Analysis by Dr. Nancy Yamaguchi

Overview and COVID-19 Apparent Demand Response

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended October 26. Prices fell for both fuels. Gasoline prices fell by 1.7 cents per gallon, while diesel prices fell by 0.7 cents per gallon. Retail prices for gasoline averaged $2.167/gallon. Diesel prices averaged $2.388/gallon. The COVID-19 pandemic caused severe demand destruction. Demand has been recovering gradually, but it has not regained pre-pandemic levels, nor is it expected to this calendar year. COVID-19 infections are continuing to rise alarmingly. The U.S. stock market dropped sharply on Monday, though futures are pointing to some degree of recovery today as bargain hunters move into the market.

The EIA publishes weekly “product supplied” data as its proxy for demand. These data show gasoline demand crashing from 9,696 barrels per day (kbpd) during the week ended March 13 to just 5,065 kbpd during the week ended April 3, a huge hit of 4,631 kbpd in just four weeks. That was the low point. Demand thereafter trended generally up until it reached 8,608 kbpd during the week ended June 19. Since then, demand has cycled up and down, but it has never regained its March 13 level. Apparent demand recovered to 8,809 kbpd during the week ended July 24, retreated to 8,617 kbpd during the week ended July 31, then jumped to 9,161 kbpd during the week ended August 21. Since then, demand has been in the range of 8,400-8,900 kbpd. It rose to 8,896 kbpd during the week ended October 2, then fell again over the ensuing two weeks to settle at 8,289 kbpd during the most recent week ended October 16. The EIA points out that “product supplied” is not a precise measure of demand, but these data provide the most up-to-date numbers publicly available.

Diesel demand dropped sharply in response to COVID-19. It began to recover in fits and starts. Diesel demand stagnated at first, recovered moderately, then began to vacillate between approximately 3,000 kbpd and 3,800 kbpd. The EIA reported that distillate fuel oil demand plunged by 1,256 kbpd between the week ended March 13 and the week ended April 10, slumping from 4,013 kbpd to 2,757 kbpd in a four-week period. Demand has been cycling up and down, rising strongly to 3,958 kbpd during the week ended August 21, then retreating during the late-August and early September to bottom out at 2,809 kbpd during the week ended September 11. This was the lowest reported level since the week ended April 10, reinforcing the concern that demand will not fully recover to pre-COVID-19 levels this calendar year. Storms and wildfires are also influencing fuel use. The week ended October 9 showed diesel product supplied surging back to average 4,175 kbpd before declining again to 3,588 kbpd during the most recent week ended October 16. It is unclear how much of the ups and downs relate to the end of driving season and the start of harvest season and heating oil season. Since mid-June, gasoline and diesel demand have stagnated at approximately 90% of pre-pandemic levels.

Futures Prices and Retail Price Outlook

During the week October 19 to October 23, West Texas Intermediate (WTI) crude oil futures prices fell by $0.31 per barrel (0.8%) to close the week at $39.85 a barrel. As of Tuesday October 27, WTI crude futures prices have dropped more sharply and are below the $39-a-barrel level.

During the week of October 19 to October 23, gasoline futures prices fell by 0.65 cents per gallon (0.6%.) Diesel futures prices fell by 1.78 cents per gallon (1.5%.) While the relationship between futures prices and retail prices is not immediate or one-for-one, retail prices are likely to decline this week.

