) from yesterday’s opening price of $54.28/b. Over the past 24 hours from 9AM EST to 9AM EST, WTI crude prices fell by $0.42 (0.77%.) Prices are recovering this morning after the up-and-down cycle yesterday, holding above the $54/b mark. The latest price is $54.16/b.