Release Date: December 12, 2017

Forecast Highlights

Global liquid fuels

- North Sea Brent crude oil spot prices averaged $63 per barrel (b) in November, an increase of $5/b from the average in October. EIA forecasts Brent spot prices to average $57/b in 2018, up from an average of $54/b in 2017.

- West Texas Intermediate (WTI) crude oil prices are forecast to average $4/b lower than Brent prices in 2018. After averaging $2/b lower than Brent prices through the first eight months of 2017, WTI prices averaged $6/b lower than Brent prices from September through November.

- NYMEX WTI contract values for March 2018 delivery traded during the five-day period ending December 7, 2017, suggest that a range of $48/b to $68/b encompasses the market expectation for March WTI prices at the 95% confidence level.

- EIA estimates that U.S. crude oil production averaged 9.7 million barrels per day (b/d) in November, up 360,000 b/d from the October level. Most of the increase was in the Gulf of Mexico, where production was 290,000 b/d higher than in October. Higher production in November reflected oil production platforms returning to operation after being shut in response to Hurricane Nate. EIA forecasts total U.S. crude oil production to average 9.2 million b/d for all of 2017 and 10.0 million b/d in 2018, which would mark the highest annual average production, surpassing the previous record of 9.6 million b/d set in 1970.

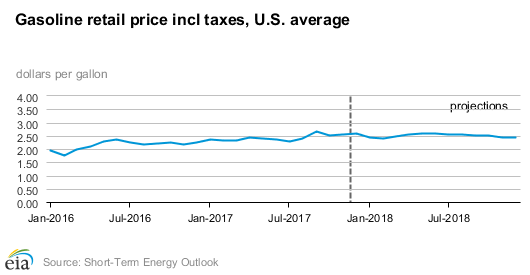

- U.S. regular gasoline retail prices averaged $2.56 per gallon (gal) in November, an increase of nearly 6 cents/gal from the average in October. The increase in November primarily reflected increasing crude oil prices. EIA forecasts the U.S. regular gasoline retail price will average $2.59/gal in December, 34 cents/gal higher than at the same time last year. EIA forecasts that U.S. regular gasoline retail prices will average $2.51/gal in 2018.

Natural gas

- U.S. dry natural gas production is forecast to average 73.5 billion cubic feet per day (Bcf/d) in 2017, a 0.7 Bcf/d increase from the 2016 level. EIA forecasts that natural gas production in 2018 will be 6.1 Bcf/d higher than the 2017 level.

- In November, the U.S. benchmark Henry Hub natural gas spot price averaged $3.01 per million British thermal units (MMBtu), up nearly 14 cents/MMBtu from October. Expected growth in natural gas exports and domestic natural gas consumption in 2018 contribute to an increase in EIA’s forecast Henry Hub natural gas spot price from an annual average of $3.01/MMBtu in 2017 to $3.12/MMBtu in 2018. NYMEX contract values for March 2018 delivery that traded during the five-day period ending December 7, 2017, suggest that a range of $1.98/MMBtu to $4.27/MMBtu encompasses the market expectation for March Henry Hub natural gas prices at the 95% confidence level.