Fuels Market Watch 24

Exclusive daily fuels market analysis by Dr. Nancy Yamaguchi.

FUEL MARKETS TODAY – Market Overview

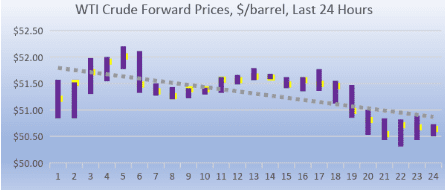

Crude oil futures prices are retreating this morning. WTI (West Texas Intermediate) crude prices opened at $51.27/b today, a rebound of $0.96 (1.91%) from yesterday’s opening price of $50.31/b. Yesterday, WTI crude prices dropped to a new annual low of $49.41/b. Crude and product prices then staged a recovery. But the rally could not be sustained, and prices are ebbing once again this morning. WTI crude prices already have dipped below $50/b, and another week in the red is possible.

Although WTI crude prices are struggling to remain above the $50/b mark, they still have a slim chance to finish in the black this week. This would break a seven-week losing streak. Between Monday, October 8th and Monday, November 26th, WTI crude futures prices tumbled downhill, shedding a remarkable $23.78/b along the way. As of the time of this writing, WTI crude prices are barely above the $50/b line. But some sort of external news event could bolster the sagging market—something along the lines of positive news from the G20 meeting, or firmer statements about an OPEC-Russia production cut agreement.

Yesterday’s price rally was largely about Russia. Russia has stated repeatedly that it would continue to cooperate with OPEC. But over the past month (as oil prices were collapsing,) Russia was standoffish about the idea of reducing production. President Vladimir Putin said that Russia was comfortable with $60/b crude prices, and that its budget is balanced at prices of $40/b this year and $43/b next year. Just a few hours after WTI crude prices dropped below $50/b, however, Russia’s energy minister conceded that the OPEC-NOPEC coalition might need to cut production, and that Russia would participate. Prices immediately reversed their downward course. Can an event like this occur again today, even if it is regarded as “verbal intervention”?

The G20 meeting begins today in Argentina. Perhaps the most tensely awaited event is the meeting between U.S. President Donald Trump and Chinese President Xi Jinping. U.S. President Donald Trump has kept markets on edge by swinging between hints of trade deals, then threats of additional tariffs. The Chinese and U.S. economies are showing signs of the strain. The latest statistics from China show that growth in manufacturing has finally stalled, reportedly for the first time in two years. Any positive outcome from the meeting will be viewed as positive for global economic activity, and hence for oil demand.

GASOLINE

Gasoline opened on the NYMEX at $1.4471/gallon today, a significant rebound of 5.66 cents (3.86%) from yesterday’s opening price of $1.3905 cents/gallon. This recovery undoes the decline of the past two days. Over the last 24-hour trading period from 9AM EST to 9AM EST, gasoline prices rose by 1.14 cents/gallon (0.8%.) Currently, gasoline prices are weakening. The latest price is $1.4242/gallon.

DIESEL

Diesel opened on the NYMEX at $1.8406/gallon today, a small decline of 0.32 cents (0.17%) from yesterday’s opening price of $1.8438/gallon. Over the last 24-hour period from 9AM EST to 9AM EST, diesel prices dropped by 3.63 cents/gallon (1.97%.) Currently, diesel prices are weakening. The latest price is $1.8095/gallon.

WEST TEXAS INTERMEDIATE

WTI (West Texas Intermediate) crude prices opened on today’s NYMEX session at $51.27/b today, a rebound of $0.96 (1.91%) from yesterday’s opening price of $50.31/b. Yesterday’s session included the lowest traded price of the year to date–$49.41/b. The time spent below the $50/b mark was brief, however, since Russia stepped in to concede that it would participate in some sort of production cut with OPEC. Over the last 24-hour period from 9AM EST to 9AM EST, crude futures declined fell by $0.42/b (0.82%.) Currently, crude prices are falling. The latest price is $50.22/b.