Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

Oil futures prices opened with gains this morning, fueled by optimism over the U.S-China trade war and reports of a massive drawdown of U.S. crude oil inventories. WTI (West Texas Intermediate) crude forward prices opened at $51.95/b today, an increase of $1.06 (2.08%) from yesterday’s opening price of $50.89/b. Gasoline and diesel also opened higher this morning. Crude and product prices are stable this morning, as markets await a key data release from the EIA on last week’s supply and demand.

Futures prices received support from the continued dialogue between the U.S. and China on trade war issues. China reportedly is considering revisions to industrial policies that would increase foreign access to Chinese markets.

Oil prices also rose upon the release of data from the American Petroleum Institute (API) showing a massive drawdown of crude oil inventories—10.18 million barrels (mmbbls.) An earlier survey of analysts predicted a stock draw of 2.99 mmbbls. The API reported a drawdown of 2.484 mmbbls of gasoline and a buildup of 0.712 mmbbls of diesel. The U.S. Energy Information Administration (EIA) will release official statistics later today. With such a bullish picture presented by the API, prices likely will weaken if the EIA data are contradictory.

In advance of pushing for a deal to reduce oil production, OPEC reported that Saudi Arabia’s crude production hit a new high of 11.016 million barrels per day (mmbpd) in November. This was an increase of 377 thousand barrels per day (kbpd) above Saudi Arabia’s production in October. Total OPEC production edged down slightly in November, by 11 kbpd. Saudi Arabia has been under pressure from U.S. President Donald Trump to ramp up production to compensate for the loss of Iranian supplies, caused by U.S. sanctions. The increase in Saudi output of 377 kbpd was nearly an exact match with the drop in Iranian output of 380 kbpd. Saudi Arabia now plans to reduce output, but the cuts will come from a very high baseline.

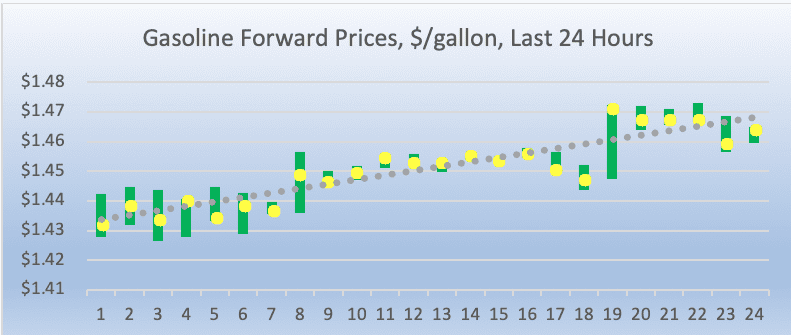

GASOLINE

Gasoline opened on the NYMEX at $1.450/gallon today, a gain of 2.68 cents (1.84%) from yesterday’s opening price of $1.4232 cents/gallon. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices rose by 3.2 cents/gallon (2.24%,) which recouped all of the prior day’s loss. Currently, gasoline prices are stable, and they are in the range of $1.45-$1.47/gallon. The latest price is $1.4591/gallon.

DIESEL

Diesel opened on the NYMEX at $1.8535/gallon today, up by 0.75 cents (0.4%) from yesterday’s opening price of $1.846/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices recovered by 1.06 cents/gallon (0.57%.) Currently, diesel prices are stable, and they are in the range of $1.86-$1.88/gallon. The latest price is $1.8678/gallon.

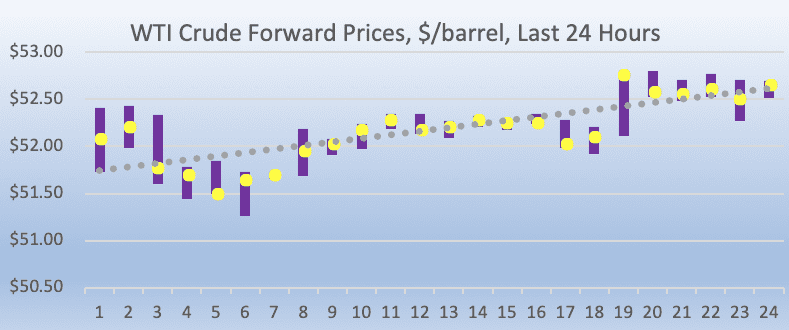

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude forward prices opened at $51.95/b today, a gain of $1.06 (2.08%) from yesterday’s opening price of $50.89/b. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures continued to strengthen by $0.78/b (1.51%.) WTI crude oil prices have stayed above the $52/b mark, and the current trend is stable, awaiting today’s key supply and demand data from the EIA. The latest price is $52.32/b.