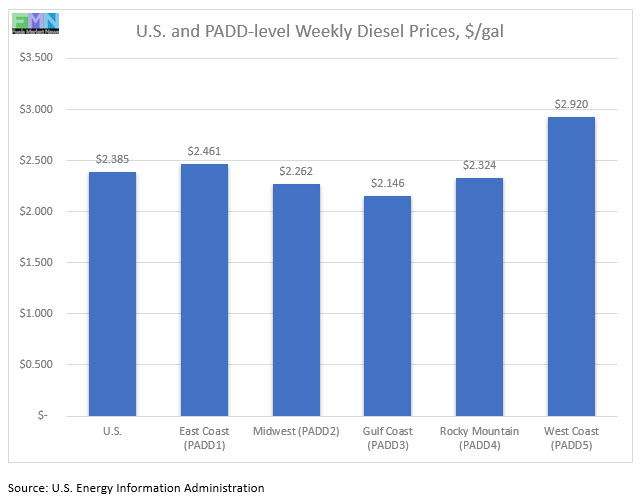

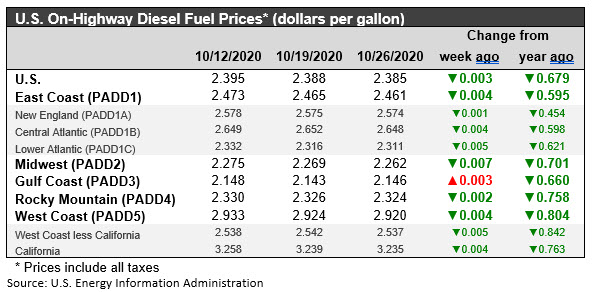

Retail Diesel Prices

The week ended October 26 brought a 0.3 cents per gallon decrease in the retail price for diesel to reach an average price of $2.385/gallon. Prices declined in all PADDs except for PADD 3. The national average price for the week was 67.9 cents/gallon below where it was during the same week last year.

For the year to date, diesel prices have fallen by a cumulative 69.4 cents/gallon, a major downward slump. The downward trend flattened in June and July, but prices have been declining recently. Looking back to the autumn of 2019, retail diesel prices had been below the $3/gallon mark until the attacks on Saudi Arabian oil facilities in mid-September 2019. They rose at that time, and they remained above the $3/gallon mark until the week ended February 3, 2020. Prices then continued to slide.

In the East Coast PADD 1, diesel prices declined by 0.4 cents to settle at an average $2.461/gallon. Within PADD 1, New England prices edged down by 0.1 cent to average $2.574/gallon. Central Atlantic diesel prices eased by 0.4 cents to average $2.648/gallon. Lower Atlantic prices fell by 0.5 cents to average $2.311/gallon. PADD 1 prices were 59.5 cents/gallon below their levels for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 0.7 cents to average $2.262/gallon. Prices were 70.1 cents below their level for the same week last year. PADD 2 joined PADD 3 during the week ended June 17, 2019, in having diesel prices fall below $3/gallon. Prices subsequently fell below $3/gallon in PADD 4 and PADD 1. Finally, PADD 5 prices also slid below the $3/gallon mark.

In the Gulf Coast PADD 3, retail diesel prices rose by 0.3 cents to average $2.146/gallon. This was the only price increase among the PADDs. PADD 3 continues to have the lowest diesel prices among the PADDs, currently 23.9 cents below the U.S. average. Prices were 66.0 cents below their level for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices declined by 0.2 cents to average $2.324/gallon. PADD 4 prices were 75.8 cents lower than for the same week in the prior year.

In the West Coast PADD 5 market, retail diesel prices fell by 0.4 cents to average $2.920/gallon. PADD 5 prices were 80.4 cents below their level from last year. Until December 2019, PADD 5 had been the only district where diesel prices were higher than they were in the same week last year. Subsequently, prices rose until this was true in all other PADDs. Prices have fallen dramatically, and the national average price is now well below its level of last year. PADD 5 prices excluding California fell 0.5 cents to average $2.537/gallon. This price was 84.2 cents below the retail price for the same week last year. California diesel prices fell by 0.4 cents to average $3.235/gallon. Until the week ended June 24, 2019, California had been the only major market where diesel prices were above $4/gallon, where they had been for nine weeks. California prices retreated below $4/gallon from July through October, rose above $4/gallon again during the first three weeks of November, and declined since then until beginning to pick up in June and July 2020. California diesel prices were 76.3 cents lower than they were at the same week last year.

