Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

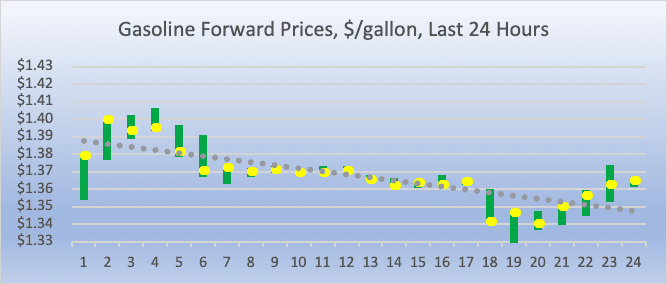

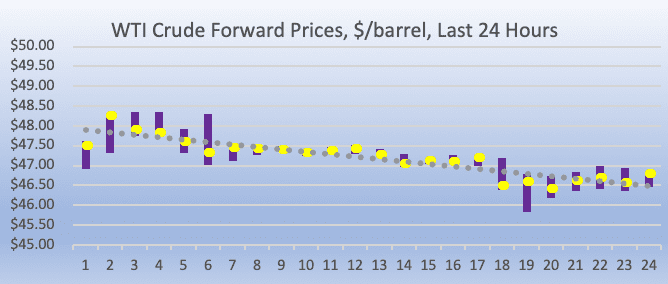

Crude oil futures prices opened higher today, then began to retreat once again. WTI (West Texas Intermediate) crude forward prices opened at $47.39/b today, a recovery of $1.08 (2.33%) from yesterday’s opening price of $46.31/b. This is the third consecutive day that WTI prices have opened below $50/b. Gasoline and diesel forward prices also opened with gains today, before prices began to languish. Yesterday, a relatively bullish set of weekly supply-demand data was countered by economic fears and another interest rate hike, causing and up-down-stabilize price pattern.

The Energy Information Administration (EIA) released official statistics on weekly supply and demand yesterday. The EIA reported a crude stock drawdown of 0.497 million barrels (mmbbls,) a gasoline stock build of 1.766 mmbbls, and a large diesel stock drawdown of 4.237 mmbbls. The net was a 2.968-mmbbl drawdown from U.S. oil stocks. These numbers were significantly more bullish than those earlier presented by the American Petroleum Institute (API.) The API reported an addition of 3.45 million barrels (mmbbls) to crude oil stockpiles, a gasoline stock build of 1.76 mmbbls, and a diesel stock drawdown of 3.442 mmbbls. The API’s net was an increase of 1.768 mmbbls to oil in storage. At that time, oil prices were so severely depressed that the presumed inventory build made barely a ripple. The EIA numbers, in contrast, appear to have given support to oil prices.

The Dow Jones Industrial Average plunged again yesterday, losing nearly 352 points (1.49%.) All major indices fell, most to new annual lows. The selloff, this time, was blamed on the Fed’s decision to raise its lending rate by 0.25%. Despite the fact that the rate hike was considered highly likely, markets interpreted the announcement as less than “dovish.” Federal Reserve Chair Jerome Powell stated that the Central Bank would continue to reduce the size of its balance sheet in 2019, gradually tightening accommodative monetary policies. Chairman Powell noted that the Fed would weigh data in 2019 before launching two planned rate increases, but perhaps markets looked for additional reassurances that the Fed was not willing to give.

GASOLINE

Diesel opened on the NYMEX at $1.7941/gallon today, a recovery of 3.72 cents (2.04%) from yesterday’s opening price of $1.7569/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices recouped 1.08 cents/gallon (0.61%.) Diesel prices have been volatile, and currently they are staying mainly in the range of $1.76-$1.80/gallon. The latest price is $1.7803/gallon.

DIESEL

Diesel opened on the NYMEX at $1.7941/gallon today, a recovery of 3.72 cents (2.04%) from yesterday’s opening price of $1.7569/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices recouped 1.08 cents/gallon (0.61%.) Diesel prices have been volatile, and currently they are staying mainly in the range of $1.76-$1.80/gallon. The latest price is $1.7803/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $47.39/b today, a recovery of $1.08 (6.57%) from yesterday’s opening price of $46.31/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures prices declined by $0.35/b (0.75%.) Over the past three days, WTI crude oil prices have hit multi-year lows, with prices falling as low as $45.79/b. Until just the past two weeks, WTI lows have not dipped below $50/b, much less below $46/b. Prices continued to weaken this morning, but they appear to be stabilizing in the range of $46.25-$46.75/b. The latest price is $46.47/b.