Analysis by Dr. Nancy Yamaguchi

The U.S. Energy Information Administration (EIA) released its weekly data on diesel and gasoline retail prices for the week ended December 17, 2018. Retail prices for both fuels continued to fall. On a national average basis, gasoline prices dropped by 5.2 cents/gallon, while diesel prices fell by 4.0 cents/gallon. Gasoline prices have fallen dramatically since October, reaching a point where the national average price is now below where it was one year ago.

Crude oil, gasoline and diesel prices continued to fall in futures markets. Prices rebounded during the week ended December 7, then resumed the downward path. During the week ended December 14, West Texas Intermediate (WTI) crude futures prices fell by $0.83/b. Gasoline futures prices dropped by 2.97 cents/gallon. Diesel futures prices fell by 3.33 cents/gallon. As of the time of this writing, WTI futures crude prices have fallen to their lowest levels since July 2016. Because retail prices tend to follow crude price movements; if the current crude price trend persists, next week’s retail prices should continue to decline.

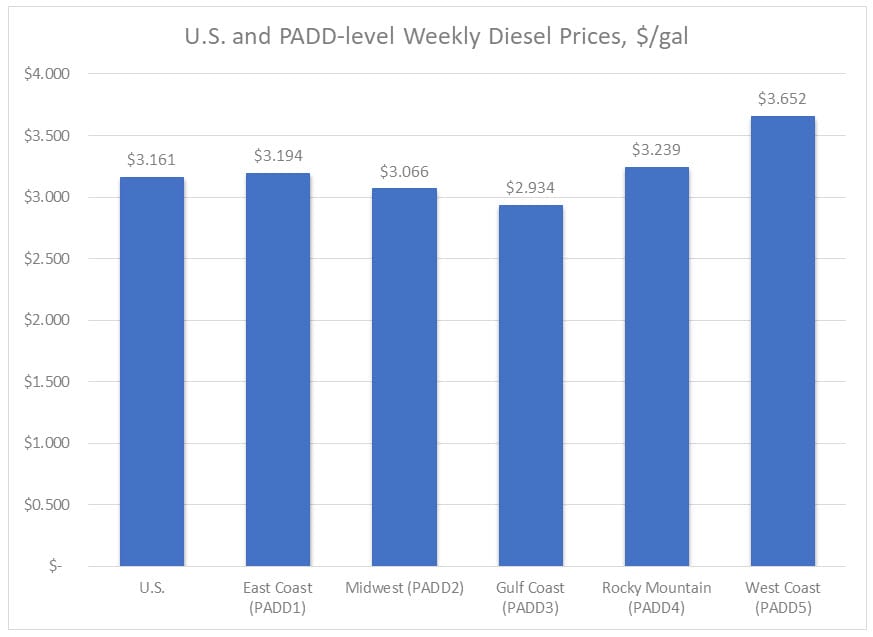

For the current week ended December 17, diesel prices dropped by 4.0 cents to an average price of $3.121/gallon. This was the ninth consecutive week that retail diesel prices have fallen. During these eight weeks, the price decline has amounted to 27.3 cents/gallon. Prices fell in all PADDs. The national average price was 22.0 cents per gallon higher than it was one year ago.

In the East Coast PADD 1, diesel prices fell by 2.9 cents to arrive at an average price of $3.165/gallon. Within PADD 1, New England prices declined by 1.9 cents to average $3.276/gallon. Central Atlantic diesel prices fell by 2.6 cents to average $3.342/gallon. Lower Atlantic prices fell by 3.2 cents to arrive at an average price of $3.021/gallon. PADD 1 prices were 26.8 cents/gallon above their prices for the same week last year.

In the Midwest PADD 2 market, retail diesel prices fell by 4.8 cents to average $3.018/gallon. Prices were 16.5 cents/gallon above their level for the same week last year.

In the Gulf Coast PADD 3, retail diesel prices declined by 3.4 cents to average $2.90/gallon. Two weeks ago, PADD 3 became the first PADD where retail diesel prices fell below the $3/gallon mark. Prices were 20.3 cents higher than for the same week in the previous year.

In the Rocky Mountains PADD 4 market, retail diesel prices dropped by 6.1 cents to average $3.178/gallon. This was the largest price decrease among the five PADDs. PADD 4 prices were 22.0 cents higher than in the prior year.

In the West Coast PADD 5 market, retail diesel prices fell by 4.8 cents to average $3.604/gallon. This price was 27.7 cents above its level from last year. Prices excluding California fell by 4.4 cents to reach an average of $3.313/gallon. This price was 26.9 cents above the retail price for the same week last year. California diesel prices dropped by 5.2 cents to arrive at an average price of $3.835/gallon. Until three weeks ago, California had been the only state where diesel prices exceeded $4/gallon. California diesel prices were 28.3 cents above last year’s price.

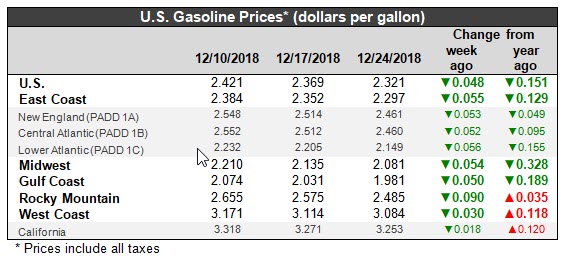

U.S. retail gasoline prices declined by 5.2 cents to average $2.369/gallon during the week ended December 17. Prices fell in all PADDs. The national average price was 8.1 cents per gallon lower than it was one year ago. Prices in PADDs 1, 2 and 3 are below their levels of one year ago. Retail prices for gasoline have fallen for the past ten weeks, slashing an incredible 53.4 cents/gallon off the average retail price.

For the current week ended December 17, East Coast PADD 1 retail prices for gasoline dropped by 3.2 cents to average $2.352/gallon. The average price was 8.6 cents below last year’s price. Within PADD 1, New England prices fell by 3.4 cents to average $2.514/gallon. Central Atlantic market prices declined by 4.0 cents to average $2.512/gallon. Prices in the Lower Atlantic market declined by 2.7 cents to average $2.205/gallon.

In the Midwest PADD 2 market, retail gasoline prices dropped by 7.5 cents to reach an average price of $2.135/gallon. Five weeks ago, PADD 2 became the first and only PADD where gasoline pump prices were lower than they were one year ago. PADD 1 and 3 joined PADD 2 in this distinction three weeks ago. Prices for the current week were 18.9 cents/gallon lower than they were for the same week last year.

In the Gulf Coast PADD 3 market, gasoline prices fell by 4.3 cents to average $2.031/gallon. PADD 3 continues to have the lowest average prices among the PADDs. Two years ago, in December 2016, PADD 3 gasoline prices were below the $2/gallon level, and if the current trend persists, PADD 3 prices may once again fall below this level. Prices for the week were 13.3 cents lower than for the same week in 2017.

In the Rocky Mountains PADD 4 market, gasoline pump prices fell by 8.0 cents to arrive at an average of $2.655/gallon. This was the largest price drop among the PADDs. Prices were 9.9 cents higher than at the same time in 2017.

In the West Coast PADD 5 market, retail gasoline prices dropped by 5.7 cents to arrive at an average of $3.114/gallon. PADD 5 prices were 15.3 cents higher than at the same time a year ago. PADD 5 continues to have the highest gasoline prices among the five PADDs. Excluding California, West Coast prices dropped by 6.7 cents to average $2.920/gallon. This was 21.0 cents higher than at the same time in 2017. In California, pump prices dropped by 4.7 cents to average $3.271/gallon. California prices were 16.5 cents per gallon above their levels from last year.