Release Date: Oct. 11, 2023

Forecast overview

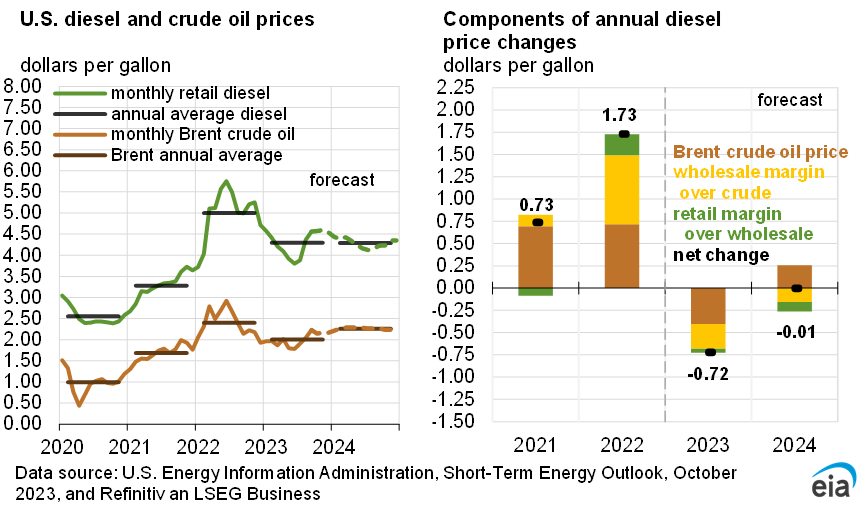

- Winter Fuels Outlook. This month we are publishing our Winter Fuels Outlook, which discusses our expectations of household energy consumption and expenditures for the upcoming 2023–24 winter season. We expect U.S. households that use natural gas, electricity, or propane as their main heating fuel to spend less on heating this winter compared with last winter. Households that use heating oil are expected to spend slightly more.

- OPEC+ production. Beginning this month, our Short-Term Energy Outlook (STEO) OPEC crude oil production table will feature a new OPEC+ crude oil production forecast. The estimate includes combined crude oil production from the 10 members of OPEC subject to production targets (OPEC-10), as well as all non-OPEC crude oil production within the OPEC+ group. We expect OPEC+ members will decrease their crude oil production by 0.3 million barrels per day (b/d) in 2024 compared with this year.

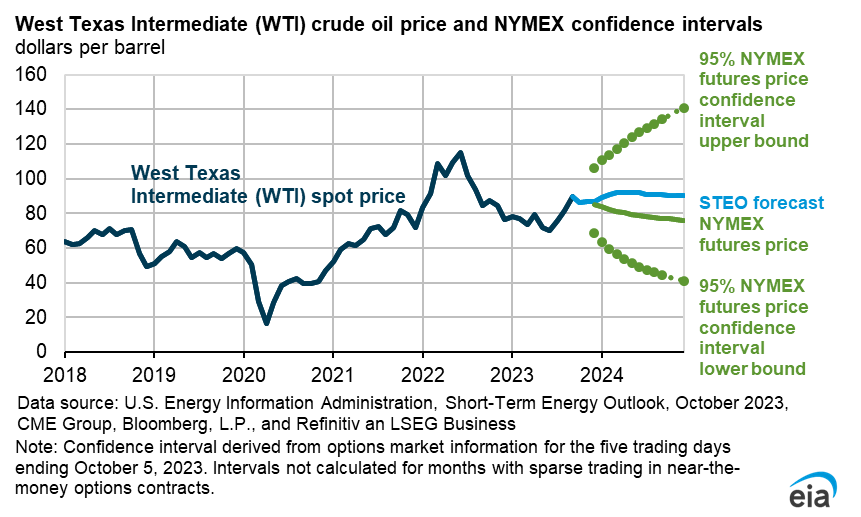

- Global oil markets. Global oil inventories in our forecast fall by 0.2 million b/d in the second half of 2023 (2H23) because a voluntary production cut from Saudi Arabia and reduced production targets among OPEC+ countries keep global oil production below global oil consumption. As a result, we expect upward pressure on crude oil prices, with the Brent spot price increasing to average $95 per barrel (b) in 2024.

- U.S. jet fuel consumption. We forecast that U.S. jet fuel consumption will increase by 6% in 2024 from 2023. The growth mainly reflects strong consumer demand for air travel, which has returned to pre-pandemic levels. Despite the increased demand for travel compared to pre-pandemic levels, we expect slightly less jet fuel consumption for the same volume of passengers due to an industry shift to larger aircrafts.

- Natural gas inventories. At the end of October, we expect U.S. natural gas inventories to total 3,854 billion cubic feet, 6% more than the five-year (2018–2022) average for the end of October.

- Electricity generation. We forecast that electricity generation from natural gas will account for about 42% of U.S. generation in 2023, an increase from 39% in 2022. This increase is the result of relatively low prices for natural gas; the retirement of 10 gigawatts (GW) of coal-fired generating capacity this year; and 5 GW of new, highly efficient natural gas-turbine capacity entering service. We expect natural gas-fired electricity generation to fall slightly to a 41% share in 2024. Despite a forecast increase in overall electricity generation in 2024, we expect generation from both natural gas and coal will fall next year in part because of increasing generating capacity from renewable sources. Our forecast assumes 40 GW of solar and wind generating capacity will enter service next year, an increase of 16% from this year, leading to the share of electricity provided by renewables rising from 22% in 2023 to 25% in 2024.

- Noncombustible renewable energy methodology. Beginning this month, STEO will calculate consumption of noncombustible renewable energy for electricity generation using a constant conversion factor of 3,412 British thermal units per kilowatthour (Btu/kWh), the heat content of electricity. You can find more information on this change, in the announcement of changes to the Monthly Energy Review.