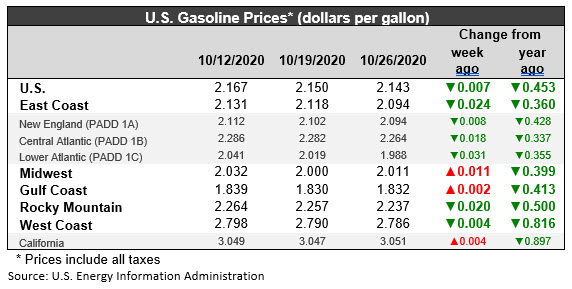

Retail Gasoline Prices

The COVID-19 pandemic continues to have a huge impact on the U.S. gasoline market. Retail prices for gasoline dropped below $2 a gallon in April, and they remained there throughout April, May, and into early June before finally climbing back to the $2/gallon level during the week ended June 8. Until the pandemic, it had been over four years since the average retail price for gasoline had been below the $2/gallon mark. With the phased re-opening of the economy, demand began to rise, as did prices. Unfortunately, so did coronavirus infections. Some economic activities have been scaled back. Gasoline prices have fluctuated over the past month, falling 0.7 cents during the current week. Prices have fallen in six of the last seven weeks.

During the current week ended October 26, average retail prices for gasoline fell by 0.7 cents to average $2.143/gallon. Prices fell in PADDs 1, 4 and 5, while prices rose in PADDs 2 and 3. Retail gasoline prices for the current week were 45.3 cents per gallon lower than they were one year ago. Until November, gasoline prices had been below their levels of last year. Prices then rose to surpass last year’s levels in all PADDs. The downhill price slide changed this, making gasoline a bargain.

Looking back at historic prices, gasoline prices hit a peak of $2.903/gallon during the week ended October 8, 2018. Prices then slid downward for 14 weeks in a row, shedding a total of 66.6 cents per gallon. In the next 17 weeks, prices marched back up by 66 cents/gallon. Prices came very close to the peak they hit in early October 2018. However, the months of May and the June 2019 brought an easing of prices amounting to 23.3 cents per gallon. The week ended July 1 reversed that downward trend and sent prices up once again. The COVID-19 pandemic caused a price collapse, but prices began to climb back up in May, June, and early July. The second half of July brought a modest easing of prices, which levelled off in mid-August and began to reverse course. The first three weeks of September brought another price retreat, partly in keeping with the end of summer driving season, and compounded by the pandemic.

For the current week ended October 26, East Coast PADD 1 gasoline retail prices declined by 2.4 cents to average $2.094/gallon. This week’s average price was 36.0 cents/gallon below where it was during the same week last year. Within PADD 1, New England prices fell by 0.8 cents to average $2.094/gallon. Central Atlantic market prices fell by 1.8 cents to average $2.264/gallon. Prices in the Lower Atlantic market dropped by 3.1 cents to average $1.988/gallon.

In the Midwest PADD 2 market, retail gasoline prices rose by 1.1 cents to average $2.011/gallon. PADD 2 prices for the week were 39.9 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices rose slightly by 0.2 cents to average $1.832/gallon. During the week ended March 16, PADD 3 was the first region where retail prices fell below the $2/gallon level. It was joined subsequently by PADD 2, then by PADD 1, and then by PADD 4. Currently, PADD 3 remains the only PADD where prices are still below $2/gallon. PADD 3 usually has the lowest average prices among the PADDs. PADD 3 prices for the week were 41.3 cents/gallon lower than for the same week last year.

In the Rocky Mountains PADD 4 market, gasoline pump prices fell 2.0 cents to average $2.237/gallon. This week’s PADD 4 prices were 50.0 cents/gallon lower than at the same time last year.

In the West Coast PADD 5 market, retail gasoline prices declined by 0.4 cents to average $2.786/gallon. PADD 5 typically has the highest retail prices for gasoline, and until mid-March it had been the only PADD where retail gasoline prices stayed above $3/gallon. Prices this week were 81.6 cents/gallon lower than last year’s price. Prices excluding California fell by 1.9 cents to average $2.478/gallon. This was 70.5 cents/gallon below last year’s price. California prices rose by 0.4 cents during the current week to average $3.051/gallon. California had been the last state where gasoline prices had remained above the $3/gallon line, but this changed the week ended March 30. On Thursday March 19, California led the U.S. by taking the dramatic step of ordering a statewide shelter-in-place to combat the spread of COVID-19. This order affected approximately 40 million people, and it caused a dramatic contraction in fuel demand. The state began to re-open businesses and facilities in May, but COVID-19 cases rose again, and some counties backtracked reopening. California retail gasoline prices were 89.7 cents per gallon below their levels from the same week last year.