Analysis by Dr. Nancy Yamaguchi

The Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended March 26, 2018. Gasoline and diesel prices marched up in all PADDs nationwide. At the national level, gasoline prices rose by 5.0 cents/gallon. Diesel prices rose by 3.8 cents per gallon.

Crude prices rose significantly during the week ended March 22, with futures prices for WTI crude rising by $3.65/b. WTI prices closed the week at $65.88/b. Prices were strengthened by geopolitical tensions. There is also a growing perception that the global supply and demand are moving into balance, with the potential risk of disruptions. These tensions are overshadowing the continued growth in US crude production. As of the time of this writing, WTI futures prices have topped the $66/b level, the highest prices seen since January.

US stockpiles were drawn down across the board during the week ended March 16, with crude inventories falling 2.622 million barrels per day (mmbpd,) diesel inventories dropping 2.022 mmbpd, and gasoline inventories drawn down by 1.693 mmbpd.

US gasoline demand appeared to drop during the week ended March 16, down by 318 kbpd. Diesel product supplied rose by 85 kbpd during the week.

For the current week ended March 26, diesel prices rose by 3.8 cents to arrive at an average price of $3.010/gallon. Until the week ended March 5, US national average retail diesel prices had exceeded $3/gallon for seven consecutive weeks. Weak crude prices then drove diesel prices below the $3/gallon mark during the first three weeks of March. This past week brought retail averages back above the $3/gallon mark.

In the East Coast PADD 1, diesel prices increased 2.9 cents during the week to average $3.038/gallon. In early January, PADD 1 joined PADD 5 in having diesel prices above $3/gallon. In February, however, diesel prices began to subside, dropping by 11.4 cents between the week ended February 5 and the week ended March 19. Within PADD 1, New England prices increased by 1.4 cents to average $3.115/gallon. Central Atlantic diesel prices rose by 1.7 cents to average $3.217/gallon. Lower Atlantic prices increased by 4.0 cents to arrive at an average price of $2.898/gallon. PADD 1 prices were 45.2 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices rose by 3.6 cents to average $2.934/gallon. Prices were 47.6 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices increased by 3.7 cents to average $2.823/gallon. This price was 44.5 cents higher than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices jumped by 6.6 cents to average $2.991/gallon. PADD 4 prices were 39.4 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices increased by 5.4 cents to average $3.438/gallon. This price was 61.6 cents above its level from last year. Prices excluding California spiked by 8.7 cents to average $3.147/gallon, which was 44.4 cents above the retail price for the same week last year. California diesel prices rose by 2.8 cents to arrive at an average price of $3.669/gallon. This price was 75.0 cents higher than last year’s price. Until January, PADD 5 had been the only PADD to have diesel prices above $3 per gallon. Prices around the country climbed until the national retail average exceeded the $3/gallon mark as of the week ended January 15. Product prices then subsided as crude oil prices fell, and they are once again climbing in tandem with recent price strength in crude markets.

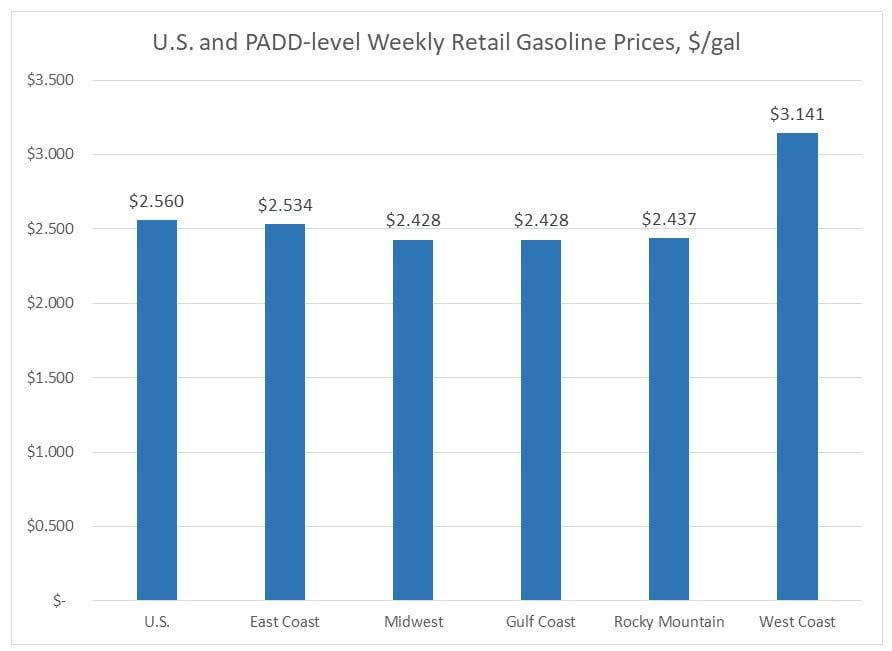

U.S. retail gasoline prices rose by 5.0 cents during the week ended March 26th, to arrive at an average price of $2.648/gallon. Gasoline prices rose in all PADDs countrywide.

For the current week ended March 26, East Coast PADD 1 retail prices for gasoline increased by 5.6 cents to $2.592/gallon. The average price was 31.6 cents higher than last year’s price. Within PADD 1, prices increased by 3.1 cents in New England to an average of $2.587/gallon. Central Atlantic market prices jumped by 7.0 cents to $2.698/gallon. Prices in the Lower Atlantic market increased by 5.2 cents, to an average price of $2.514/gallon. This was 30.7 cents higher than last year’s average price for the same week.

In the Midwest PADD 2 market, retail gasoline prices rose by 2.0 cents, reaching an average price of $2.515/gallon. Gasoline pump prices were 33.1 cents higher than they were one year ago.

In the Gulf Coast PADD 3 market, gasoline prices rose significantly by 7.7 cents to average $2.381/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Prices for the week were 29.4 cents higher than for the same week in 2017.

In the Rocky Mountains PADD 4 market, gasoline pump prices surged by 8.5 cents to average $2.528/gallon. PADD 4 prices were 22.5 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices increased by 5.9 cents to arrive at an average price of $3.274/gallon. This was 42.6 cents higher than at the same time a year ago. PADD 5 typically has the highest gasoline prices among the five PADDs. During the twelve weeks of 2018 to date, PADD 5 has been the only PADD where prices have exceeded $3/gallon. Excluding California, West Coast prices increased by 6.4 cents, to an average of $2.906/gallon. This was 31.6 cents higher than at the same time in 2017. In California, prices rose by 5.6 cents to arrive at an average pump price of $3.487/gallon. California prices were 48.9 cents per gallon above their levels from last year.